Subprime auto debt crisis coming?

In 2016 US auto makers sold more cars than ever before, with many of the mainstream media hailing this as clear evidence of rising consumer confidence. But it was not just auto sales that revved higher, so too did auto loans.

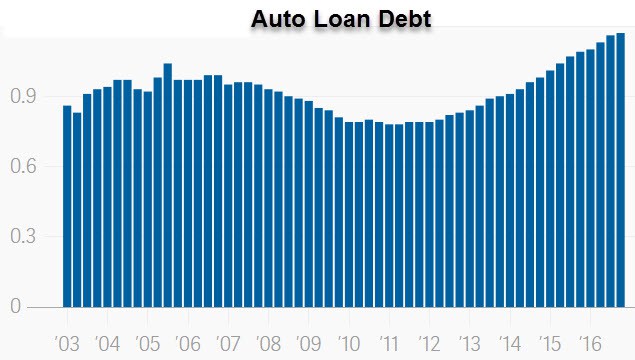

US auto buyers racked up $1.2 trillion in auto loans last year, an increase of 9% from the previous year. Meanwhile, the number of vehicles purchased increased by only 1.5%, highlighting that auto loans are now representing a higher percentage of household debt.

It is not just that auto loans are increasing that we find concerning, it’s the fact that auto loans made to consumers with subprime credit have accounted for a growing percentage of the market. These increased sales have been achieved by aggressively pushing people into auto loans that they cannot afford.

It’s not like we haven’t seen this movie before. In 2007/08 we entered the subprime mortgage crisis, all based on lending too much money to people who had poor credit ratings. When they defaulted on their mortgages, we saw the US real estate market implode.

So now in the auto loan sector, delinquencies have moved up as the credit quality of the loans has deteriorated and the length of the auto loans has increased, up to 84 months.

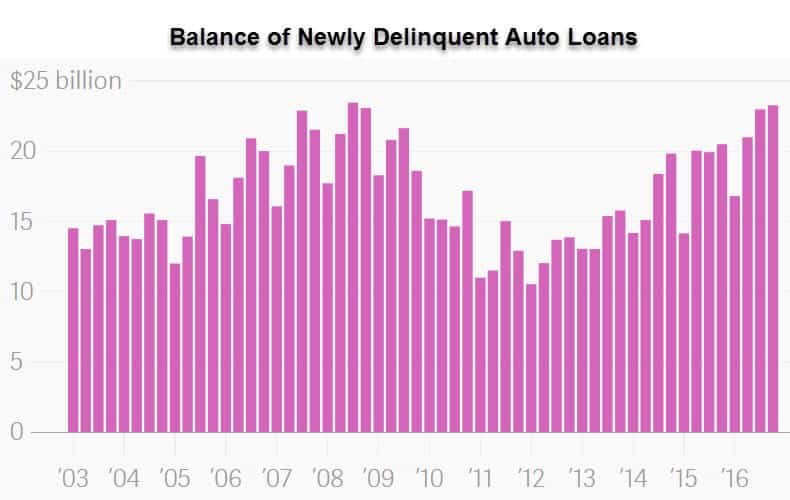

Auto loan delinquencies hit the highest level since the financial crisis as more than six million American consumers are at least 90 days late on their car loan payments, according to the Federal Reserve Bank of New York.

“The worsening in the delinquency rate of subprime auto loans is pronounced, with a notable increase during the past few years,” said the bank

About $23.27 billion in loans were 30 days or more late as of Dec. 31, a whopping 14% increase from the year earlier and the most since the $23.46 billion in the third quarter of 2008.

Moreover, of those subprime auto loans, the New York Fed said a full 75% originated with auto finance companies which have been loosening their credit standards since 2010.

As a result of these weak lending practices by the auto finance companies, almost 5% of their auto loans were running at least 90 days in arrears during the fourth quarter, compared with 1% for auto loans issued by banks and credit unions.

As we should have learned in the subprime mortgage crisis, when you make loans to people who cannot afford them, eventually many of those loans are going to go bad, which is what is happening now.

In addition, sales are declining and used car prices have dropped, none of which makes us want to own stock in the automakers today.

Stay tuned!