Will crypto currency ever be stable?

Investors in crypto currency (CC) are a brave bunch, and are still relatively few in number. CC investor reluctance is based on several fears and misgivings, such as:

- extreme volatility

- unknown or unfavourable tax treatment by governments

- tenuous legality imposed by governments

- complex access to, & use of, brokerages for CC transactions

- complexity & lack of understanding of Blockchain technology

- short history of Blockchain technology & trust in it

We have in past articles discussed some of these issues, however, the extreme volatility issue has never had a proposed solution – until now. A group of famed economists & financial innovators have proposed the creation of “the first non-anonymous blockchain-based digital currency” … named SAGA (SGA). It is being developed by The Saga Foundation, a Swiss non-profit. The advisory board members have some very impressive credentials:

- Jacob Frenkel, former Governor of Bank of Israel, & Chairman, JP Morgan International

- Myron Scholes, economics Nobel laureate

- Dan Galai, co-developer of VIX, the leading measure of market volatility

- Leo Melamed, chairman emeritus of CME & pioneer in financial futures

Think of SAGA as a CC without those things that cause regulators, central bankers, & most people to be nervous – wrenching volatility – an ambiguous notion of value – anonymity. So, how could SAGA possibly work to contain the extremes of CC volatility?

To achieve low volatility & notional value SAGA will use some traditional finance methods, such as fractional reserves & deposit reserves. SGA will be pegged to the IMF’s Special Drawing Right, an international reserve asset that is a basket of currencies, dominated by the $US & the Euro. SGA’s money supply will be adjusted algorithmically, based on the size of its economy, so that when its economy expands a smart contract will increase SGA token supply. There will also be a “price band” that will act as another check on volatility.

SGA holders must complete “know your customer” & anti money laundering documents under Swiss national law, which will eliminate anonymity. This may seem contrary to some initial CC objectives, however, many CC exchanges already have strict customer identification measures, & are under some form of government control. Anonymity is a 2-sided coin, & mainstream investors almost always agree to being identified.

SAGA coin (SGA) sales are predicted to start in quarter 4 of 2018, & can be purchased with ETHER or bank transfers. We will monitor progress on the foundation’s website.

Another coin trying to achieve price stability is TETHER, whose makers claim is fully backed by $US reserves. There is about $2.3 billion worth of TETHER circulating in the CC markets, but it is unknown whether the cash reserves actually exist. TETHER has fired the auditor hired to verify their cash reserves claims, so there is suspicion. And there are other players in the “stable coin” market, such as BASECOIN and DAI Token, both trying algorithm-based methods to gain stability & credibility.

It remains to be seen if traditional financial processes will be successful in stabilizing any part of the CC market space – – we all know that these very same methods have led to crashes, failures, and massive bailouts in the past. Let Crypto Trend be your guide to the winning technology investments in this emerging market sector.

Will crypto become a safe-haven play?

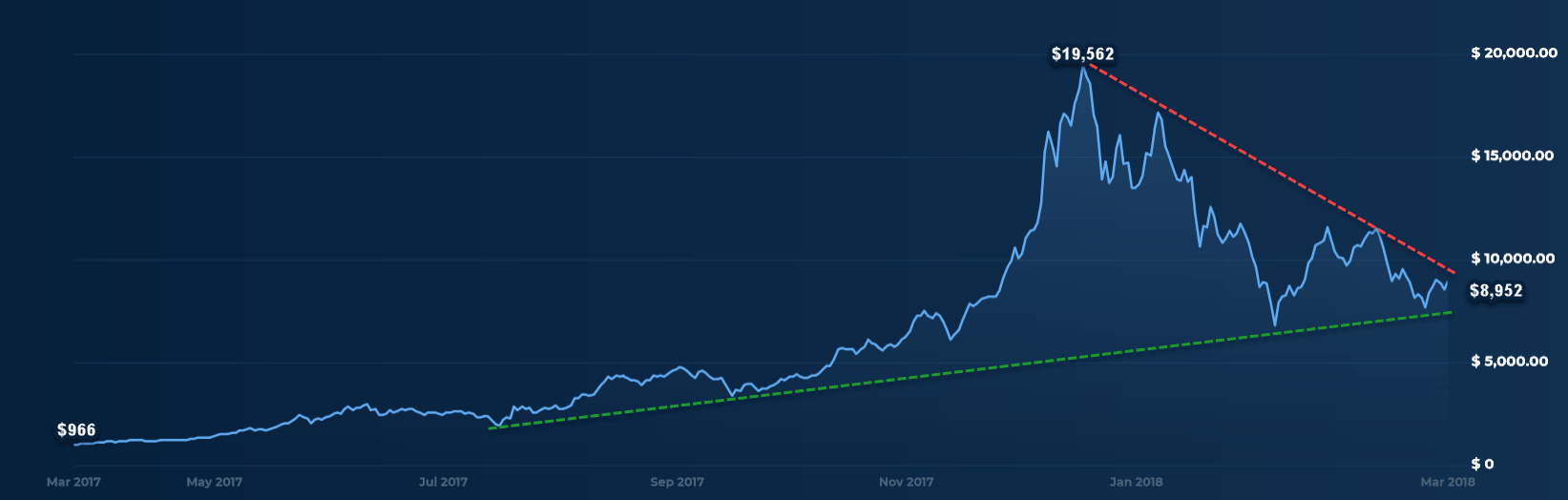

We have labeled the crypto sector as the ‘wild west’ for a good reason, it has displayed an enormous level of volatility. Looking at the following chart of bitcoin, we can see that within the last year we saw bitcoin rise over 1925% from March 2017 to mid-December, then decline 54% from that December high to today’s level at $8.952.

Bitcoin remains volatile today but has been trading in a tighter and tighter wedge pattern in the last two months, where we should get an idea of which direction it will move.

The more conservative equity markets have not been acting well since the highs in later January, with the S&P 500 down over 10% since that high. It’s not just trade war fears either, we also saw the Federal Reserve Bank of Atlanta recently lower its growth forecast from over 5% to under 2%. Also, tensions in the Middle East are heating up. All in all investors have been getting more and more concerned and have been moving their capital out of equities.

On a day where equity markets declined over 2% we saw bitcoin up .50%. It is still very early in the crypto sector, but it will be interesting to see if crypto ultimately becomes a safe-haven play.

Stay tuned!