Pay attention to these charts

While we are long-term bullish on the equity markets, we are cautious here based on some technical indicators that we pay attention to. As we can see on the following chart, the S&P 500 is overbought here based on the Bollinger Bands and the Relative Strength Index (RSI) indicators.

On the next chart of the Russell 2000 Small Cap index, we can see that since the peak of the Tech bubble in 2000, the Russel 2000 has formed a long-term megaphone pattern (higher highs and lower lows). But more interesting is that in the shorter-term we see a smaller megaphone within the larger megaphone.

This smaller megaphone pattern warns of a potential significant correction in the Small Cap stocks.

Typically, when a significant top forms in the equity markets, the large cap stocks (Dow Industrials and S&P 500) continue to move higher, while the small caps (Russell 2000) tend to fall behind. This suggests that we could continue to rally here until May, and then see a potential strong sell-off.

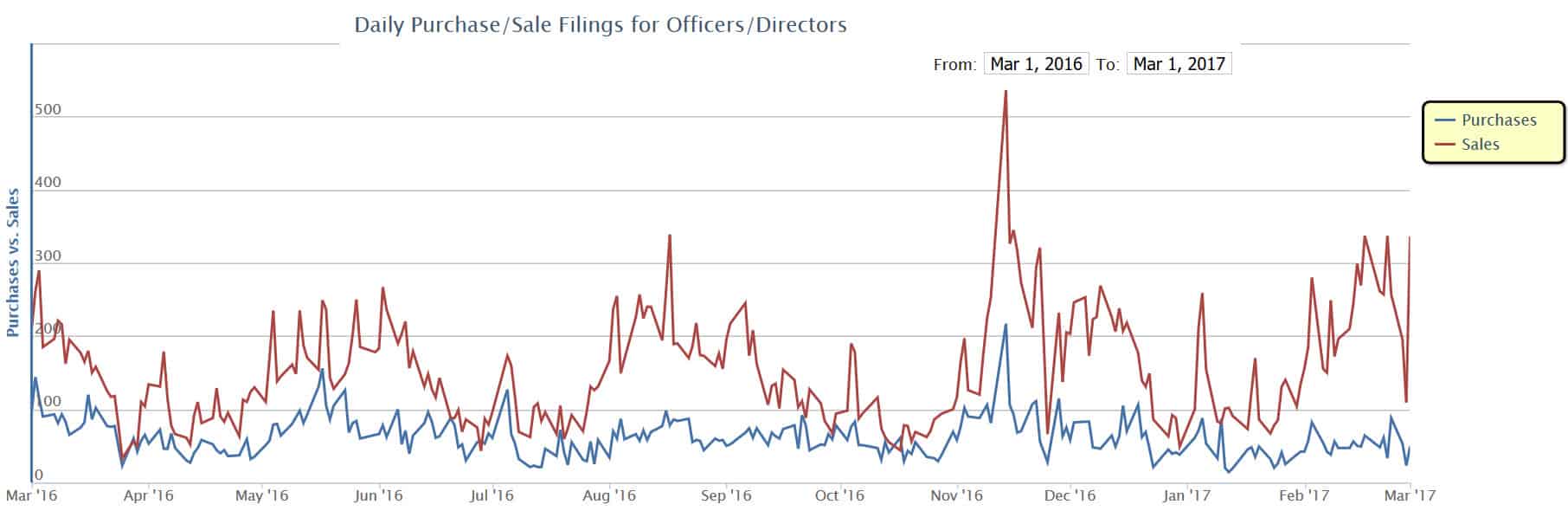

Another chart that suggests caution is the Insider Buy/Sell chart we see below. As we can see, the insider selling has spiked higher over the last week. Insiders typically sell when they think a top is near. This does not mean we are headed for a massive crash, but that we are due for a correction.

We continue to hold our long positions, but have sent subscribers a couple of insurance trades to protect us in the event the markets turn against us. We will be watching for that scenario where the large cap stocks (Dow and S&P 500) continue to make new highs, while the small caps (Russell 2000) do not.

Stay tuned!