Oh yeah, Turkey matters – here’s why

In the last few days we have received various forms of this question.

Why should we care about a currency crisis in Turkey?

The reason that investors need to ‘care’ about a currency crisis in Turkey is that despite all the trade war talk, we do live in a global economy. In The Trend Letter we cover global bonds, currencies, equities, commodities, and precious metals. We do this to show our subscribers how these sectors are all connected, and how a sharp move in one sector will affect other sectors.

In Sunday’s issue, we showed subscribers how a collapse in the Turkish Lira could be the next domino to fall in what we have been warning about…a global sovereign debt crisis. Here are the points from Sunday’s issue:

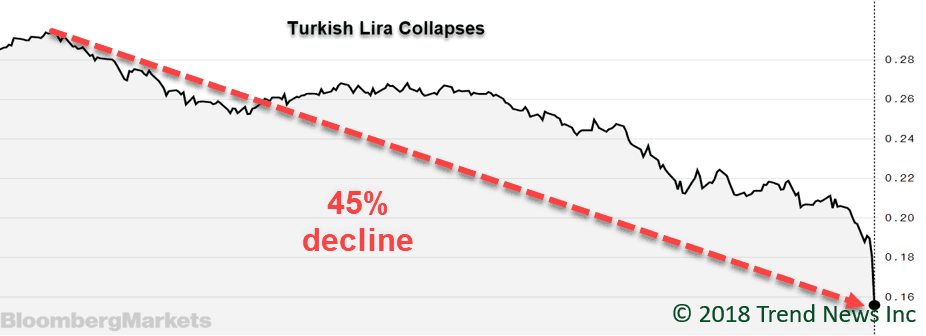

- The big currency story last week was the collapse of the Turkish Lira

- The Lira has lost 45% of its value since September & almost 20% in the last week

- Turkish President Erdagon called the plunge a ‘fluctuation’

- While most investors will simply shrug at this news, we are on alert for contagion to hit Europe, and the emerging markets

- European banks are carrying over $220 billion in $US denominated debt from Turkish companies

- With the Lira plunging in value vs the $US, it means it will cost these companies a lot more to service these debt payments that are denominated in US dollars

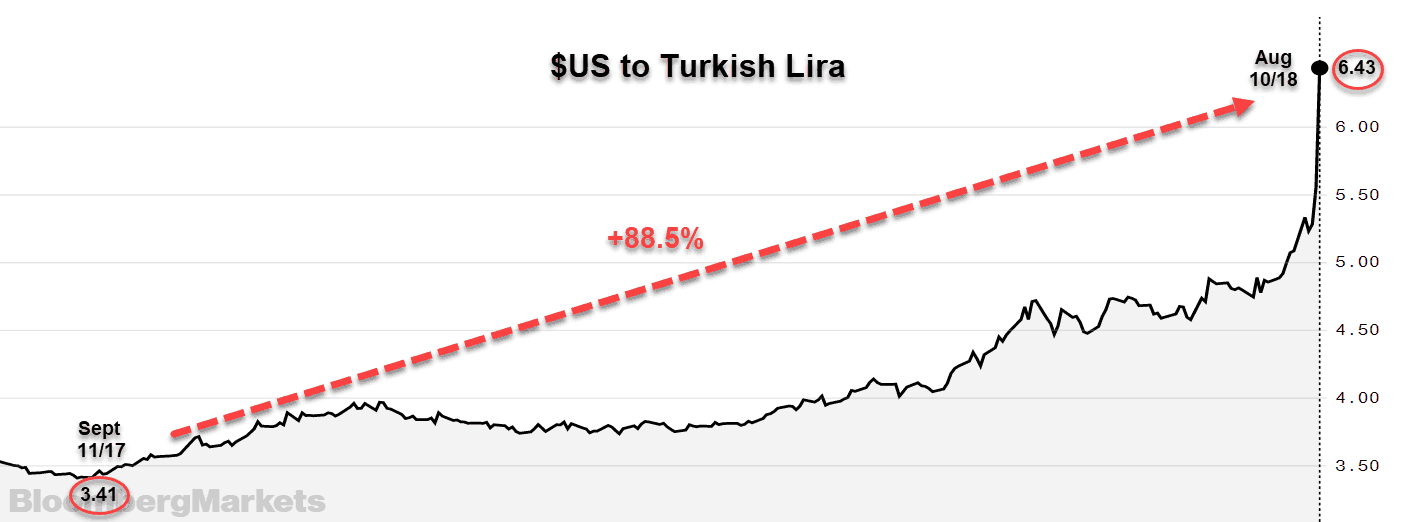

- In fact, a company today would need to pay 88.5% more to buy the same number of $US dollars to pay their $US denominated debt payment than it would have last September

- On September’17, for a Turkish company to make a $1 million dollar debt payment, it would have cost them 3.41 million Lira

- Today, to make a $1 million payment, it would cost them 6.43 million Lira

- This will put a great deal of pressure on these Turkish companies to pay their debts

- Understand that the issues in Turkey are wide spread in many emerging markets…they borrowed heavily in US dollar denominated debt when US rates were historically low

- And now with the $US rising, these debts will become much more expensive to service

The key here is that Turkey is just one of many emerging market countries that have borrowed enormous amounts of debt that is denominated in US dollars. According to the International Monetary Fund (IMF) and supported by the Bank of International Settlements, emerging market borrowing has doubled in the past five years to US$4.5 trillion.

Global investors are now targeting countries with similar economic challenges, whether they be bloated current account deficits, inflationary pressures, or high debts denominated in foreign currencies. We are seeing currencies in Argentina, Brazil, Chile, Hungary, Mexico, Indonesia, India, Poland, and South Africa all taking a hit.

What many investors do not understand is that pension funds who need ~7% annually to meet their obligations could not survive buying government bonds paying around 1% (and in Europe paying negative yields), so they sought other, more risky investments.

When Turkish bonds collapsed and were paying yields of 20%, many banks and pension funds scooped them up, assuming they were safe. If your pension fund or mutual fund owns a bunch of Turkish government bonds, or bonds of Turkish companies, then that is why you should ‘care’ about an economic collapse in Turkey.

When global capital is worried about a currency, it moves out of that currency and into a perceived safer currency. Right now the perceived safest currency in the world is the US dollar. In our February issue of Trend Letter, we made a currency recommendation that would benefit greatly from a strong US dollar. That trade is up over 21% in 6-months.

This strong US dollar vs almost every other currency is getting overbought here, so we should see a temporary reversal. But long-term, understand that $4.5 trillion in US dollar denominated debt is coming due, and with the US dollar much stronger today than it was when these funds were borrowed, it tells us that these emerging market companies and countries will need to buy a lot of US dollars in order to service those debts.

Stay tuned!