For over 15 years we have been publishing The Trend Letter, and in that time span we have made hundreds of recommendation to subscribers, and many of those recommendations have made subscribes huge gains.

In the past few weeks, our models have triggered 4 new Buy signals, all designed to position our subscribers to be prepared for the changes ahead. In addition to the new Buy signals over the last few weeks, we anticipate that many new Buy & Sell signals will be triggered soon.

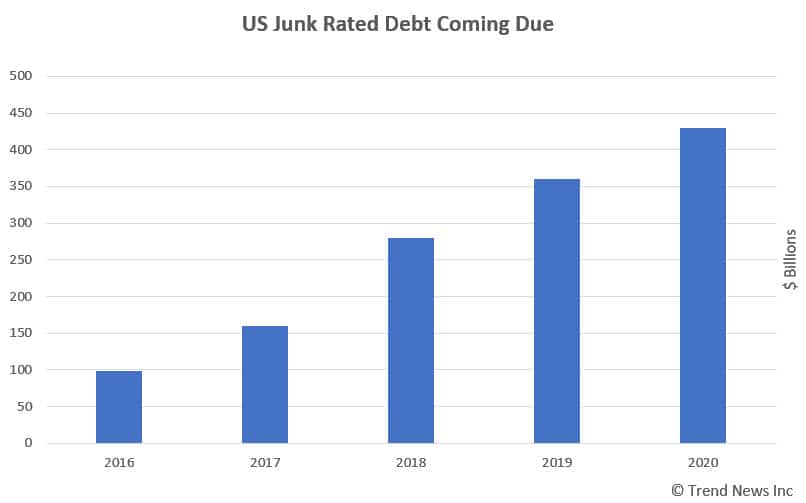

For years we have talked about and warned how we were approaching a global Sovereign Debt Crisis. As we near 2018, we are getting much closer to this crisis kicking in.

We have seen yields on Sovereign bonds from as high as 20% in the mid 1980’s, to just a year ago seeing over $12 trillion invested in government bonds yielding less than 0%. Instead of receiving 20% per year for lending the government their money as they would have received in the 1980’s, these investors were willing to pay the government each year to take their money. And many of these bond holders were willing to give the government their money for periods of 7 years or longer, and pay the government for the privilege.

The reality in all this is that every government has been following the same plan, run up massive deficits, promise lots of free things to the poor and middle class, and then issue huge amounts of debt to pay for these promises. But the deficits keep growing, so governments then raise every tax and fee they can find. But even that isn’t enough to cover the massive debt loads.

The reality is that most governments have borrowed much more than they will ever be able to pay back, and the result will be a global wide Sovereign Debt Default, and it will financially destroy most of the citizens.

Even those who think they are immune because they do not invest in bonds or much else. will be affected. If you have a pension plan, you will be affected. If you expect Social Security, you will be affected. The global bond markets are huge, and when investors realize how at risk those government bonds are, and all try to head for the exits at the same time, many will be crushed.

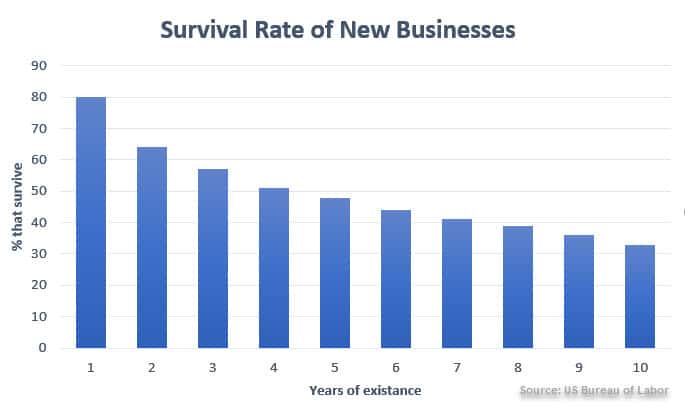

Socialism is the art of spending other people’s money. All we hear from politicians today is that the “rich” are not paying their fair share. They keep blaming anyone who has been successful, calling them tax cheaters. In Canada, during the last election, the Liberal party promised to cut taxes for small business. Now that they have been in power for two years, they are going after small businesses, saying they are cheating the system. They say they are doing this to protect the middle class, even though most small business owners are middle class.

Those in power never look in the mirror and realize that borrowing and spending far more money than you can ever possibly pay back is a very bad strategy. Instead they look for a scapegoat, and the scapegoats today are anyone with a reasonable income.

In 2009, we warned that we were heading for a class war, where those retired and collecting a pension would be attacked by those younger people having to pay for those pension plans. It is neither the fault of the retired seniors, or the younger workers. The real culprits are the politicians and bureaucrats who led us down this unsustainable path.

Today we hear calls for “free” education and “free” guaranteed income to all. We wonder where that money will come from. For years these policy makers knew what was coming, but instead of tackling the situation when it was manageable, they simply “kicked the can” down the road, leaving it for the next administration to deal with it. And of course, the next administration did the exact same thing.

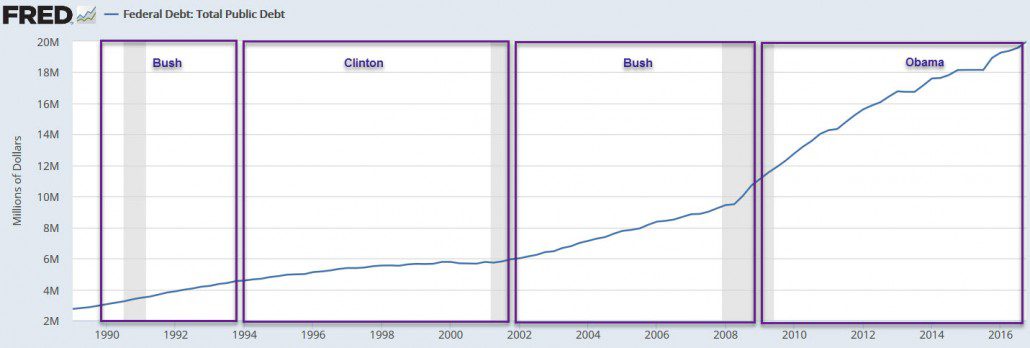

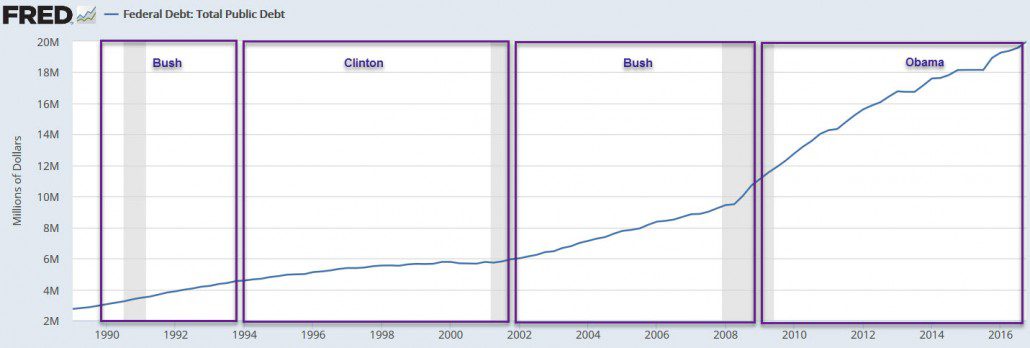

It didn’t matter which political party was in power in the US, as both the Republicans and Democrats did the same thing. The pace of overspending ramped up with Bush and Obama. In fact, Obama racked up more debt than all other presidents combined. With Trump’s promises of massive spending, this trend is not likely to end anytime soon.

Here is a chart showing how the ‘official” US federal debt has grown dramatically over the past 16 years. The total ‘official’ US debt today is $20.17 trillion! To put that number into perspective, it equates to $61,913 per citizen, or $167,309 per taxpayer.

This situation is not going to be solved without a lot of pain for a lot of people. Governments are now getting very desperate for cash, and the mantra they are all now chanting is “tax the rich.” It is going to get violent and very ugly. It will not be limited to one country or one continent…it will be global.

Those who understand what is happening and how to follow the global flow of capital will be able to position themselves to not only survive this global financial crisis, but to actually prosper from it.

We are following these developments very closely and have a plan to get our subscribers through this crisis, so that they remain in good financial shape once the worst is over. New Buy and sell signals will be issued soon.

If you would like to join our growing list of subscribers, and receive all of our Buy and Sell signals. at a 38% discount, click here. Note that all subscriptions come with a 90-day, money-back guarantee.

Stay tuned!