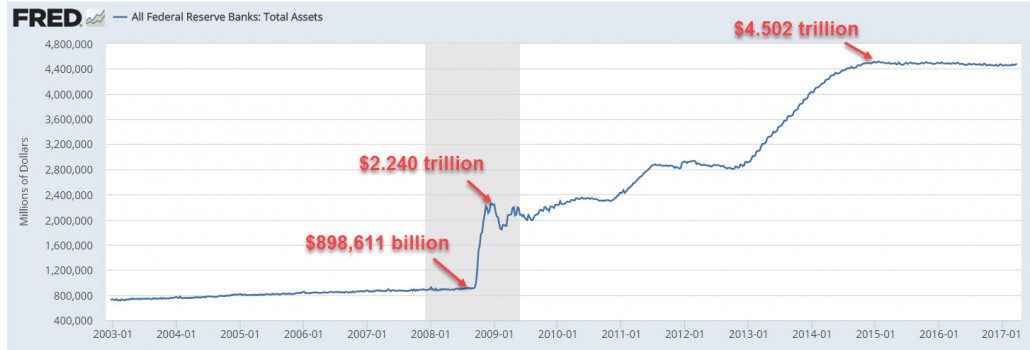

What happens when the Fed unwinds its $4.5 trillion in assets?

As we highlighted in Wednesday’s Musings, the US Treasury Department issued copious amounts of debt in the form of US Treasury bonds to cover massive deficits, and to try stimulating the economy. We also showed how the Fed was a major purchaser of those bonds and accumulated a massive $4.5 trillion in assets on its books.

That $4.5 trillion includes almost $2.7 trillion in Treasury bonds and about $1.8 trillion in mortgage-backed bonds. Just last year, the Fed made over $92 billion in interest from those bonds. The Fed then gives that money to the government (Treasury Department).

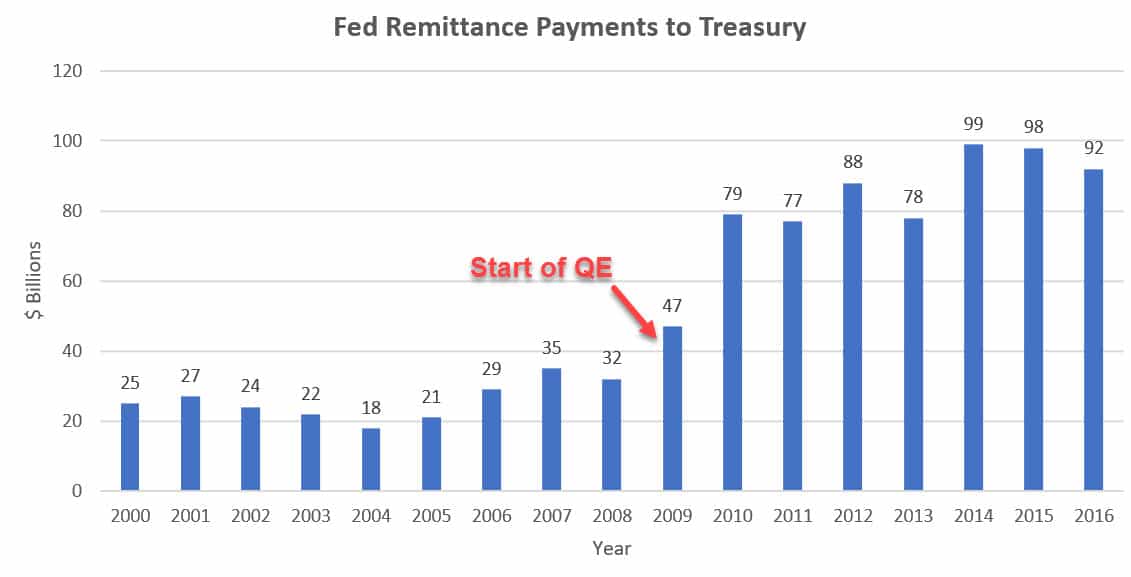

Below is a chart showing how much the Fed has given the government in each of the last sixteen years. As we can see, starting in 2009 (the start of QE) the amount of interest the Fed earned in its bond holdings increased almost 50%, from $32 billion in 2008, to $47 billion in 2009. As the Fed kept buying more and more bonds, their interest gains moved up significantly as well, to the point where in 2014 and 2015, the Fed made almost $100 billion in interest from those bonds.

And each year the Fed gives that money to the government. It sounds crazy that the government received almost $580 billion in interest from bonds that were initially purchased by money created out of thin air.

Now that the Fed is done with QE and its bond buying initiatives, what does the Fed do with the huge $4.5 trillion in bonds? Remember, those payments of almost $100 billion a year to government was earned from just the interest on these bonds, they haven’t actually sold any bonds yet.

When the Fed bought the bonds, they did it to manipulate the bond market and force interest rates (yields) lower. Although the Fed purposely disrupts the markets when buying bonds, they do not want to disrupt the markets selling them. If they were to sell large blocks of bonds it would flood the market with bonds, driving the value of the bonds down, and raising the yields higher.

Their other option is to hold the bonds to maturity and not replace them. This would allow their portfolio to shrink over time, and it would have a much calmer impact on the market, as everyone would know when these bonds are coming due.

Whatever route they choose, sell the bonds, or let them mature, the proceeds go back into government coffers. If they let the bonds mature, over the next five years there is almost $1.5 trillion that will mature, and that money goes back to the government.

You just have to believe that Trump has his eye on this cash windfall, as it would allow him to implement his infrastructure plan without having to increase the deficit or raise taxes.

Stay tuned!