Illinois – the canary in the coal mine

A few months ago, we highlighted how Illinois was broke and that it would soon be the first state to have a junk bond rating. After all, the state has gone over two years operating without a budget.

The state is in shambles, running up $15 billion in unpaid bills, and according to CNN Money Watch, Illinois’ unfunded pension liabilities increased 25% in one year to over $250 billion.

In an attempt to raise revenues, the state officials did what all politicians and bureaucrats do, they raised every form of tax and fee possible. In fact, their proposed solution to overcome their $6 billion budget deficit is to raise taxes by $5 billion, or $1,125 per household per year.

The problem there is that people are leaving Illinois in droves. In 2016, almost 90% of all Illinois counties saw their population shrink. For the third year in a row, Illinois leads the US with the number of residents leaving the state. The population of Illinois is now the lowest it has been in a decade.

It is not just residents that are leaving, as businesses say they are being hit with a perfect storm of regulations and tax hikes this summer, putting a damper on hopes for business expansion and jobs growth.

“Earning a profit is getting to be a dirty word,” Mark Grant, Illinois state director of the National Federation of Independent Business, told Illinois News Network.

In her frustration with lawmakers, the state’s comptroller Suzana Mendoza stated…

“I don’t know what part of ‘We are in massive crisis mode’ the General Assembly and the governor don’t understand. This is not a false alarm.”

States are not like Federal governments who can print money out of thin air. States are more like real businesses in that they must balance their budgets as there is only so much money and credit available.

Illinois is the canary in the coal mine. It is an early warning that governments have made outlandish promises to workers in the form of unsustainable pensions funds, and these obligations can never be met.

Puerto Rico had a similar scenario a few months ago, basically they were bankrupt. Illinois is the second alarm in the US, and there will be many more to follow.

Politicians and government officials all over the globe have made promises that can never be met. The winners are those who get to collect on those promises right away, while the losers are those who are stuck with the bills long after the politicians have retired on their pensions.

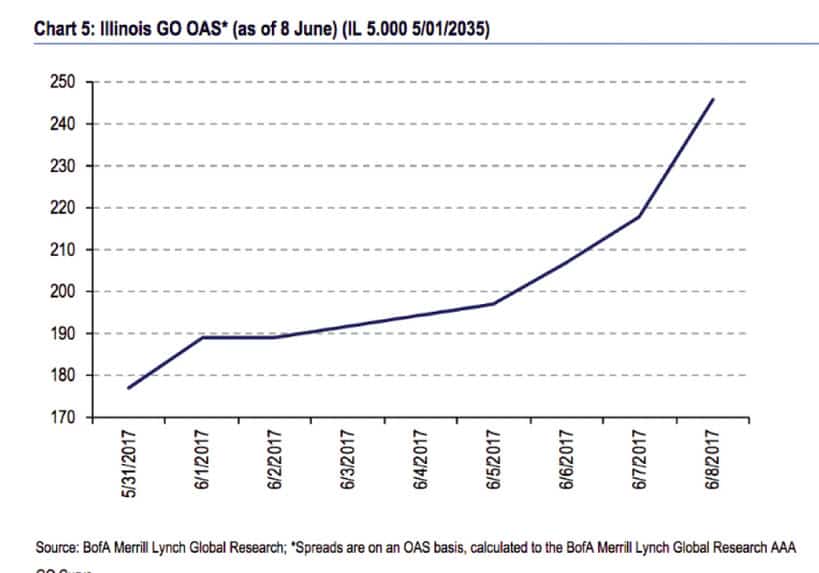

For Illinois, the problems just magnify. By mismanaging their budgets for so long, investors are now fleeing Illinois bonds. This has caused a sharp spike in bond spreads on Illinois general obligation bonds, making it costlier for the already cash-strapped state to borrow.

The state’s pension crisis threatens to burden taxpayers with massive, ever-escalating taxes to bail out a system that is simply not sustainable. And every day Illinois goes without a solution to its pension crisis, the state’s pension debt grows by over $20 million.

And Illinois is not alone, this problem is widespread. Later we will show how big the US federal liabilities problem is.

Over three years ago we warned of a global debt crisis that would devastate most investors. That crisis is now underway. Understand what is unfolding, and have a plan to protect your family”s financial future.

Stay tuned!