As we expected, since publishing Crypto TREND we have received many questions from readers. In this edition we will answer the most common one.

What kind of changes are coming that could be game changers in the cryptocurrency sector?

One of the biggest changes that will impact the cryptocurrency world is an alternative method of block validation called Proof of Stake (PoS). We will try to keep this explanation fairly high level, but it is important to have a conceptual understanding of what the difference is and why it is a significant factor.

Remember that the underlying technology with digital currencies is called blockchain and most of the current digital currencies use a validation protocol called Proof of Work (PoW).

With traditional methods of payment, you need to trust a third party, such as Visa, Interact, a bank, or a cheque clearing house to settle your transaction. These trusted entities are “centralized”, meaning they keep their own private ledger which stores the transaction’s history and balance of each account. They will show the transactions to you, and you must agree that it is correct, or launch a dispute. Only the parties to the transaction ever see it.

With Bitcoin and most other digital currencies, the ledgers are “decentralized”, meaning everyone on the network gets a copy, so no one has to trust a third party, such as a bank, because anyone can directly verify the information. This verification process is called “distributed consensus.”

PoW requires that “work” be done in order to validate a new transaction for entry on the blockchain. With cryptocurrencies, that validation is done by “miners”, who must solve complex algorithmic problems. As the algorithmic problems become more complex, these “miners” need more expensive and more powerful computers to solve the problems ahead of everyone else. “Mining” computers are often specialized, typically using ASIC chips (Application Specific Integrated Circuits), which are more adept and faster at solving these difficult puzzles.

Here is the process:

- Transactions are bundled together in a ‘block’.

- The miners verify that the transactions within each block are legitimate by solving the hashing algorithm puzzle, known as the “proof of work problem”.

- The first miner to solve the block’s “proof of work problem” is rewarded with a small amount of cryptocurrency.

- Once verified, the transactions are stored in the public blockchain across the entire network.

- As the number of transactions and miners increase, the difficulty of solving the hashing problems also increases.

Although PoW helped get blockchain and decentralized, trustless digital currencies off the ground, it has some real shortcomings, especially with the amount of electricity these miners are consuming trying to solve the “proof of work problems” as fast as possible. According to Digiconomist’s Bitcoin Energy Consumption Index, Bitcoin miners are using more energy than 159 countries, including Ireland. As the price of each Bitcoin rises, more and more miners try to solve the problems, consuming even more energy.

All of that power consumption just to validate the transactions has motivated many in the digital currency space to seek out an alternative method of validating the blocks, and the leading candidate is a method called “Proof of Stake” (PoS).

PoS is still an algorithm, and the purpose is the same as in the proof of work, but the process to reach the goal is quite different. With PoS, there are no miners, but instead we have “validators.” PoS relies on trust and the knowledge that all the people who are validating transactions have skin in the game.

This way, instead of utilizing energy to answer PoW puzzles, a PoS validator is limited to validating a percentage of transactions that is reflective of his or her ownership stake. For instance, a validator who owns 3% of the Ether available can theoretically validate only 3% of the blocks.

In PoW, the chances of you solving the proof of work problem depends on how much computing power you have. With PoS, it depends on how much cryptocurrency you have at “stake”. The higher the stake you have, the higher the chances that you solve the block. Instead of winning crypto coins, the winning validator receives transaction fees.

Validators enter their stake by ‘locking up’ a portion of their fund tokens. Should they try to do something malicious against the network, like creating an ‘invalid block’, their stake or security deposit will be forfeited. If they do their job and do not violate the network, but do not win the right to validate the block, they will get their stake or deposit back.

If you understand the basic difference between PoW and PoS, that is all you need to know. Only those who plan to be miners or validators need to understand all the ins and outs of these two validation methods. Most of the general public who wish to possess cryptocurrencies will simply buy them through an exchange, and not participate in the actual mining or validating of block transactions.

Most in the crypto sector believe that in order for digital currencies to survive long-term, digital tokens must switch over to a PoS model. At the time of writing this post, Ethereum is the second largest digital currency behind Bitcoin and their development team has been working on their PoS algorithm called “Casper” over the last few years. It is expected that we will see Casper implemented in 2018, putting Ethereum ahead of all the other large cryptocurrencies.

As we have seen previously in this sector, major events such as a successful implementation of Casper could send Ethereum’s prices much higher. We’ll be keeping you updated in future issues of Crypto TREND.

Crypto TREND Premium

We have received many questions asking if we will be making specific recommendations, similar to what we do in The Trend Letter & Trend Technical Trader. The answer is yes, we will be making recommendations on cryptocurrencies and blockchain technology companies. These recommendations will be in our Crypto TREND Premium service. This service is a subscriber only service which costs $699.95 per year. For those who are already subscribers to The Trend Letter and/or Trend Technical Trader, we are offering Crypto TREND – Premium at a $300 discount for only $399.95.

We will be sending out links to subscribe to Crypto TREND – Premium in the very near future.

Note that we will continue to publish this free Crypto TREND newsletter to help readers who are not yet ready to take the plunge and invest in this space to better understand this very volatile digital currency sector and the amazing potential of the blockchain technology.

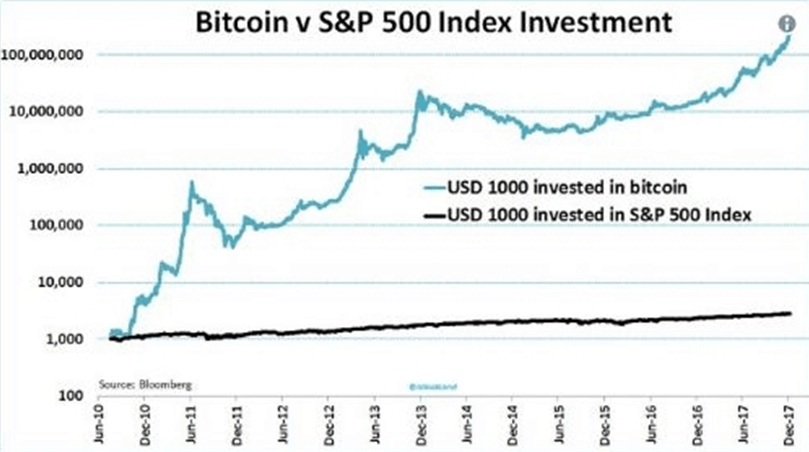

Tomorrow is the first day that Bitcoin futures can be traded on the CBOE Global Exchange, and in a week they can be traded on the CME Exchange. These are two key events that will open the door to greater inflows of institutional money, while also making it easier to bet on bitcoin’s decline.

We will be watching.

Stay tuned!