Crypto Update – January 19/18

A question that many readers ask is “why do we need or want crypto currency – isn’t there already enough currencies in the world?“

Understanding some of the benefits of crypto currency (CC) in a world of fiat currency helps us to see why developers came up with it in the first place, and keep coming up with more and better CC’s. Let’s start with some of the problems with fiat currencies:

A. Governments can print as much fiat currency as they want, and throughout history there are many examples of currencies that have been inflated to death. There are two reasons this cannot be done with crypto currencies …

1. there is an upper limit on the amount of each coin that can ever be made. With Bitcoin this upper limit is set at 21 million – no inflation possible here.

2. governments do not control the issue of crypto currencies.

B. Fiat currency transactions are all centralized, and we all have to trust that our bank teller, our cheque clearing house, our currency broker etc, will do their job honestly and fairly, and at a reasonable cost. There are several examples where this trust has been violated, and thus, the desire for something better was created.

Here is an illustrative example of a clear violation of consumer trust. Wells Fargo, a banking giant in the USA, created about 3.5 million ghost accounts so that they could charge customers for services they did not ask for or need. The unwary customers who did not notice the unwanted extra accounts would continue to pay the fees, trusting that their bank was taking good care of them. It was later discovered that Wells Fargo was also signing up customers for unwanted insurance policies and again charging customers for services they did not ask for. This is fraud on a large scale, and here is what was learned … We Cannot Trust the “Trusted” Intermediaries.

We also see that financial institutions have been making record profits for a long time, levying transaction fees that generate large profits. It’s not hard to see the need for a new technology to enable secure, reliable, cheap, and transparent transactions without the potential for manipulation and rip-offs by governments and large financial institutions. All of this is what blockchain technology can bring to the realm of financial transactions.

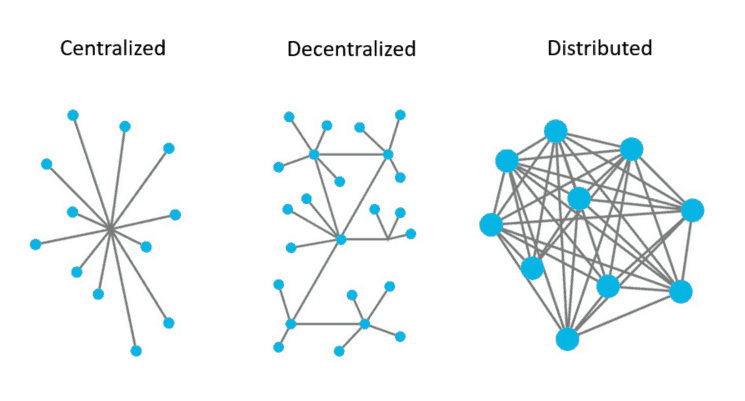

The key difference is that current systems are “centralized”, whereas blockchain is “distributed”. What really matters is that “trust” is 100% transparent in the distributed model. Blockchain technology is based on a distributed ledger (a distributed database). It is distributed in the sense that there are complete copies of the whole database scattered all around the world.

In today’s world, almost all financial institutions, companies, governments, and individuals keep their records in a centralized database, usually with a centralized back-up of that one database. You only get to see the parts of that data that concern you, and you must trust that “privacy policies” are strong and that data integrity standards are high. These centralized databases can be manipulated, records can be altered, hard drives can fail, data can be lost, and the records represent only one party’s view of any given transaction.

In the world of blockchain (distributed ledger technology), the opposite is true. The transactions recorded on the ledger represent a transaction that takes place between the parties involved, and is confirmed by the blockchain network via a consensus. This is “trust” on a LARGE scale. Once a transaction is written to the ledger, it is immutable – it cannot be changed. The details of each transaction are visible to everyone, but the identification of the individual parties is protected by the use of private keys. Private Key owners can identify their own transactions in the ledger, but cannot determine the identity of the parties in any other transaction. The conceptual diagram below shows the difference between a centralized, a decentralized, and a distributed network.

Vive le difference !!

It wasn’t long ago that the LIBOR scandal uncovered that many of the most “trusted” financial institutions in the world were manipulating interest rates for their own benefit. Banks like Barclays, Deutsche Bank, JPMorgan Chase, UBS, Citigroup, Bank of America, and the Royal Bank of Scotland were found to be right in the middle of these manipulations. The corruption and violations of trust are seemingly endless. Blockchain to the rescue !!

Crypto crash!

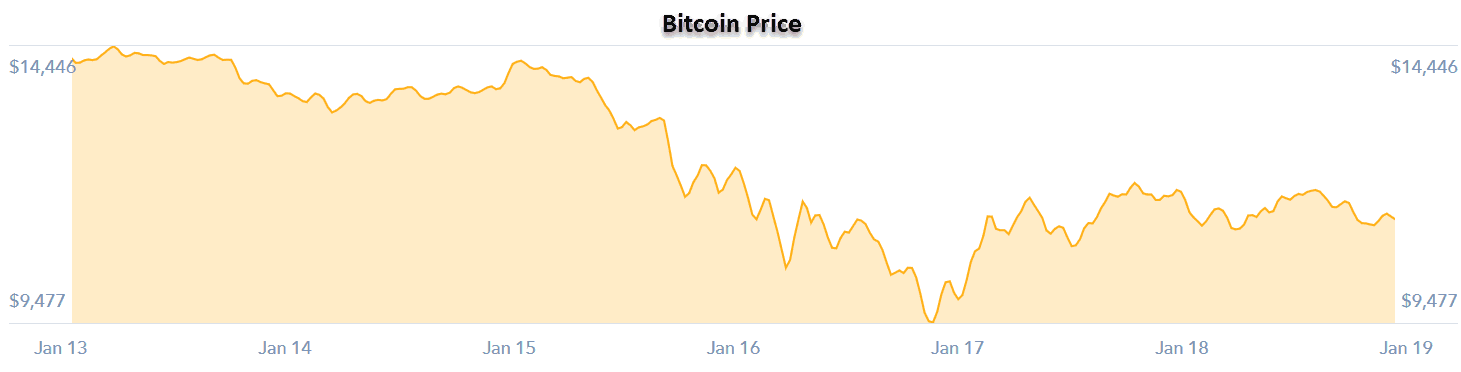

We have called the crypto sector the “wild west” and this past week was another great example of the volatility in this space. We saw how governments are paranoid about crypto currencies, as both China and South Korea expressed plans to clamp down, or even ban crypto currency trading.

The South Korean government officials warned that crypto currencies encourage illicit behavior, such as money laundering, tax evasion, and gambling. It also stated that it needed to protect these investors from losing their money.

South Korea is one of the largest crypto currency traders alongside the US and Japan, and the news of a ban set off panic in the South Korean crypto markets. As we can see, the bitcoin price dropped from $14,444 to $9,477 before recovering some of the losses and trading at $11,275 at the time of this writing.

But it turns out South Korea is still evaluating the situation and has not made a decision. It is expected to deliver a decision sometime next week.

The threat of a ban has caused quite an uproar from the masses. As of today, an online petition on the website of the presidential Blue House had drawn more than 221,000 signatures opposing the move. Heavy internet traffic briefly crashed the site.

While we welcome a proper regulated oversight, we are not of the belief that politicians and bureaucrats are better qualified to tell the people what they can or cannot do with their hard earned money.

This “wild west” show is going to remain volatile for quite a while. For those who do wish to invest in crypto currencies, this volatility just gave them another opportunity to get in at much lower prices.

If you are ready to make a speculative investment into this disruptive technology, and want to receive all current and future recommendations from Crypto TREND Premium, we are keeping our Early Bird Special offer open for a little longer, to give our readers the opportunity to get started at a $175 discount. To take advantage of this special offer, click here.

Stay tuned!