China leading the charge for electric cars

Last year China sold over 28 million vehicles, more than any country in the world. China sold over 10 million more vehicles than the 17.6 million sold in the US.

Of the 28 million vehicles sold in China in 2016, 507,000 were Zero Emission Vehicles (ZEV), which was a 53% increase from 2015. By contrast, in 2016 Europe sold 222,200 ZEVs, 14% higher than 2015, while the US sold 157,000 ZEVs, 36% more than 2015.

Although China already sells more ZEVs than the US and Europe combined, they want to drastically increase these numbers. ZEVs represent about 1.8% of all vehicles sold in China last year. The government has now proposed aggressive targets of 8% ZEVs in 2018, and then 12% in 2020.

These are very aggressive targets, ones that have the auto-industry very concerned that these targets a far too ambitious. Whether or not they enforce these targets, it is clear China is serious to move its people to ZEVs versus the internal combustion engine (ICEs).

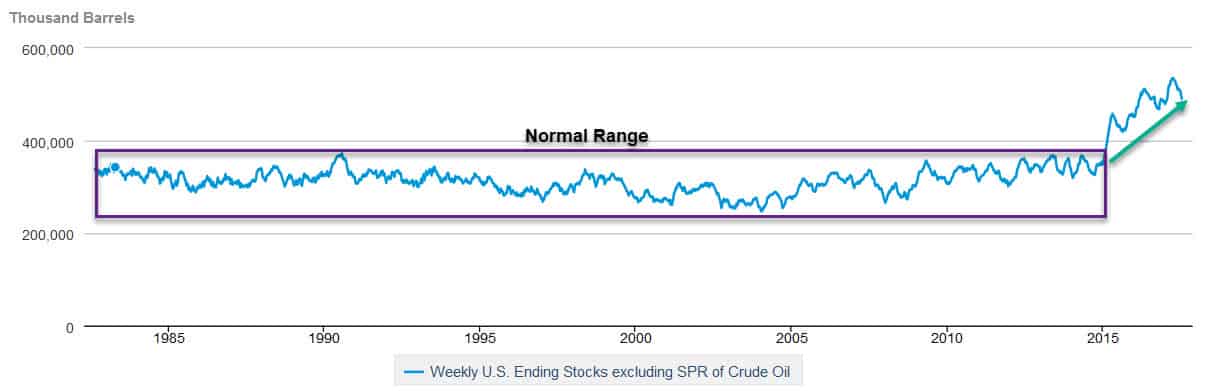

To understand why China is so motivated to lead the world toward electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs), the simple answer is that they really have no choice. Expanding ICE vehicles would mean that China would continue to be heavily energy dependent on from foreign sources. A second and more obvious reason is the terrible air pollution problems in China. Below is a picture of the smog outside Tiananmen Square in Beijing.

Today, China is the world’s largest auto market and represents most of the new worldwide demand for autos. There are 1.3 billion people in China, and it is a population the is rapidly seeing a rise in per capita incomes, which is creating demand for personal transportation that cannot be met in an environmentally sustainable way using traditional technologies.

Already the world’s largest auto market, China’s 28 million vehicles sold in 2016 is expected to grow to 40 million by 2025. In the US, there are 260 million vehicles and 325 million people. That means that there is a vehicle for 80% of the entire population. In China there is a vehicle for only 16% of the population. While China may never catch up the the percentage of vehicles to people in the US, they are certainly going to close the gap, and lead the world in ZEV purchases going forward.

Stay tuned!