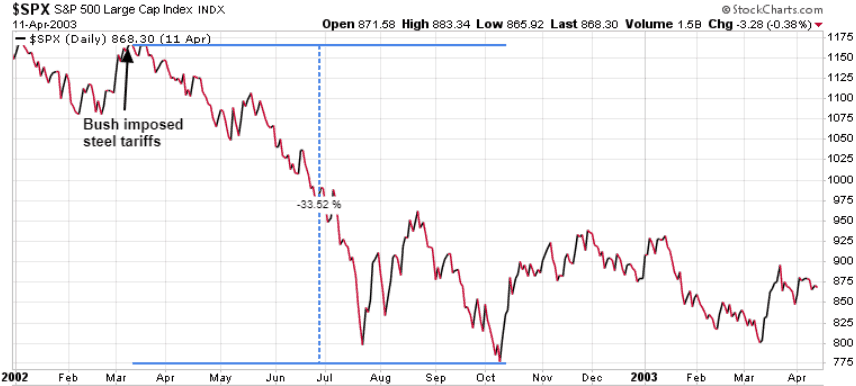

Here’s what happened the last time the US applied steel tariffs

While Donal Trump says ‘Trade wars are good, and easy to win,” history suggests otherwise. In March 2002, George Bush gave into lobbyists and slapped on steel tariffs of between 8% and 30% on imported steel. At that time, Bush exempted Canada, and Mexico because of NAFTA, plus a few developing countries.

Immediately after those tariffs were applied, the S&P 500 dropped over 33% over the next seven months.

Trump is demonstrating that he is no more astute than Bush was, assuming that a trade war is a ‘good thing’. Every time a country applies protectionist policies, other countries do the same, and the losers are the consumers who end up paying more for the finished products.

Governments always react, never fully understanding the end result. Trying to protect an inefficient industry in your country by applying tariffs against a more productive country does not make the domestic industry more efficient, it just makes the finished products more expensive for your consumers. Tariffs are designed to raise the cost of imported goods. They are nothing more than a tax, and in this case, a tax to be paid by US consumers.

So sure, Trump may succumb to steel lobbyist in the US and apply these tariffs to save 143,000 jobs in the steel industry, but these tariffs will hurt over 6 million other workers in industries like the auto industry that use steel to manufacture their products. The end result is the finished products that use steel or aluminum are going to cost more for consumers. So how is this a ‘good thing?’

For US companies that use steel and aluminum, not only will their costs go up, they will be less competitive, and their exports will suffer. And then of course we will have the problem of reciprocal tariffs that have already been threatened by countries being hit by Trump’s steel and aluminum tariffs. The European Union and Canada have already stated that they will retaliate.

Currencies play a huge role in the cost of imported products. Canada is the biggest exporter of steel to the US. The $CAN is currently trading at 77.50 against the $US, meaning all other things being equal, steel priced in $CAN will be 22.5% cheaper than steel priced in the $US.

While these tariffs may help the bottom line for American steel companies, the real losers will be the US consumers. If this turns into a full-on trade war, there will be many more casualties globally, including investors. Contrary to Trump’s comment, nobody wins a trade war!

Stay turned!