Friday, February 28/20

DJIA down 3577 points this week, or 12.3%, and that’s after rallying 650 points in the last few minutes of trading.

Down 4670 points from last Wednesday’s close to this morning’s low, or 15.8%.

In last Wednesday’s Update we wrote that: “the dominant trend in global equities is intermediate and long-term bearish” and we entered a 3rd VXX position and SDOW which since then rose 84% and 62% respectively up to this morning’s highs.

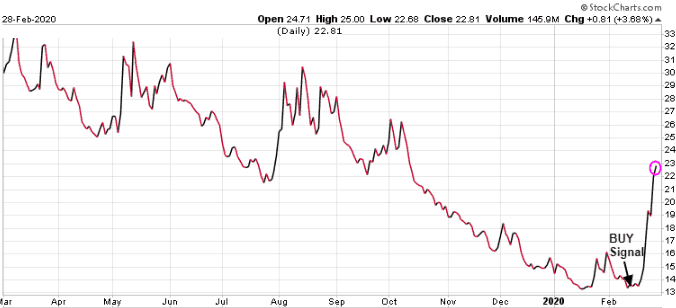

Lumber Liquidators is our major long position, and of LL we wrote that same Wednesday evening it was: “compelling us to take our 3rd position now rather than waiting for possible lower prices.” It’s up 20% since then, and was up as much as 45% within two days after investors cheered the company’s surprise Q4 and 2019 reports we predicted should be exceptionally bullish.

We’ve cautioned many times that weeks, months, even years of market gains can and will be wiped out in a matter of days.

The DJIA went from all-time highs just two weeks ago to this morning hitting the same level it started 2018.

All through January we cautioned: “The bear icon remains above as a reminder of how grossly overbought stocks are. The widespread froth in markets, including a 24-month high in bullish sentiment along with a nearly complete lack of concern for risk and fundamentals, is at or beyond historic extremes by virtually all relevant measures. A material reversal in stocks seems imminent, which should progress very quickly once it starts, and will likely be the most severe since late 2018 and quite possibly much worse.”

In fact, on January 13 we bolstered our case with several charts. Two days later the DJIA hit another all-time high, yet while the world was talking of a melt-up we were adamant that the melt-up had already come and gone.

By the end of the month the DJIA was over 700 points lower, still we were adamant that the worst was yet to come.

January 31 we wrote: “We’ve been validated in having kept the bear icon above as a reminder of how grossly overbought stocks were and very much still are. A material reversal in stocks has likely begun, which should be the most severe since late 2018 and quite possibly much worse.”

People will blame pandemic fears, but rapid drops such as this have happened before and there was no virus concern back then.

All that really matters is to know that a long-term bear market has likely begun, which should be no surprise at all to our readers, and that although stocks will likely stage a big bounce now – possibly due to a coordinated intervention by global central banks over the weekend – equities remain extremely overvalued and we expect markets to trade much lower in the intermediate to longer term.

We further expect to enjoy great gains on both the short and long side of the market, picking up bargains along the way.

More simply: no change in our studies, sentiment or outlook.

No change in the Weekly pivot.

The Monthly Indicator also remains bearish, with a new and higher level now the same as the Weekly at 29570.

To protect our existing long positions we’re taking the unprecedented step of removing stop levels on long positions for the time being.

These are carefully-chosen “value” plays, of which there are very few in stocks today, which we expect to hold longer-term thus do not wish these stopped out on a possible general market spike lower.

Rather, if prices drop significantly on our long holdings we’ll seek to enter additional positions.

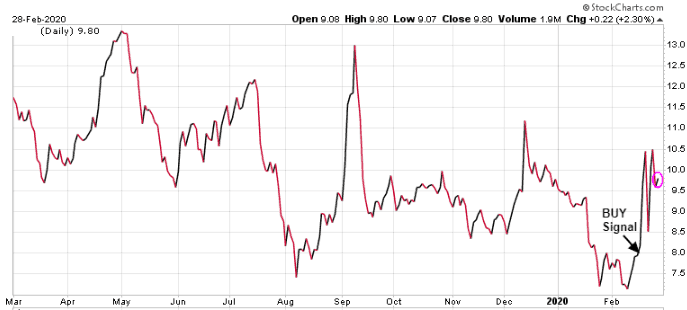

Consider DML, which today spiked down to within a penny of our stop before rallying 16% to close up 10% on the day and flat for the week.

The same thing happened with LAM, reaching within a penny of our stop then rallying 20% to close up 7.6% today and flat for the week.

We’ve stated many times in the past that the idea gold goes up during a geopolitical crisis or stock market slide is false. About half the time it does rise, and the other half it drops. Recall when stocks collapsed in 2008 gold and mining shares collapsed too.

When things get bad enough people need to sell whatever they must to meet margin calls and to pay their bills. That’s especially true at the end of the month.

In the face of that it doesn’t matter what anyone thinks gold “should” do. In recent weeks we enjoyed gold rising along with stocks and the U.S. dollar. This week was different. Our proprietary Gold Trend Indicator remains on a bullish signal.

We’ve lowered the buy stop on WWR once again, now to $2.01 and with no stop if entered.

Our 2nd VXX position was sold at $20.42 yesterday for a gain of 48.5% in a month.

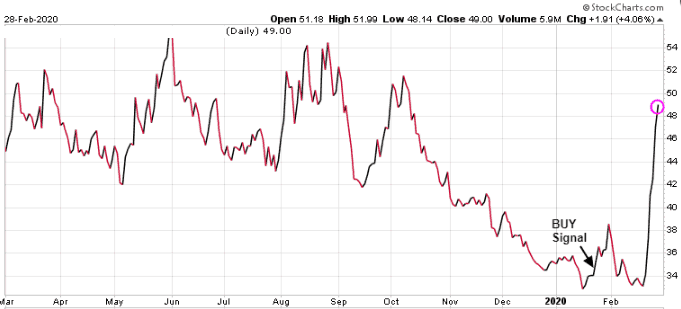

TZA opened at $51.18 today, above our $48.00 offer, so that’s closed for a gain of 47% in a month.

At this morning’s high SDOW was up 56% from our entry late last week, and is up 46% at the close.

In case markets plunge again Monday morning, we’re removing the stop on SDOW and offering it for sale at $52.00

We plan to reset some or all of these sold positions at lower levels, possibly very soon. We’ll write more about that on Monday.

Open Positions

Omitted in free sample.

Indicators

GTI (Gold Trend Indicator) : Bullish

Weekly: bearish, 29570 Moderately aggressive investors, trading or hedging on an intermediate basis, who follow the Weekly Indicator may find it prudent to be hedged or net short if the DJIA is trading below this pivot level. Reminder – we do not have a change to “bullish” or “bearish” unless the DJIA closes the calendar week above/below this pivot level.

Monthly: bearish, 29570 Conservative investors, trading or hedging on a longer-term basis, who follow the Monthly Indicator may find it prudent to be hedged or net short when the DJIA is trading below this pivot level. Reminder – we do not have a change to “bullish” or “bearish” unless the DJIA closes the calendar month above/below this pivot level.

NOTE : Speculators and frequent traders will prefer to use the Daily or Weekly Indicator as trading or hedging pivot points, while longer-term investors may prefer to consider only the Monthly Indicator.

Gold & Silver Penny Stock Basket

A basket of five tickers trading in Canada on the Vancouver Venture Exchange, suggested on December 27 2019, that we find particularly compelling and have relatively low floats (number of shares outstanding) which should magnify potential gains if speculative capital flows into this sector.

Until that may happen we consider these like lottery tickets or call options that won’t expire, so will not employ stops and as a result suggest only small amounts of highly speculative capital is appropriate for such positions.

Omitted in free sample.

If this Free Sample has piqued your interest and you wish to implement prudent hedging strategies to protect your financial position in the event of severe market declines, we are extending the World Outlook Financial Conference prices to anyone who subscribes this weekend. We will never offer better prices than these to new subscribers.