Market Musings – March 15/17

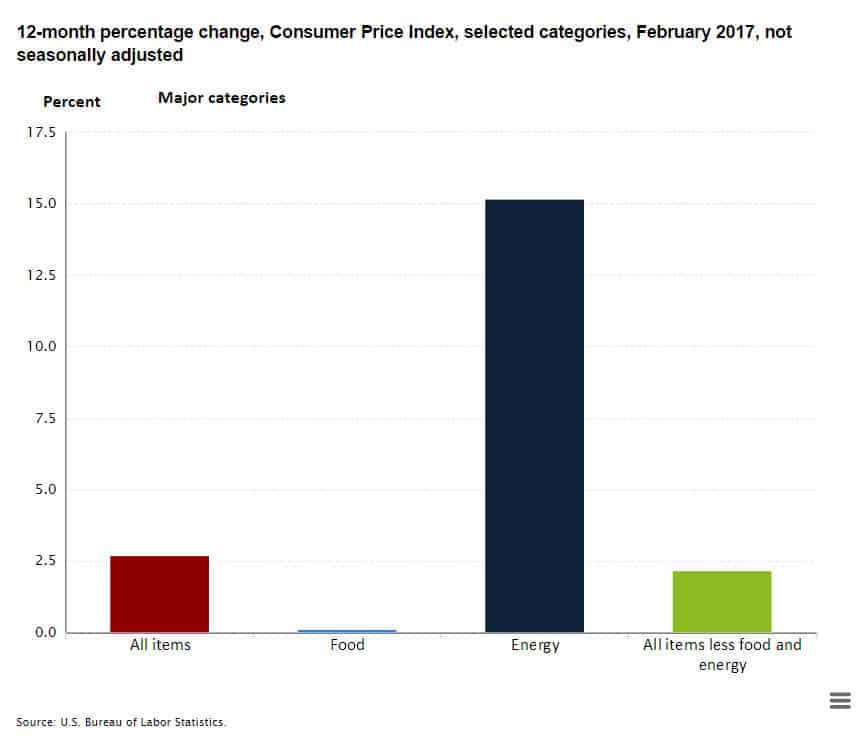

1. Inflation

The US Bureau of Labor Statistics reported that Consumer Price Index (CPI) jumped 0.1% in February. Even though this was the smallest month-over-month increase since the summer, prices are now rising at a 2.7% annualized rate.

2. Bonds

With inflation rising at an annualized rate of 2.7%, the US Federal Reserve did the expected today, raising the Fed Fund Rate 25 basis points. The market was expecting this rate hike and was looking for three more later this year, but the Fed surprised by indicating they were forecasting only two more rate hikes this year.

This less ‘hawkish’ outlook juiced the bond market, pushing bond prices higher, and yields lower.

3. Currencies

With the Fed forecasting a slower pace of rate hikes the US dollar sold off.

A declining US dollar pushed up the Euro, Yen, Canadian dollar, and most other currencies.

4. Equities

With a less hawkish forecast from the Fed, investors poured back into stocks, with the S&P 500 up almost 20 points today.

5. Gold

With a weaker US dollar, gold and silver moved higher, with gold up 17.00 and silver up .48.

6. Oil

The International Energy Agency reported that US oil stocks declined for the first time in ten weeks, They also said that OPEC compliance with their production cut deal reached 91% in February. Combined with the US dollar weakening on a more ‘dovish’ Fed forecast of two more rate hikes versus three, oil rallied 3.48% today.

Stay tuned!