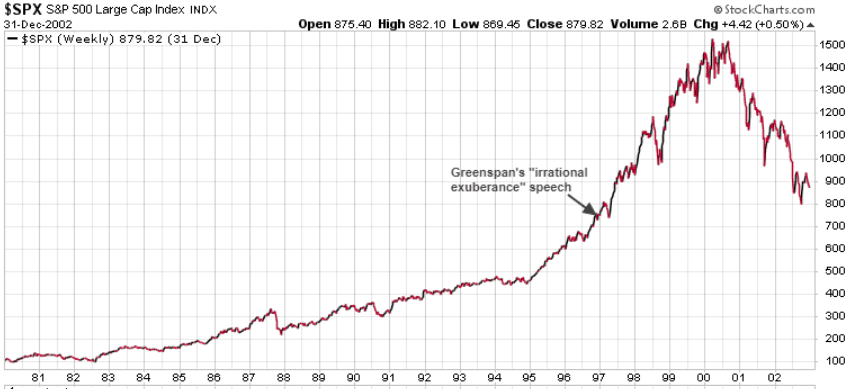

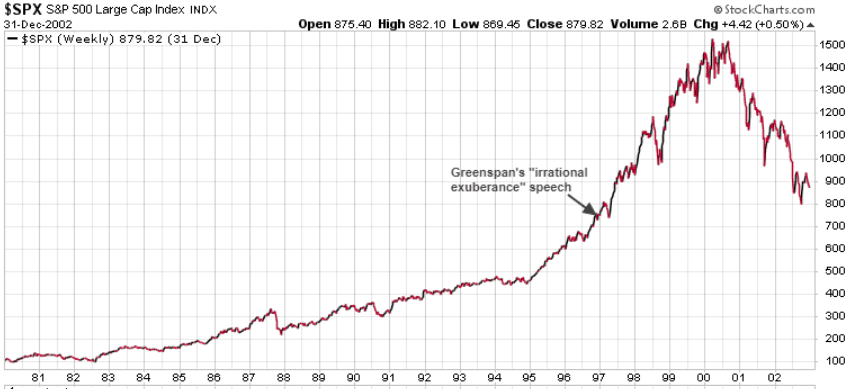

Back in December,1996, in a speech titled “The Challenge of Central Banking in a Democratic Society,” then US Federal Reserve chair Alan Greenspan used the term “irrational exuberance” to describe the DOT COM spike in the stock market.

The stock market was already in a 15 year bull market, but had really started to spike in 1995. Greenspan was concerned with the steeper rise, and warned that unsustainable investor enthusiasm would drive asset prices up to levels that aren’t supported by fundamentals. And he was right.

But before he was right, asset prices continued to rise almost 100% over the next three years, before the big Tech Bubble crashed in 2001.

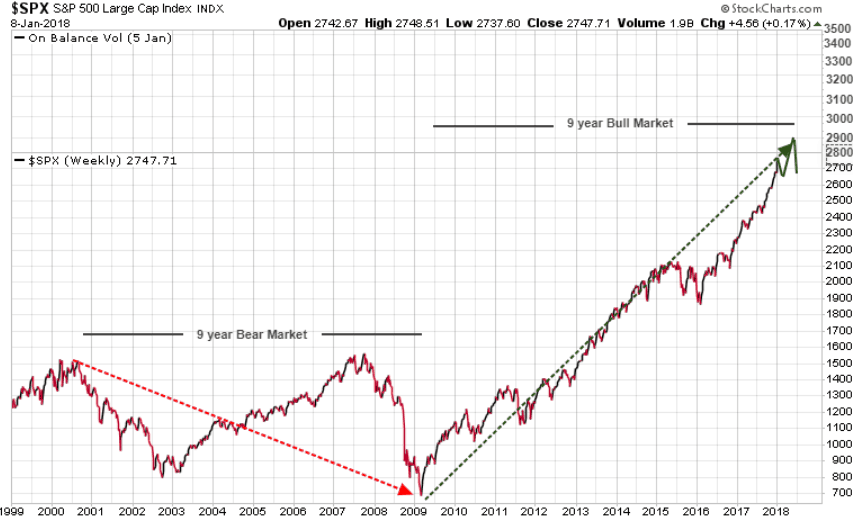

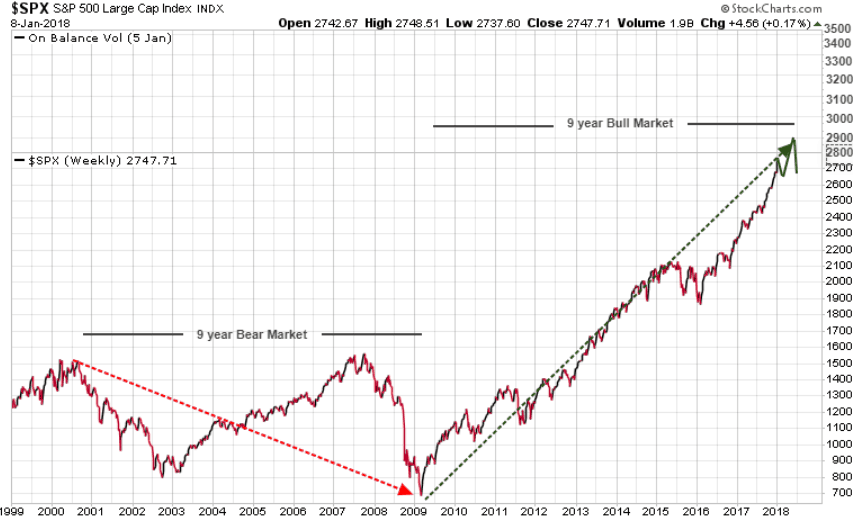

That bull market lasted 18 years from 1982 to 2000. We are not saying that this current 9 year bull market in stocks has another 9 years to go, but we need to be aware that just because this market is getting very expensive and we are hearing the word ‘bubble’ an awful lot these days, we could see this market really ramp up in the next few months.

While prices are high, prices are not what will kill this market. We need to continue to see more “irrational exuberance” where everyone who is not yet in the market starts to panic and jump in, not wanting to get left behind. It is when the mass investors, those who are always last to the party, step up and buy stocks. That will be when the top will be in, as there will be no one left to buy. We haven’t seen enough signs that signal we are there just yet.

In our January 8/17 issue of The Trend Letter, our models had targeted the S&P 500 at 3000 by March’18. To reach that target, the S&P 500 would need to rise a further 9.4% in the next two months, certainly not out of the question.

March’18 would be 9-years since this bull market started, after the previous 9-year bear market. But we believe that this market still has more room to run.

Very near-term this market is overbought and needs to take a break, so a correction into the mid 2600 range should be expected, before the next run to 2900.

If we do get that spike to the 2900 level in March, then watch for a pullback/correction. We will be updating subscribers in next week’s issue of The Trend Letter how our models see the rest of 2018.

While we do expect the equity bull run to continue, you must to have a strategy to protect yourself in case of a severe market correction, or even market crash.

Trend Technical Trader (TTT) is an excellent hedge service with many strategies to hedge and protect your wealth in the event of a severe market correction. Not only does TTT allow you protection, it also gives a great opportunity to actually make significant gains in a down market.

We are offering you TTT at $250 off the regular price of $649.95, now just $399.95. Click here if you wish to subscribe.

Stay tuned!