As an investment newsletter company, one of the key messages we strive to get across to investors is that investing involves risk, and market downturns are inevitable. Therefore, having a sound investment strategy can help you navigate the turbulence in your portfolio and prevent you from falling prey to herd mentality by selling low into a down market.

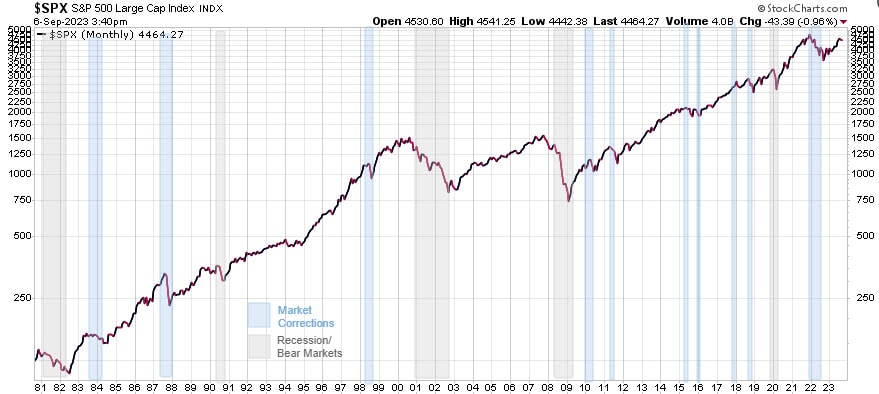

On the chart below we can see that from the early 1980’s, there have been at least 15 times we had a bear market (gray shaded areas), with a decline of at least 20%, or a market correction (blue shaded areas) with a decline of 10% or more.

Hedging is one of the best strategies that investors can use to mitigate the effects of market downturns. It involves taking an opposite position in a related asset, to offset losses in investments. Hedging is like an insurance policy that protects you against negative events that would impact your portfolio. Essentially, a hedge provides a counterbalancing effect by moving in the opposite direction. This means that if the investment you’re concerned about faces a decrease in value, the hedge investment is structured to increase in value, offsetting potential losses.

Hedging is a flexible strategy. You can apply it broadly to help minimize loss across entire asset classes in your portfolio, such as equities, fixed income holdings, commodities, or even currency allocations. Or you can hedge narrowly to help shield individual sectors or even specific stocks.

Portfolio hedging can become part of your long-term investment strategy. Deployed tactically, a hedge can be applied and removed as needed, without disturbing your core strategy or long-term goals, to help provide short-term shelter from adverse market events. Hedging your portfolio can provide you with an alternative to selling in a down market, realizing investment losses, and potentially generating significant redemption fees, transaction costs and tax consequences.

How to implement hedging strategies

There are several common hedging strategies investors can use to help mitigate portfolio risk: short selling, buying put options, selling futures contracts, and using inverse ETFs.

While short selling, buying put options, and selling futures contracts are common hedging methods, they can be complex and have limitations that may deter many investors. We use inverse ETFs as a less complex, more attractive hedging option, as they avoid certain drawbacks associated with other techniques.

Inverse ETFs can be used to hedge equity and bond holdings. And, as investors have diversified into a broader selection of asset classes, it has become common to see investors hedging commodity and currency holdings as well. Let’s look at an example:

It’s likely that most investors have investments in large-cap stocks within their investment portfolios. The S&P 500 is one of the more widely monitored stock market indices globally. An alternative hedging investment option to consider is the ProShares Short S&P 500 ETF, which is identified by the ticker symbol SH. This exchange-traded fund is structured to provide daily inverse (-1x) exposure to the S&P 500. Essentially, if the S&P 500 experiences a 1% decline on a given day, SH is designed to increase by 1%, and conversely, if the S&P 500 rises, SH should decrease in value accordingly.

SH could have been used as a hedge during a recent market decline in the first half of 2022. This decline was triggered by concerns such as inflation, escalating interest rates, Federal Reserve policy tightening, and mounting fears of an impending recession that unsettled the equity markets. During this decline the S&P 500 lost ~30%, while the ProShare Short S&P 500 ETF gained ~30%.

While typically the goal of hedging is to protect from losses, Trend Technical Trader (TTT) takes it one step further. Cycles will always occur, and TTT seeks to profit greatly from those cycles, both up and down.

TTT was originally designed as a hedging service designed to profit during stock market declines, and the bigger the decline, the bigger the gains TTT trades would generate. The objective is to help serious investors avoid losing a significant portion of their wealth in the next downturn and position them for the next big buying opportunity.

In addition to being a hedging service, TTT now trades long positions as well, covering energy, equities, and precious metals, and it includes the proprietary Gold Technical Indicator (GTI).

Are you prepared?

Seriously think about subscribing to Trend Technical Trader and put yourself in position to not just survive the coming melt-down, but to actually profit from it.

Stay tuned!