Caution required, correction due

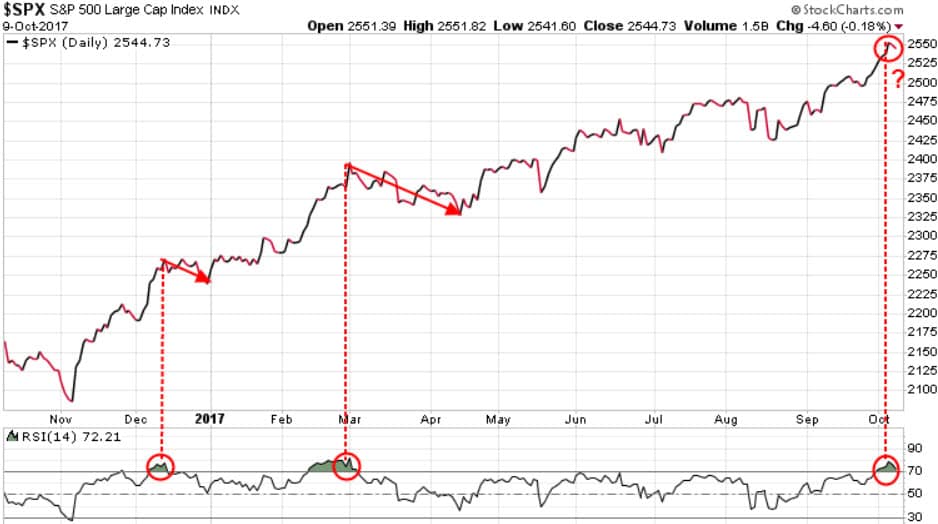

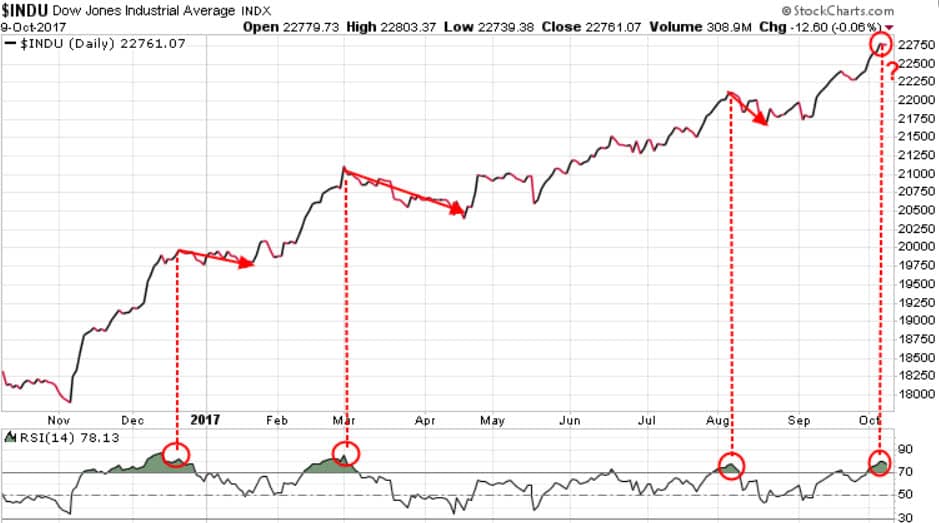

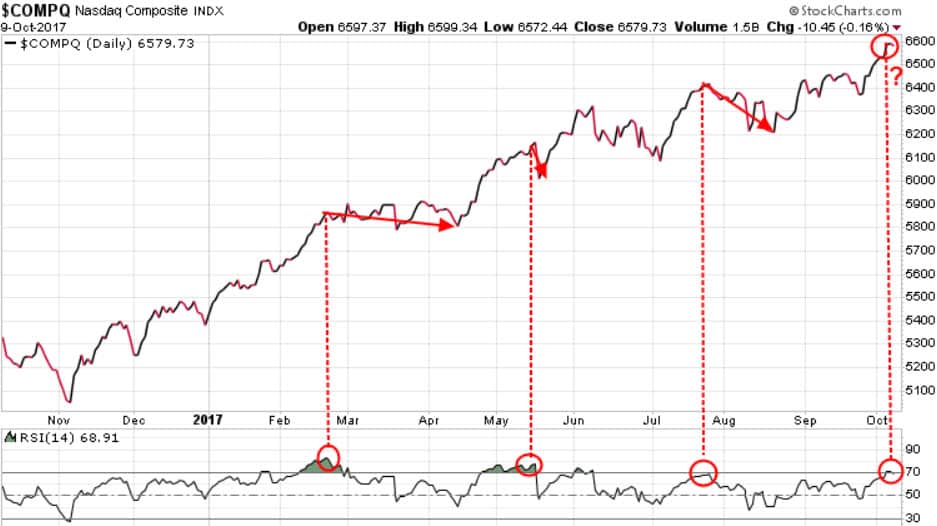

We have been bullish on stocks for quite some time, and last week we saw yet another bullish trend, as the S&P 500, Dow Jones Industrials, Russel 2000 Small Caps, and the NASDAQ, all made new all-time highs. These new highs are very bullish, but as we can see on the bottom of each chart, the Relative Strength Index (RSI) readings have moved into overbought territory for each of these key indexes.

The red arrows highlight that when we reach these RSI levels, we generally see small pullbacks, or larger corrections.

S&P 500

Down Jones Industrial Average

Russel 2000 Small Caps

NASDAQ

Every bull market needs corrections to allow the markets to take a pause, and allow momentum to re-charge. Periodic weakness actually increases the longevity of the bull market. These RSI readings are suggesting that these markets are due for a correction anytime now.

Our models are calling for the S&P 500 to reach 3000, and even 3600, before this bull market run ends. But all markets need that re-charge, and these markets are overdue for such a correction.

Note: We sent out a pending trade recommendation to subscribers of The Trend Letter to profit should we get a correction here.

If you would like to subscribe to The Trend Letter to receive all of our BUY & SELL signals, and receive a 38% discount off the regular rate, CLICK HERE

Stay tuned!