Potential water-fall correction for S&P 500

In our blog posted on July 26/17, we noted that a number of indicators were flashing warning signs that the market was getting overbought, and that a correction was coming soon.

On August 7/17, we posted a blog highlighting how August is typically a month where we see a high, with a correction soon after.

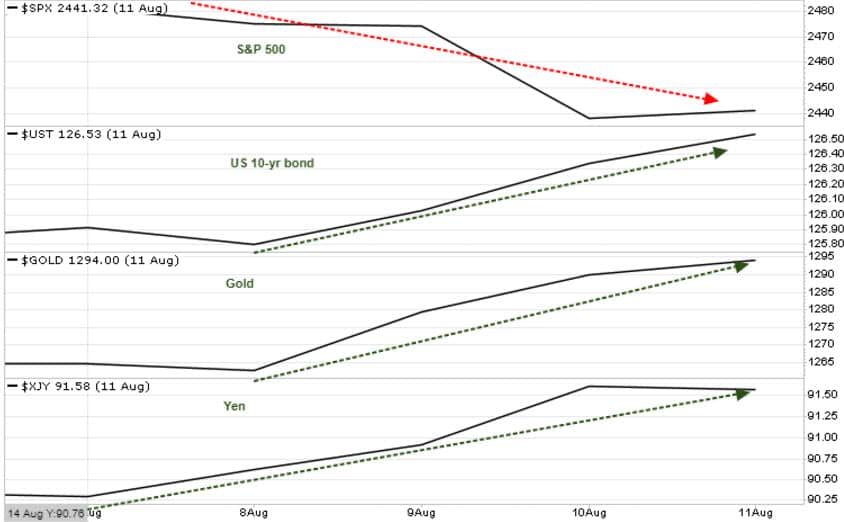

Last week, we had the stand-off between North Korea and the US, which spooked the markets, sending the equities lower, and safe haven plays such as US bonds, gold, and the Japanese Yen higher.

We will have to wait and see if these tensions escalate into something more serious, which would further bring volatility into the markets. Since the high stakes rhetoric last week, North Korea’s Kim Jong-un has blinked, now saying he will see what the US does before making his next move.

If a war breaks out, then certainly the markets would see a longer-term reaction. But markets tend to view the bigger picture, and usually get over a ‘conflict’ fairly quickly.

In January, we noted that once the S&P 500 closed above 2300, that 2500 was the next target. We identified the 2490-2515 range as a Key Resistance level for the S&P 500. On August 8th, the S&P hit 2491, technically reaching that target Key Resistance level.

As noted in that July 26th blog, once the 2490-2515 range was achieved, then there the door would be open to a correction down to the 2400-2415 level. We could certainly take another run at 2500 in the next week, but be prepared for a correction into the first week of September, before we see the next leg up (blue line on chart below).

Note also, that our model does identify a scenario where the 2400 support level does not hold, and then the door is open for a quick water-fall correction (red line), which would set up for a phenomenal buying opportunity.

We will keep subscribers up to date in our weekly reports each Sunday, and will fire out Flash Alerts if our models’ trigger new BUY/SELL signals.

If we get the water-fall washout, it will flush out margin players, creating a very sharp, dramatic decline. We are positioned for such an event and will notify subscribers when it is time to back the truck up.

Stay tuned!