Yesterday we issued our 6th crypto/blockchain recommendation to subscribers of Crypto TREND Premium. There are currently 1,387 crypto currencies, so it is indeed challenging selecting which ones to purchase. At the time of this writing, the five recommendations we have made to date are up an average of 92% in less than a month. With so many cryptos now available, Crypto TREND and Crypto TREND Premium are your guides to explore this crypto jungle and to recognize which are the ones with the biggest upside potential.

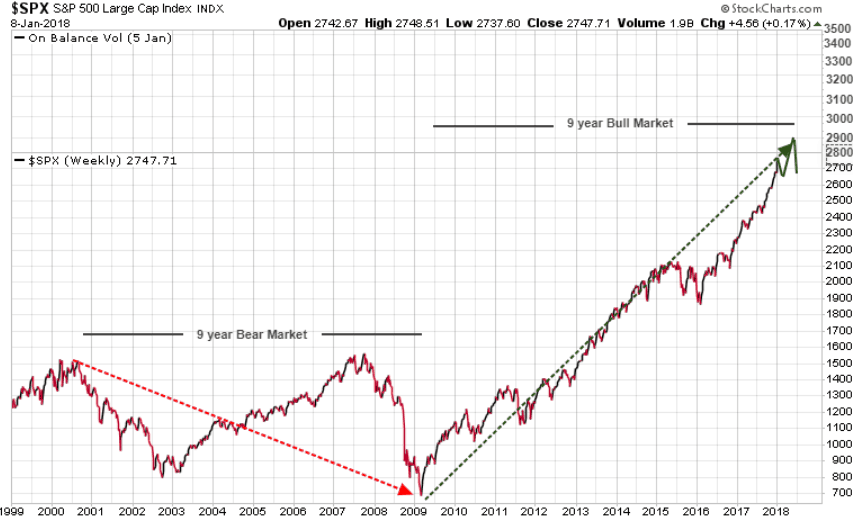

By selecting each of the six recommendations we have made to date, subscribers can begin creating a nice small crypto portfolio. This sector reminds us of the DOT COM bull run where hundreds of companies included DOT COM in their name. Same story with the uranium bull market, where we saw tons of companies that owned nothing but “moose pastures” renaming themselves by adding “uranium” to their name. We are seeing similar actions today where companies are adding “Crypto” or “Blockchain” to the their name. Recently, Long Island Ice Tea changed their name to Long Blockchain Corp, believe it or not.

When researching the crypto and blockchain world, understand that many of the people writing about cryptos are often very biased and have their own agendas. Many are holding certain tokens and are doing their best to promote that currency and talk down others. Sifting through all this material and finding the diamonds in the rough is what the Crypto TREND team does.

As with the uranium bull market, there will be many players trying to make a quick hit with a new crypto currency or blockchain application, but in the end, only the ones that are true disruptors, ones that will change the way we do business, will survive. We are looking for companies that have a clear plan to make a difference, such as companies that are using blockchain to solve global challenges, to make transactions cheaper, faster, and more secure for businesses and the general public.

The Crypto TREND team will continue to provide in-depth research and our Crypto TREND Premium will turn that research and analysis into recommendations that we feel will come out on top as this “wild west” sector becomes more mainstream. For investors there is always at least one big barrier to entering a new bull market, and these barriers give the early investors the opportunity to make potential massive gains. While we believe that crypto currencies and blockchain technology are real game changers, possibly on a par with how the internet changed our world, there are numerous obstacles that will likely keep this sector incredibly volatile in these early days.

First, for the average investor, trying to understand blockchain technology tends to cause a painful brain cramp. While almost all investors use debit and credit cards daily, virtually none of these users have any real understanding of the technology of how these transactions work. The key is that they “trust” it to work perfectly. With blockchain technology, even though virtually every bank and government is looking to use this technology, most investors do not yet “trust” it.

Another barrier for crypto is that it is a convoluted process to get started as an investor. Most exchanges that accept credit or debit deposits only allow very small limits until you have completed a number of successful transactions, making the initial accumulation of tokens quite slow and cumbersome. Also, the concept of setting up a digital wallet is a whole new mindset that many find quite challenging.

And then there is the risk that governments will try to outlaw crypto currencies. While we initially felt that the threat of crypto currencies was far too great for governments to allow to succeed, the more they become mainstream the more difficult it becomes for governments to shut them down. With government so heavily indebted, and hungry to tax every transaction they can get their hands on, this threat is still valid. It is quite interesting to note that ever since China and South Korea threatened to clamp down on bitcoin, it rallied to new highs.

As noted earlier, Crypto TREND Premium has just made its 6th recommendation. If you are ready to make a speculative investment into this disruptive technology, and want to receive all current and future recommendations from Crypto TREND Premium, we are keeping our Early Bird Special offer open for a little longer, to give our readers the opportunity to get started at a $175 discount. To take advantage of this special offer, CLICK HERE.