Will we ever see $100 oil again?

Yes we will see oil at $100 again, and in fact, we will likely see oil at north of $200 in the next decade. But before we get there we are most likely to see oil in the $30 range.

When the Fed started its Quantitative Easing (QE) program, they created an environment where oil producers were able to borrow for almost nothing. As oil prices climbed to over $100, producers wanted to expand as quickly as possible, so they all borrowed as much as they could.

The problem is that many of these producers borrowed to extremes, many ending up with a debt-to-cash ratio of over 4:1. As always happens, high prices are the cure for high prices, meaning as all producers rushed to ramp up production, production surpassed demand, forcing prices much lower.

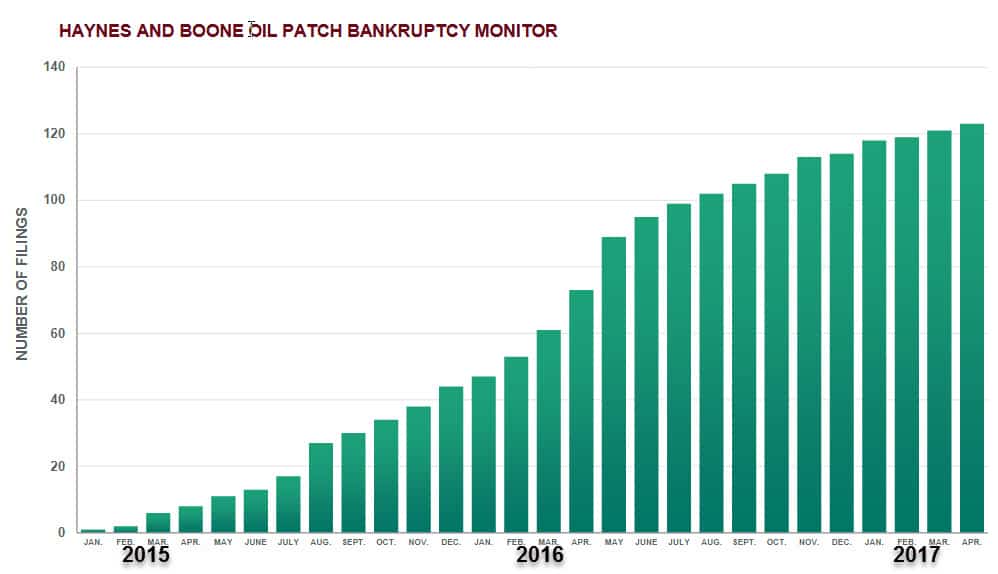

According to the Haynes & Boones Oil Patch Bankruptcy Monitor, since 2015, 123 North American oil and gas producers have filed for bankruptcy 2015.

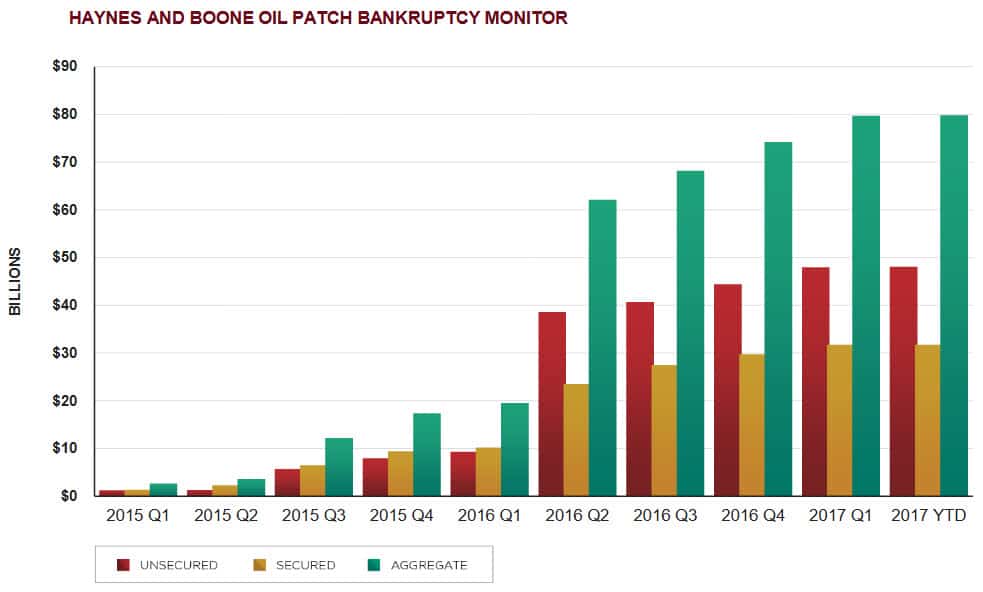

These bankruptcies involved a total of $79.9 billion in cumulative secured and unsecured debt.

With investors in desperate search for yield, many ending up buying the debt from these heavily leveraged oil and gas produces, resulting in some serious losses.

As oil prices dropped, oil and gas producers started slashing their costs, cancelling exploration and expansion plans, laying off hundreds of thousands of employees.

Then prices started to recover from the low around $26. Along the way we had OPEC finally give in and apply quota levels, as they wanted desperately to get prices up to $60. Prices did get to $55, but then the North American and other non OPEC countries continued to ramp up production. .

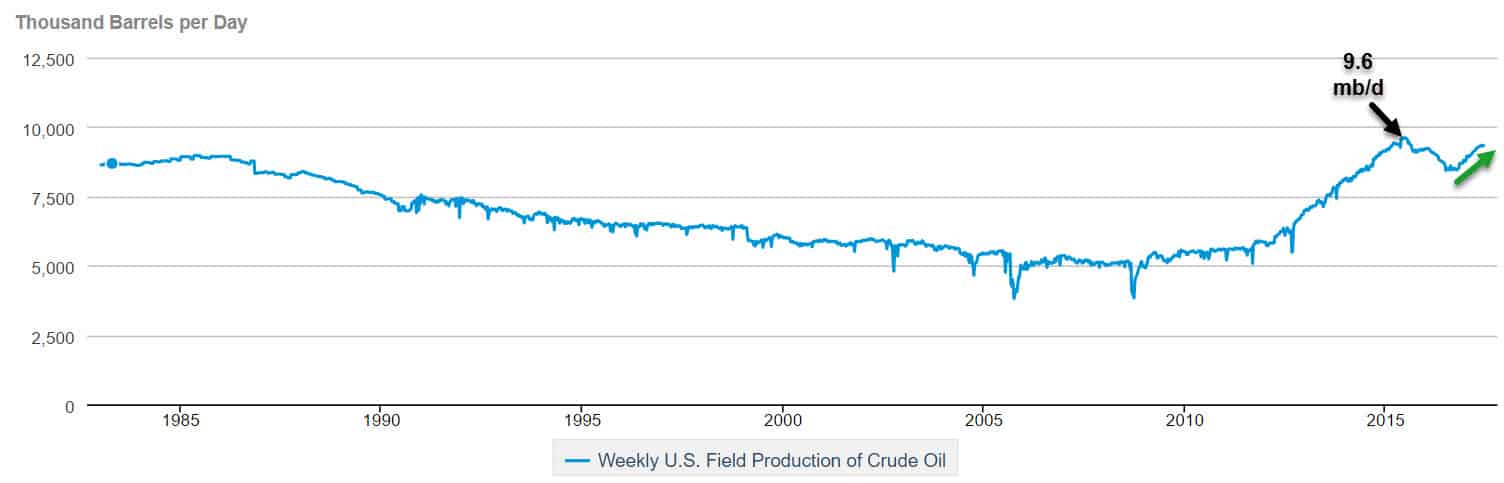

And now, the gap created with OPEC cuts is being filled by the US and non OPEC producers. In the US production is closing in our the all-time high of 9.6 mb/d.

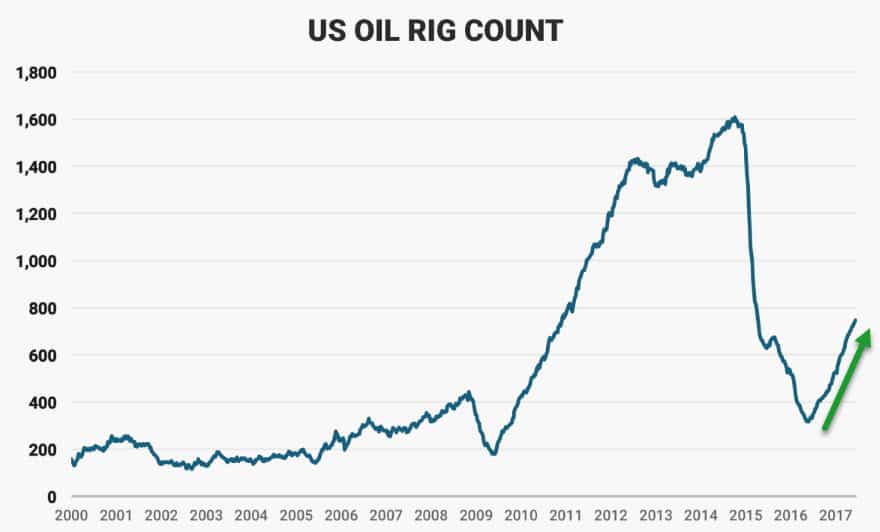

And the exploration continues to grow as producers added another 6 rigs last week, for a total of 747 rigs, a 122% increase from a year ago. Last week was the 22nd consecutive weeks where the rig count increased.

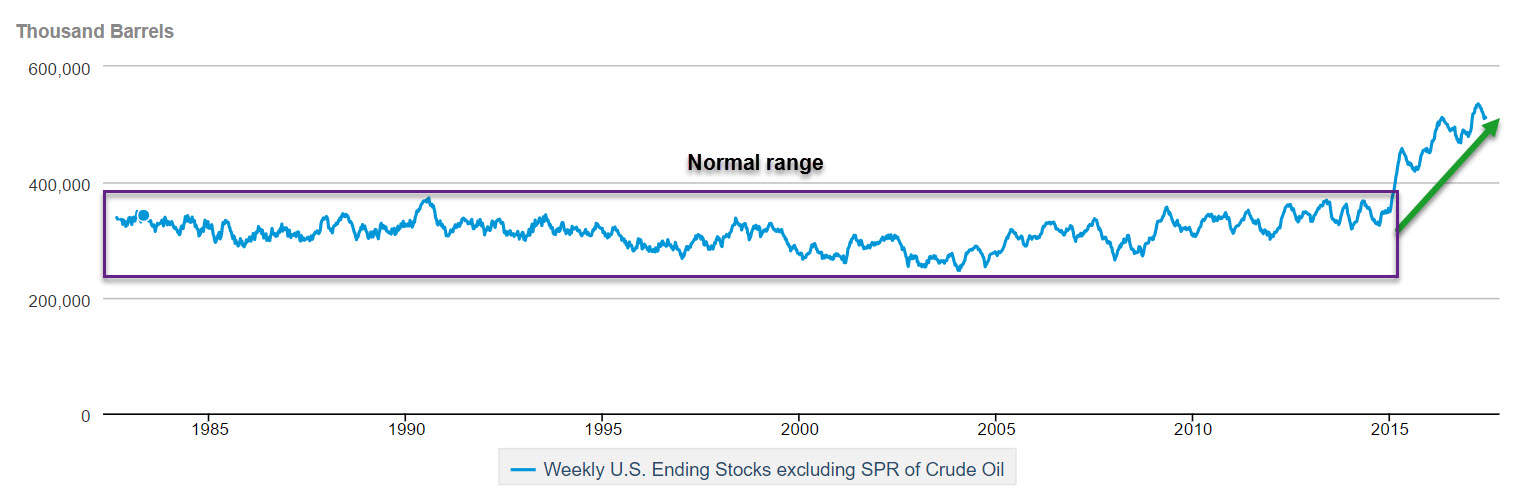

We are now in summer “driving season” where oil stocks usually decline as refinery utilization rises to peak summer highs, but as we can see on the following chart even if inventories drop here, they are at extreme levels measured against the normal range.

With US and non OPEC producers ramping up production and offsetting OPEC cuts, oil prices have been falling. Most OPEC countries are very dependent on oil revenues to finance their budget spending, so you know that the tension is building and that the risk of non compliance is rising. These countries are cutting back, and having to watch the US and other non OPEC producers continue to increase production and steal market share.

The temptation is going to be for OPEC countries to bail on their quotas and start to take back market share. The result of such a move would add even more supply to an already over supplied sector, driving prices even lower.

But understand that once we work through this next liquidation, we are looking for a great buying opportunity at much lower prices!

Yes oil prices could easily go down to $30 or even lower before this turns around. But all sectors move to extremes and none more than the oil sector. As production outpaces supply, prices decline, lower prices mean decreased cash flow, and ultimately cause cuts and shutdowns. Basically, the cure for low oil prices will be lower oil prices.

While currently we have an over supply issue, as we look out to the future, we see some dramatic changes ahead.

BP published a study showing that non OECD countries (such as China and India) will account for over 90% of the population growth into 2030. Due to their rapid industrialization and motorization, they will contribute over 90% of energy demand growth.

While renewable energy will continue to grow, once we get through the next liquidation in the oil sector, we see much higher oil prices in the next decade, mostly driven by demand from China and especially India.

Note: On May 30th we sent a sell signal on oil to our subscribers. This very simple trade to action is up 29% as of June 20. If you want to receive these type of trading signals, click here.

Stay tuned!