Watch for the S&P 500 to reach 3000+ before bull market ends

Q: I am a new subscriber and see that you have projected the S&P 500 to hit 3000 in 2018, how do you justify such a projection?

A. We are currently in the middle of one of the biggest bull markets in history. Historically, before the top blows off a bull market there is a final massive run up as the mass investors jump on board.

We see this phenomena in every sector: stocks, real estate, precious metals, you name it. Before the real estate crash in 2005, everyone, and we mean everyone, was talking about how much their home was worth and how there is only so much land, so prices could never go down.

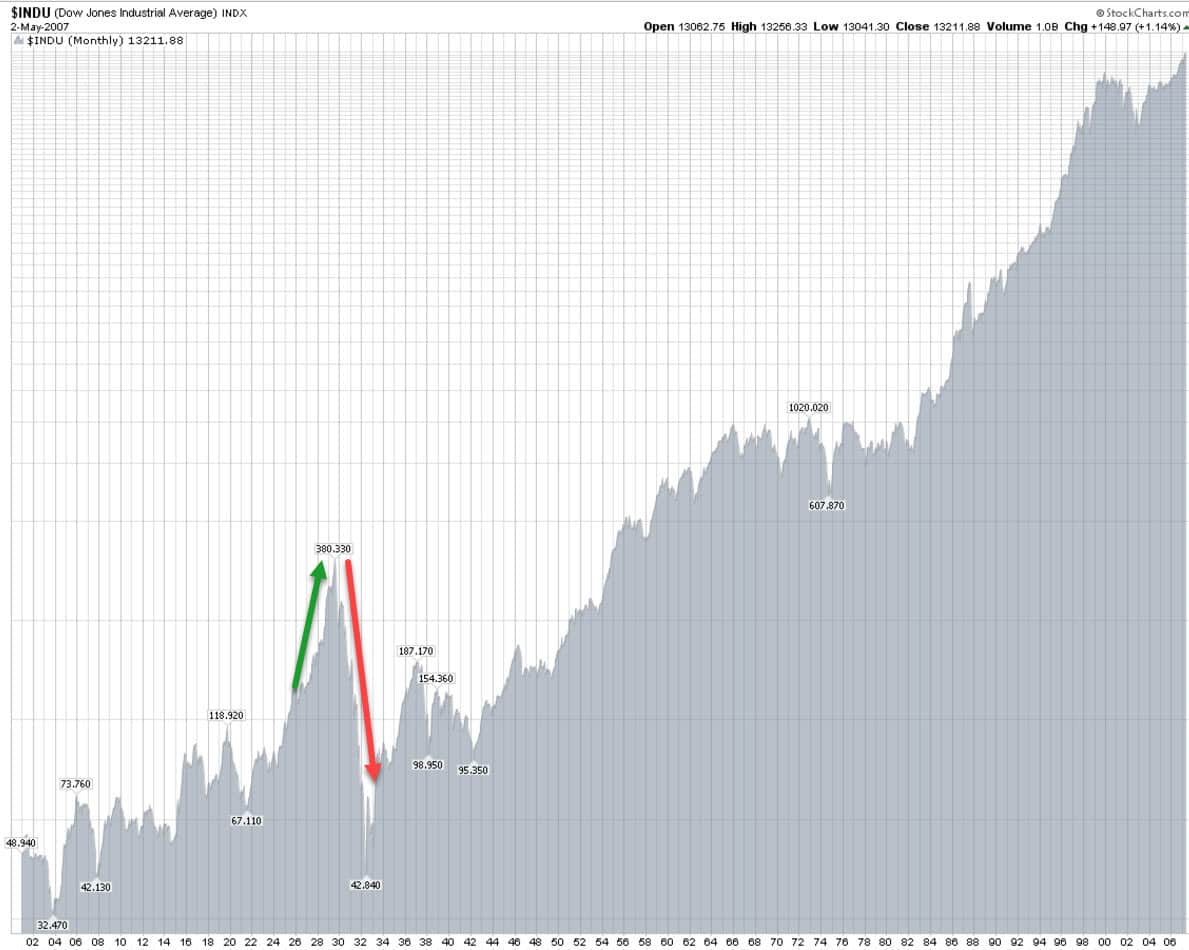

It was the same for the Japanese market back in the 1980’s. As highlighted below, the Nikkei Index jumped over 100% in the last couple of years of that bull market as the masses piled in, wanting to get in on the big gains.

The key is that the final run up of a bull market can be massive. Today, there is no euphoria about the stock markets. Just recently we had investors pouring money into long-term bonds earning in some cases, negative returns.

According to Blackrock’s CEO Rob Kapito, investors have stockpiled some $70 trillion in cash, and now, due to low returns in the bond market, those investors are starting to move their capital into equities. That is a massive amount of cash that has been sitting on the sidelines as investors burned in the 2008 crash wanted nothing to do with equities.

Are we at the top here – we do not think so? In January our models called for the S&P 500 to reach 3,000+ by mid 2018, and that forecast has not changed. We are certainly due for a correction soon, and not the one-day correction that we saw last week. But we would see a correction as a great buying opportunity.

Bull markets end when everyone is in, and there are no more buyers. That is not the case today. There are still tens of trillions of investor’s dollars on the sidelines today. The end of this bull market will come when all bull markets end, and that is when the masses all start to pile in during the last couple of months of the bull market.

Right before the end, we will see headlines calling for massive gains, as euphoria will be rampant. Soon after that manic euphoria we will see this market crash. But that is not the case today, today we are looking for the S&P 500 to hit 3000+ in 2018.

If we get a correction we will be sending subscribers new BUY alerts.

Stay tuned!