Thanks to modern technology, we are now on the verge of a historic event, where we will not only be able to invest in publicly traded companies, but trade in anything perceived to have value. We are talking about the average Joe being able to purchase portions of things like fine works of art, fancy cars, and even commercial real estate – the kinds of purchases previously available only to the wealthy. This new technology is called ‘tokenization.’

What is tokenization?

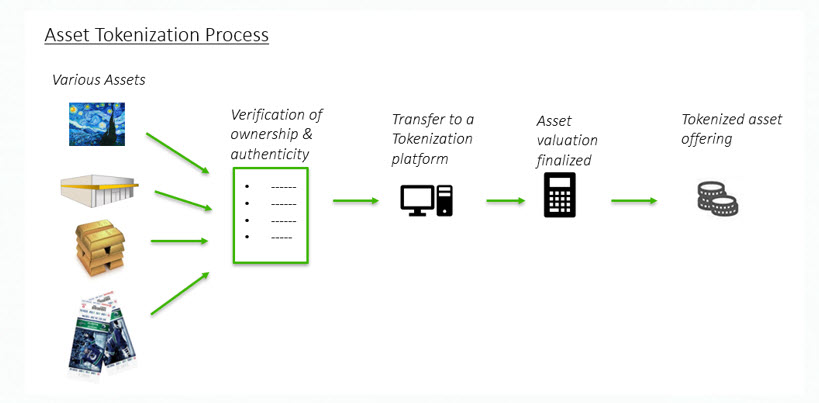

‘The process of converting ownership rights into a purely digital representation of an asset that can be subdivided, traded, and stored with decentralized ledger technology (DLT)’

Today, according to US Investment firm Piper Sandler, in the US alone, almost 15 billion stock shares are traded DAILY. According to Bloomberg, the total global market capitalization is $115 trillion.

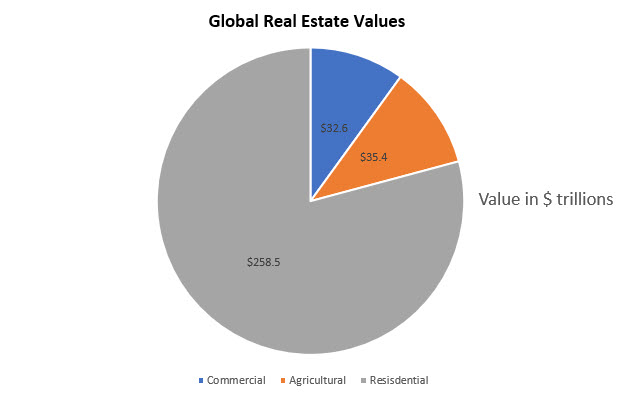

As noted, the total global value of all stocks is $115 trillion, but what if investors could also buy and sell portions of other asset classes, like residential and commercial real estate. New technology can unlock the global private economy and make it open to everyone.

According to Savills Research, the total global residential real estate market is worth $258.5 trillion, the global commercial real estate market is valued at $32.6 trillion, and agricultural land is worth $35.4 trillion. That is a total of $326.5 trillion for global real estate.

Problems investing in Real Estate:

Real estate requires a lot of capital, so people with lots of money can invest in real estate, but that also means that regular people tend to get left out, especially for commercial real estate.Here are a few other barriers:

- Notoriously illiquid market

- Slow, manual process

- Costly layers such as, agents, lawyers, and high deposit fees

Advantage of tokenization:

Flexibility

Anyone can invest a specific amount and become a partial property owner and benefit from the profits generated. Additionally, the token holder can sell these tokens on secondary markets at higher rates. The property owner can sell parts of their assets through token issuance. Real estate tokenization provides a better option for crowdfunding as it gives the user instant digital ownership. Here, the user is free to sell the token when required

No Location Limits

Property tokenization removes the limitations related to location. There is nothing to stop a user from buying a property on the other side of the world. Users can participate and profit from resort construction, housing estates or rentals anywhere in the world.

Investment Speed and Ease

The primary objective of any optimized activity is to reduce the time required to complete a process. Blockchain technology enables this by removing obstacles such as notary fees and bank fees. This removal results in increasing investor returns and shortening the process for raising capital. It effectively streamlines the process and brings in more significant revenue.

Token investment minimizes costs and provides greater freedom as anyone can purchase a share in real estate and profit from it. The site automates the process and does not require pointless formalities. The user acquires the property rights by purchasing a token, which does not require any mortgage or real estate records.

Diversification and Broader Audience

Till now, the only form of real estate investment required significant sums of money.

Tokenization removes the need to purchase the whole property. Anyone can divide a property into several smaller tokens and sell them.

A user only has to purchase a single token. Here, the user can participate in a smaller shareholding structure like distributed investing. This process requires a small sum of money to buy a piece of real estate. The process lowers the entry barrier and makes investment accessible to people with less capital.

Distributed investing also enables users to diversify their investments. Users can consider investing in other properties and purchase them, thereby diversifying their investments.

Better Security

Real estate tokenization makes transactions secure and makes the process transparent. Tokenization utilizes blockchain technology and provides the highest security standards available. Blockchain, by nature, is decentralized. It means there is no copying or code reversal, and nodes will identify any changes to the code.

Future Perspective

The concept of tokenization has a significant impact on the real estate industry. The trading of digital assets and tokenized real estate shares will bring substantial change. Blockchain technology could alter the way the real estate industry works and operates.

Also, tokenization lowers the high entry barriers and brings change to an industry. For a long time, the real estate industry dealt with high barriers to entry and illiquidity. Tokenization opens up this market and helps democratize this sector. It also enables large quantities of capital to enter.

Example:

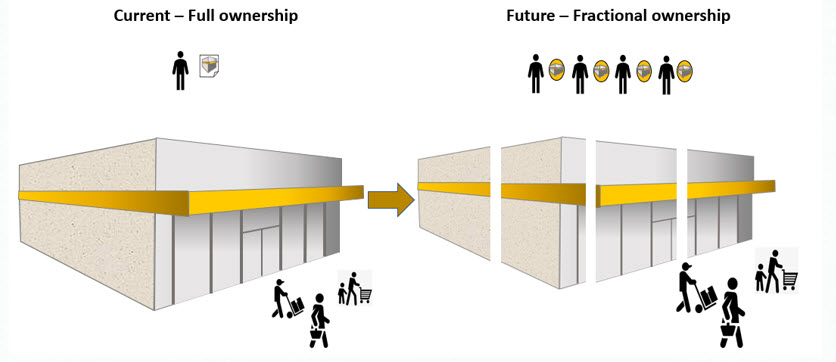

Say you own a small warehouse complex currently worth $2 million and want to raise $500,000 to invest in another project. Previously, you would have to find a partner to buy in. The number of potential partners would be limited and how do you source them?

With this new technology you could ‘tokenize’ the complex – transitioning from Full ownership to Fractional ownership. If the total square footage of the complex was 100,000 square feet, you could sell tokens, each representing one square foot, currently worth $20. Fractional ownership could be sold to tens, hundreds, even thousands of token purchasers. The value of these tokens would fluctuate much like any other security. If the value of the business increases, the value of the tokens would increase, and all token holders would benefit.

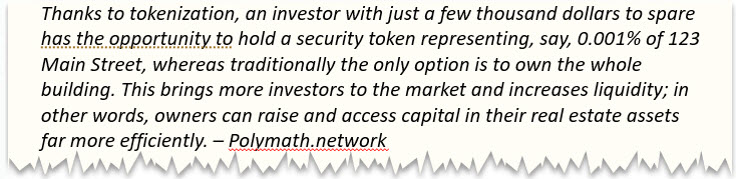

You no doubt have already heard about digital tokens, be they cryptocurrencies such as Bitcoin or Ethereum, and you have likely heard of Non-Fungible Tokens (NFTs). You have likely heard of Non Fungible Tokens but you may not understand what they are. Here is a very simple explanation.

NFTs (or “non-fungible tokens”) are a special kind of cryptoasset in which each token is unique — as opposed to “fungible” assets like Bitcoin and dollar bills, which are all worth exactly the same amount. Because every NFT is unique, they can be used to authenticate ownership of digital assets like artworks, recordings, and virtual real estate or pets.

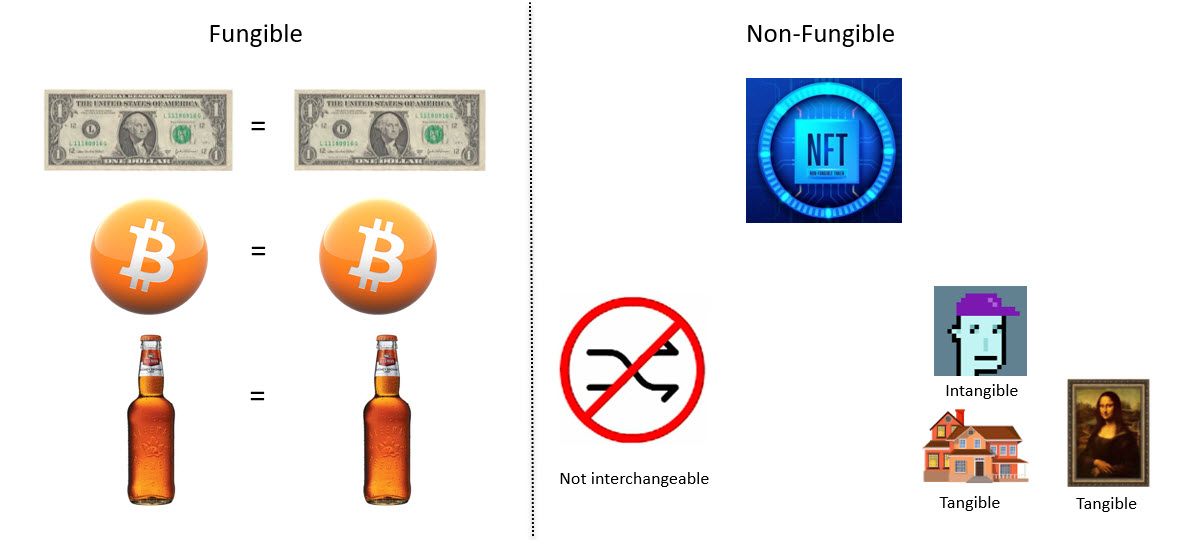

Here is a visual showing the difference between ‘Fungible’ and ‘Non-Fungible’ assets. On the left we have fungible items, where each of the dollar bills, bitcoins and bottles of beer are all interchangeable. You can switch one dollar for another dollar, one bitcoin for another bitcoin, and one bottle of the same brand beer for another bottle of the same beer.

On the right we have Non-Fungible items, and they are unique. You have a tangible item like a house, it may be the same design as another but it is located at a unique specific address in a specific city, so it is unique. The Mona Lisa is a unique art form, there is only one. Others can try to paint a copy, but they will not be the ‘Mona Lisa’. There is also the intangible NFTs that are getting a lot of publicity, each one unique. These are digital art pieces that are unique and have become extremely popular, especially with the younger generation.

Digital art has an established history dating back to the 1960s, but the ease of duplication traditionally made it near-impossible to assign origin and value to the medium.

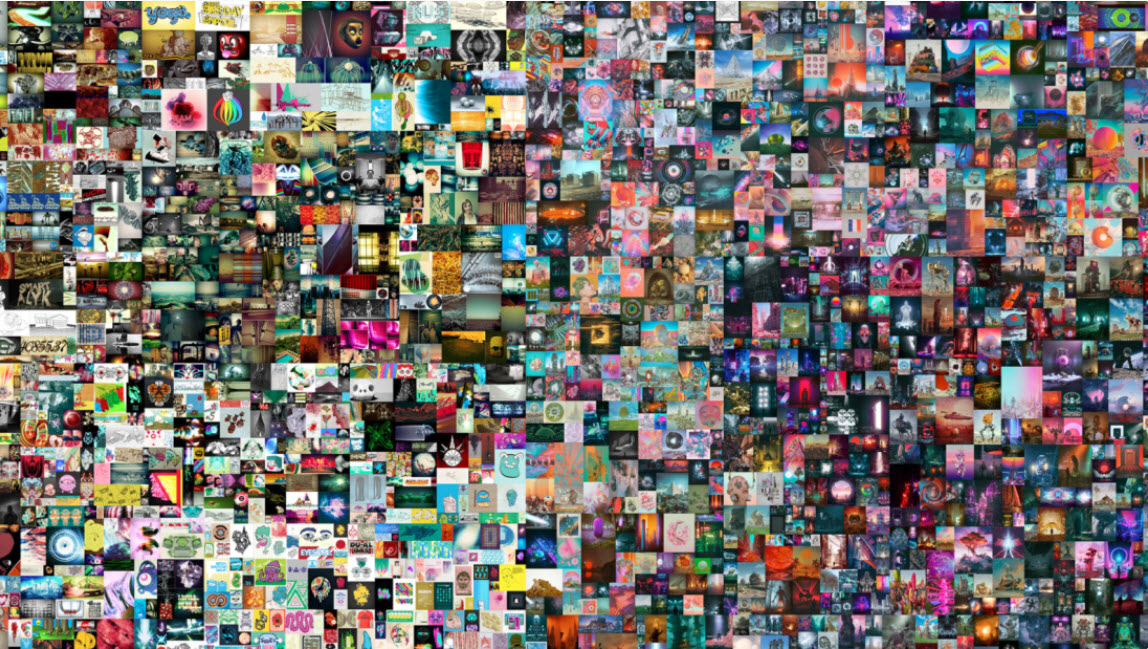

The recent introduction of Non-Fungible Tokens (NFTs) and blockchain technology has enabled collectors and artists alike to verify the rightful owner and authenticity of digital artworks. On March 11, 2021 Christie’s auctioned off a piece of digital art from graphic designer Mike Winkelmann, better known as Beeple. The piece was called ‘Everydays: The first 5000 days’, where he created a digital artwork every single day for 5000 straight days (13 and a half years). The digital collage sold for an astonishing $69,346,250!!

The digital artwork was delivered directly from Beeple to the buyer, accompanied by a unique Non-Fungible Token, effectively a guarantee of its authenticity and ownership.

This guarantee of authenticity and ownership is revolutionizing some sectors that may surprise most readers. One of those sectors is the vintage wine industry where fraud has become a major problem. Imagine forking out thousands of dollars for a prized bottle of wine only to find out later that it is a fake. ‘I’ve opened so many fake 1982 Château Mouton Rothschilds, I’ve lost count,’ Melissa Smith, founder of Enotrias, which provides white-glove private sommelier services to people who can afford it.

‘We’d been discussing the possibility of creating wine NFTs for a few months’, says Brian Bell, general manager at Geyserville’s Skipstone Ranch. ‘There is so much about the concept that we love. Not only is the provenance guaranteed, but it reduces the risk inherent in collecting wine. There is a direct correlation between the number of times a wine bottle is moved and its potential for damage. All you need is one minute in a really hot place, and the wine has been compromised forever, and will never be the same.”

The NFT not only ensures that the wine is what it says it is, it also means that the bottle of wine will be stored by Skipstone, in its underground cellar, until the day the buyer decides to consume it.

‘Even when it’s resold, only the NFT gets moved,’ he says. ‘The bottle of wine will stay where it is.’

Various wineries have become interested in NFTs. The biggest name to get involved recently was Yao Family Wines of Napa, a premium winery owned by former NBA star Yao Ming, which auctioned a bottle of The Chop Cabernet Sauvignon in April alongside a “limited-edition NFT”.

Other wineries from France to Georgia are using NFTs as novel ways of marketing and promoting their wines. Flavien Darius Pommier, who owns Chateau Darius in St Emilion, is selling four NFTs for each vintage for around €100. For each NFT you get a piece of artwork, the opportunity to store your wine, and two physical bottles. He has sold eight so far but notes that he’s created many times more interested customers. He intends to increase the number of NFTs he offers per vintage.

The key point here is that virtually any asset could be tokenized and traded freely by the general public.

What we have seen so far with cryptocurrencies and NFTs is simply the first inning in this potentially game changing new technology. The capital markets are not designed to support small business. Today, virtually all Initial Public Offerings (IPOs) coming onto the markets are valued at $100 million or more. Up until now small companies have avoided going public because it is too expensive and too much of a hassle to do so. Instead, they have raised money from a small pool of private investors. The typical retail investor doesn’t have access to those deals. That’s where security tokens come in. Security tokens will make it much easier for small businesses to raise the capital they need to expand.

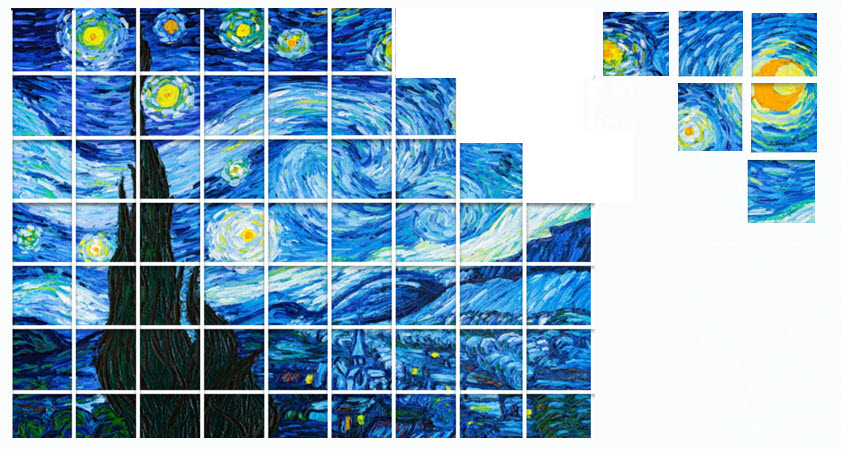

Similar to Bitcoin, security tokens will not trade in fixed whole units like stocks and bonds, they will be fractionalized. You will be able to buy a fraction of a company, or building, or work of art, or any other asset.

Maybe one day the Museum of Modern Art decides to raise some money to acquire more paintings. You have always loved Van Gogh’s Starry Night which is reportedly worth over $100 million, but now you could buy a fraction of it. In that scenario you could invest $1,000 and own 0.001% of that painting.

The initial sale of a security token is typically called a security token offering (STO). It’s also sometimes called a tokenized security offering (TSO) or a tokenized asset offering (TAO). But no matter what term is used, the result is the same. Once tokens are created and sold to investors, they need to be listed on an exchange so investors can trade their tokens. Currently, there are not very many listing options, but the number of exchanges is growing rapidly.

Tokenization removes the middleman, making it easier and cheaper for investors to buy/sell real estate and for owners/developers to raise capital. Investors can trade tokens almost instantly for a very low fee, similar to a stock market trade, but without the high fees. For businesses and asset owners, tokenization makes it possible to raise capital.

The final piece of the puzzle is perhaps the most powerful and brings us full circle. Decentralized financial infrastructure now offers the potential for these tokenized assets to participate in full-fledged money markets.

And it is happening now – we see this sector having massive growth potential. Understand, we are not talking about the current stock exchanges, this is a completely new market that will be bigger than anything we’ve seen in our lifetimes.

When you buy a stock, you get a digital certificate that proves you own a piece of that publicly traded company. With the ‘tokenization’ transaction, instead of getting a certificate, you get digital proof of ownership with a ‘token.’ The difference is this fractional ownership through ‘tokenization’ could dwarf the global stock exchange volumes. We are talking about the potential to trade almost anything via ‘tokenization’.

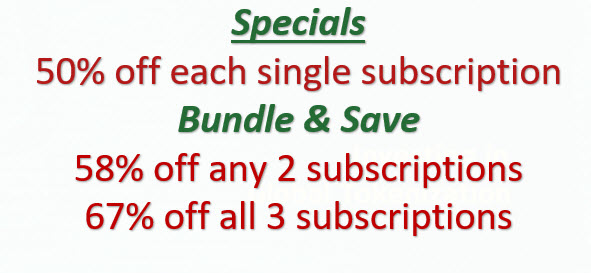

We are watching these developments very closely and will be updating both our Trend Disruptor & Technical Trader subscribers as we move forward. But if you don’t want to miss out on a potential generational investment opportunity, don’t hesitate to sign up for one or both of those services an ddo so at Special Conference prices below

Trend Letter – Equities, Currencies, Bonds, Commodities, Precious Metals

Trend Disruptors – Artificial Intelligence, Augmented Reality, 5G , Cloud, Tokenization

Trend Technical Trader – Hedging service + Gold, Metals, Energy, NFTs, Psychedelic Therapy

Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | 299.95 | $300 | Trend Letter $299.95 |

| Technical Trader | $649.95 | $324.95 | $325 | Trend Technical Trader $324.95 |

| Trend Disruptors | $599.95 | $299.95 | $300 | Trend Disruptors $299.95 |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1,249.90 | $524.95 | $724.95 | Trend Letter + Technical Trader $524.95 |

| Trend Letter + Trend Disruptors | $1,199.90 | $503.95 | $695.95 | Trend Letter + Technical Trader $503.95 |

| Technical Trader + Trend Disruptors | $1,249.90 | $524.955 | $724.95 | Trend Disruptors + Technical Trader $524.95 |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1,849.85 | $610.45 | $1,239.40 | Trend Suite TL =TTT + TD $610.45 |