Total US debt: $1.05 million per taxpayer

If you are an American citizen who pays taxes, your liability of the total US debt now totals $1.05 million.

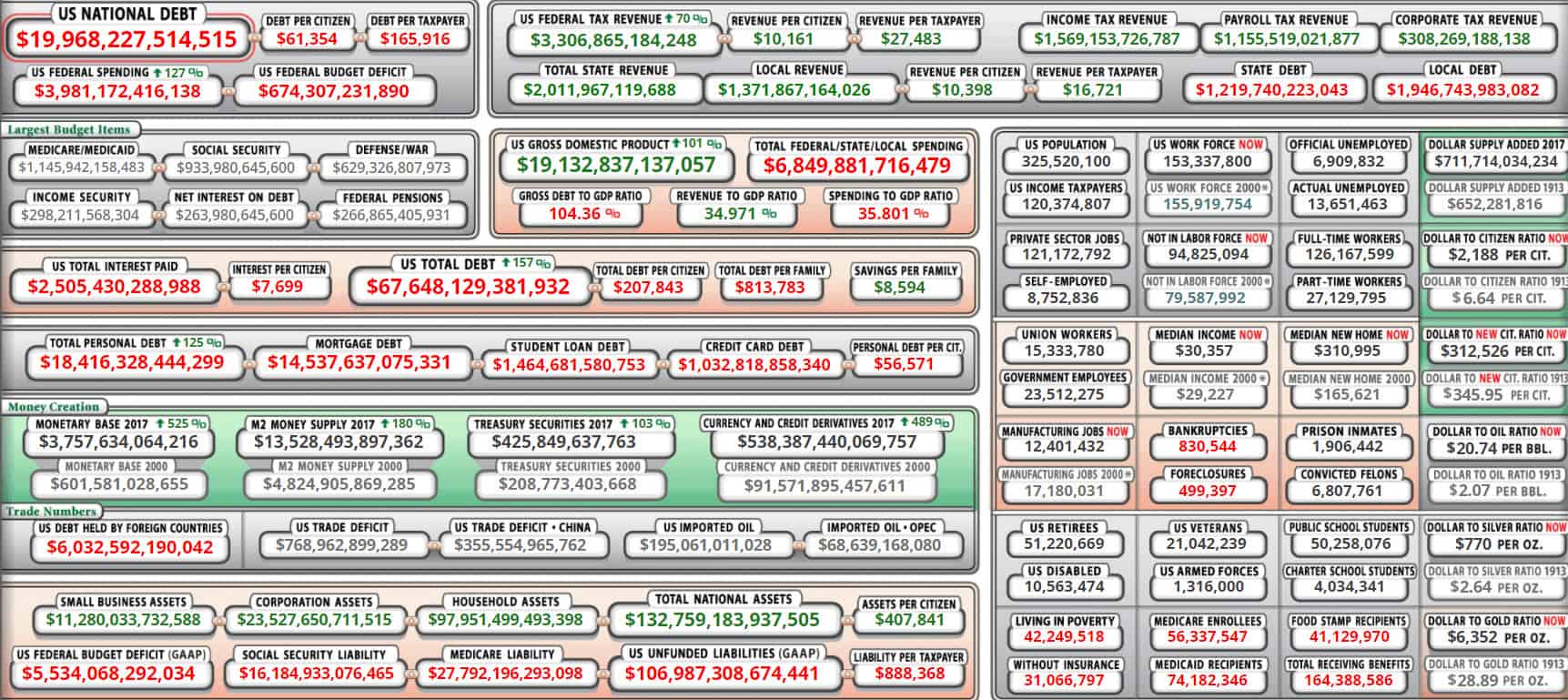

When discussing the national debt, most people assume that the total national debt is the ‘official’ debt, which is sitting at $19.98 trillion, which in itself is an outrageous number.

The current population in the US stands at 325 million, so that $19.98 trillion debt works out to $61,476 per man woman and child. But of that 325 million people only 120 million ,or 37%, actually pay income tax. So if we were to divide the national debt by the number of people who pay income tax, it works out to $166,500 per taxpayer.

But this figure only covers the ‘official’ national debt, it does not include the federal government’s long-term unfunded liabilities – money the government is obligated to pay over and above the revenues it is estimated to receive. These liabilities include Social Security, Medicare, Federal Employee and Veterans benefits. When you add it all up, the total of US government unfunded liabilities is $106.98 trillion.

When we divide the unfunded liabilities by the number of taxpayers it equates to $891,500 per taxpayer. Add the $166,500 per taxpayer for the ‘official’ national debt, and each taxpayer currently has a liability of $1.05 million. And this does not include all the municipal, and state debt that is also out of control.

Every level of government in the US is running large deficits, resulting in massive debts. The only sources of revenue for these governments are taxes and fees. So if you own property and are a taxpayer, expect to see all forms of taxes and fees continue to rise.

Click here to see a live, rather frightening, but very real picture of the US debt situation.

Stay tuned!