Malls are dying at record pace as Amazon eats up retailers

According to Bloomberg the demise of so many retailers has left shopping malls with hundreds of slots to fill, and the pain could be just beginning. More than 10% of US retail space may “need to be closed, converted to other uses or renegotiated for lower rent in coming years”, according to data provided to Bloomberg by CoStar Group.

Urban Outfitters Chief Executive Officer Richard Hayne didn’t mince words when he sized up the situation last month. Malls added way too many stores in recent years — and way too many of them sell the same thing: apparel.

“This created a bubble, and like housing, that bubble has now burst,” he said. “We are seeing the results: Doors shuttering and rents retreating. This trend will continue for the foreseeable future and may even accelerate.”

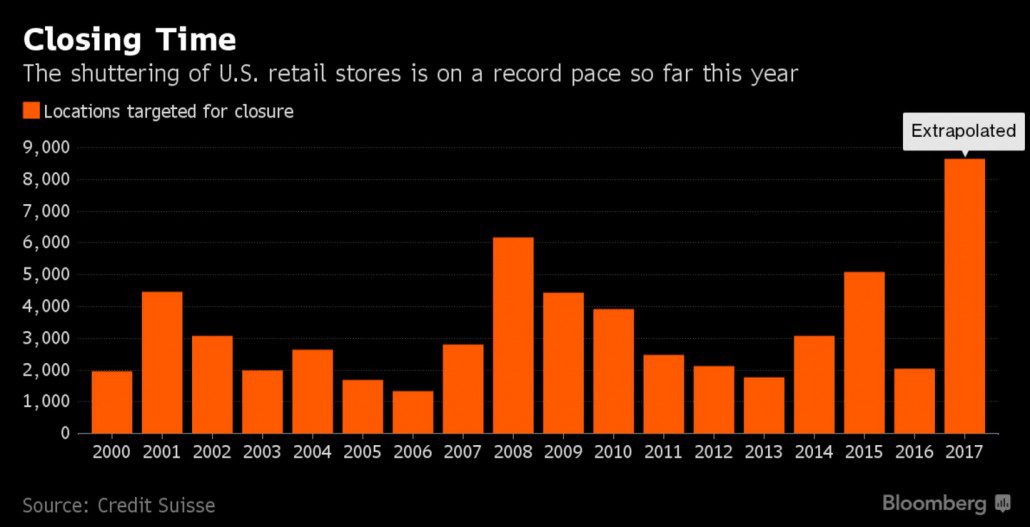

Year-to-date store closings are already outpacing those of 2008, when the last U.S. recession was raging, according to Credit Suisse Group AG analyst Christian Buss. About 2,880 have been announced so far this year, compared with 1,153 for this period of 2016, he said in a report.

Extrapolating out to the full year, there could be 8,640 store closings in 2017, Buss said. That would be higher than the 2008 peak of about 6,200.

Many retailers are trying to re-emerge as e-commerce brands. Kenneth Cole Productions said in November that it would close almost all of its locations. Bebe Stores Inc., a women’s apparel chain, is planning to take a similar step. But these brands who are trying to move aggressively online are having trouble trying to keep up with the growth in market leader Amazon.

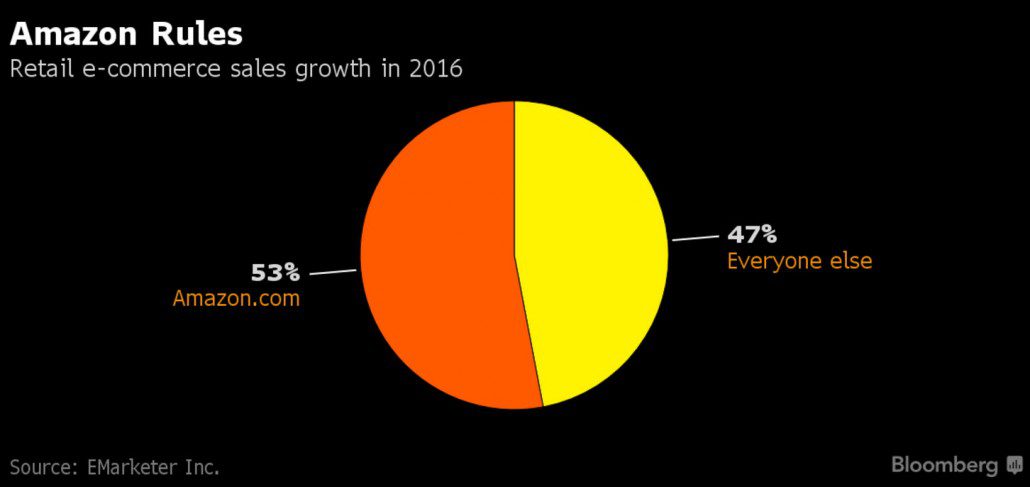

The Seattle-based company accounted for a massive 53% of all e-commerce sales growth last year, with the rest of the industry sharing the remaining 47% according to EMarketer Inc.

This glut of malls is predominately a US issue, as “Retail square feet per capita in the United States is more than six times that of Europe or Japan,” Urban Outfitters’ Hayne said last month. “And this doesn’t count digital commerce.”