Foreign institutions are dumping US bonds

As the 2008 financial crisis hit, the US Treasury Department issued massive amounts of debt in the form of US Treasury bonds to cover massive deficits, and to try to stimulate the economy. As we can see on the following chart, on August 20/08 the US Federal Reserve (Fed) owned just under $900 billion in assets. But as the Treasury department issued more debt, the Fed was a big buyer of that debt, and on December 31/08, just four months later, the Fed owned over $2.24 trillion in assets. By December 2015, the Fed had over $4.5 trillion, and today the Fed still has $4.47 trillion in assets on its books.

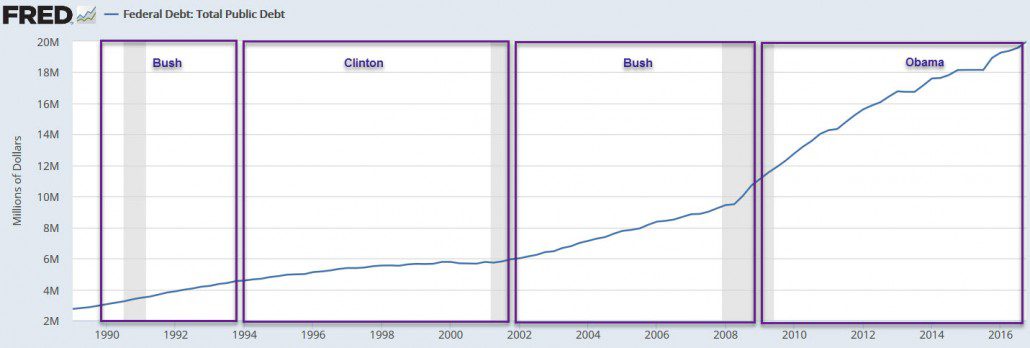

As we highlighted in our March 23rd Musings the “official” US federal debt has grown dramatically over the past 16 years. The total “official” US debt today is $19.98 trillion!

Thanks to the Fed suppressing interest rates, the cost to service the ballooning debt burden has been relatively manageable. But as Newton showed us, for every action, there is an equal and opposite re-action.

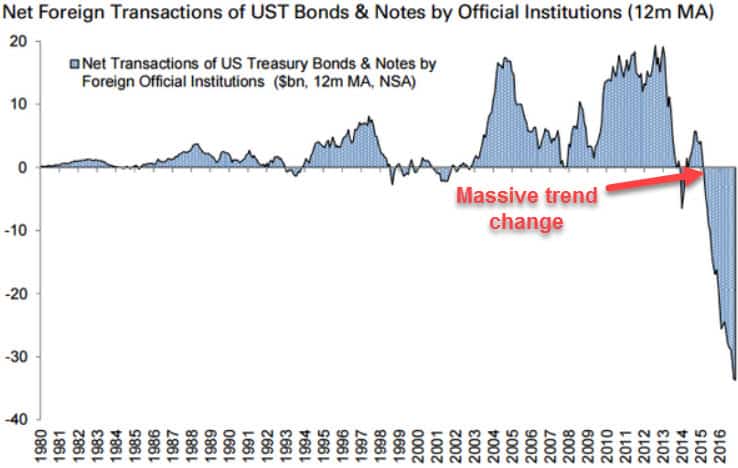

As investors we need to understand that while the US Fed has been major buyers of US debt, they have by no means been the only buyers of US debt (bonds). Foreign governments and large foreign investors have been major buyers of US bonds, but that trend is now changing.

As shown on the following chart from Goldman Sachs, foreign official institutional investors have been selling US treasuries at a record pace. A significant portion of this selling pressure is coming from China. Recently Chinese FX reserves hit five year lows as China has liquidated reserves to keep their currency from depreciating.

As this massive debt rolls over, the US Treasury must re-issue new debt to cover the maturing debt, (or default on their debt). To attract new buyers, Treasury rates will need to rise dramatically to cover the ever rising budget deficits and maturing existing debt. While rising interest rates will be a welcome reprieve for income starved savers, rising rates will mean a huge rise in debt serving costs for the US government. The real question going forward is who is going to buy the new and maturing US debt, if China and other foreign official institutions are dumping US debt? And who is going to buy the $4.5 trillion that the Federal Reserve has on its books? Just asking!

Stay tuned!