Crypto Currencies (CC’s) are making inroads into the daily lives of more and more people every week. While China has taken a contrarian stance, trying to curtail Crypto Coin marketplaces, most other countries are finding ways to embrace this market or at least consider positive ways to deal with it. Clearly, most governments around the world do NOT want to miss out on the CC market as a rich source of revenue, so it is surprising that China has chosen to head in an authoritarian direction, perhaps believing that strict controls and prohibitions will be better for them. History has taught us that prohibition does not work, especially when it provides the masses with something they really want – wine, beer, & spirits are still with us – under reasonable control worldwide.

Here is some of the latest evidence that CC’s are rapidly heading towards mainstream status in the investments marketplace:

- Many Daily News shows now include a market recap segment with a full screen on Crypto Currencies, typically right after the Commodities recap screen.

- Arizona, Wyoming, and Colorado are preparing to accept CC’s for tax payments.

- In January, KFC Canada launched a limited time offer of the “Bitcoin Bucket” of chicken – the first major restaurant organization to utilize CC’s.

- Two entrepreneurs in the UK have sold 50 new luxury apartments in Dubai for Bitcoin.

- The Canadian Securities Exchange (CSE) has proposed a new blockchain based system of clearing and settling the purchase and sale of securities, aiming to provide real-time clearing and settlement, with low costs and fewer errors, compared to conventional services.

- Ripple has an agreement with the Saudi Arabian Monetary Authority (SAMA) to support cross-border payment technology with banks in Saudi Arabia, to enable instant settlement of cross-border transactions, lowering barriers to trade and commerce.

- Western Union is testing transactions with the use of RIPPLE’s (XRP) blockchain based settlement system, anticipating faster, cheaper, and more accurate money transfers.

Of course there are some who fear the integration of traditional fiat currency systems with the newly minted virtual currency systems. One of those is Augustin Carstens, general manager of the Bank for International Settlements (BIS) who believes that Bitcoin is a bubble, a Ponzi scheme, a speculative mania, and an environmental disaster. He also believes that CC’s are used a lot for money laundering and other criminal activities. He therefore is recommending strict regulation by all Central Banks, as CC integration could threaten the stability of financial institutions.

We see that we still have a “wild west” range of opinions and views about the CC market space, but we note that there is more and more evidence that the mainstream media and governments at all levels are acknowledging CC’s as a significant part of the financial landscape, a part that cannot be ignored or stifled. We see the trend is toward having CC’s and Blockchain technology company stocks in a well balanced, forward looking investment strategy.

Investing in Blockchain & other new technologies

Even with all the wild swings in the crypto space, our Crypto Trend Premium portfolio is still up an average of 30.82% at the time of this writing. As the sector goes through its growing pains of weeding out the weaker players, just like in the internet boom, most of the of these players will fall by the way side, but in the end some real winners will emerge.

While there is a great deal of volatility in the crypto space, as an investor, you need to understand that the underlying blockchain technology is a disruptive technology that will impact a great many sectors. As highlighted in our February 3rd blog, there are currently over 36 industries that are heavily investing in blockchain technology today.

Remember, disruption doesn’t happen overnight. Blockchain technology is still in its infancy, and a lot of the actual technology has yet to be perfected. Blockchain technology will supplement traditional industries, making them more efficient. We are certain that blockchain will transform the banking industry.

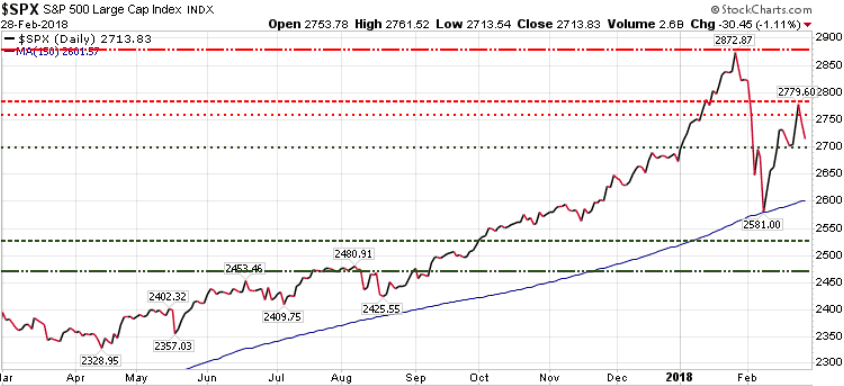

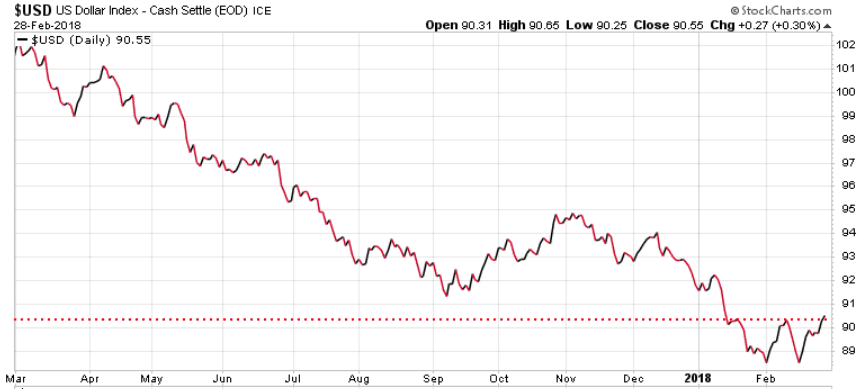

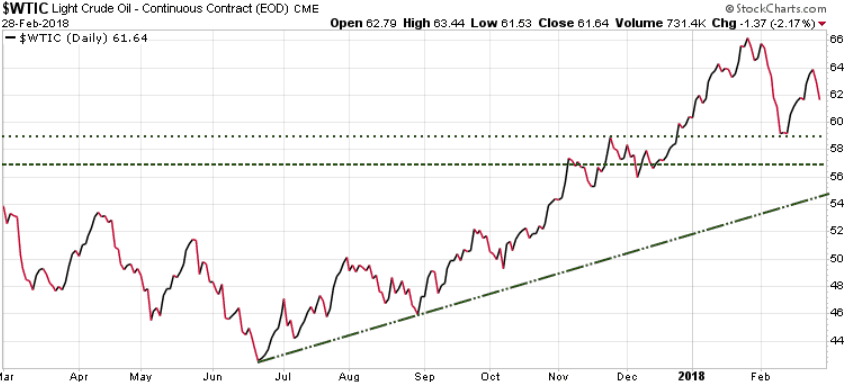

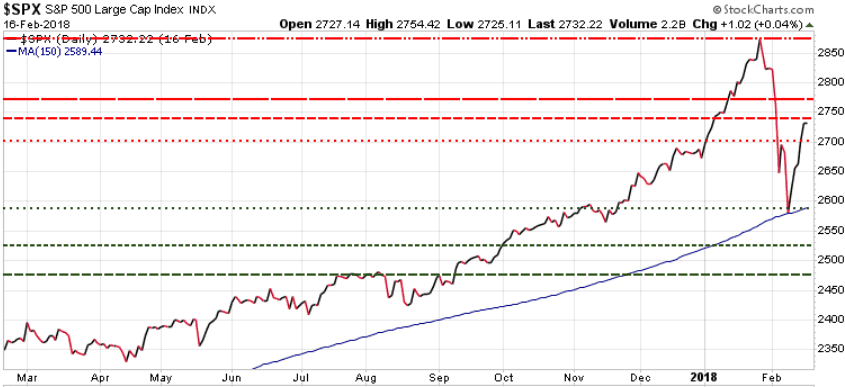

As investors, we believe that as blockchain, 5G, and other new disruptive technologies mature, solid long-term gains will be realized for those who are bold enough to be early participants. We have evaluated dozens of blockchain and new tech companies and have a short-list that we are ready to pull the trigger on as soon as we see more stability in the general markets.

Thanks to the very timely warnings of both The Trend Letter and Trend Technical Trader for a global equity market pullback and/or correction, we have held off issuing any new recommendations until we get a BUY Signal for the general market, which could come anytime in the next few weeks.

If you are ready to make a speculative investment into these disruptive technologies and want to receive all current and future recommendations from Crypto TREND Premium, we are keeping our Early Bird Special offer to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00. To take advantage of this special offer, click here

Stay tuned!