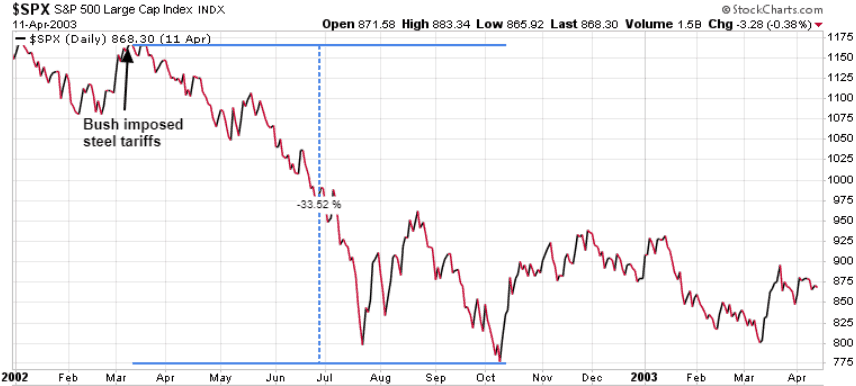

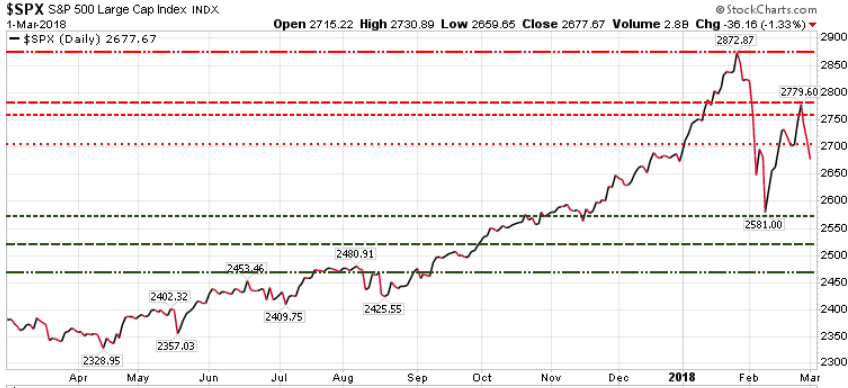

S&P 500

The S&P 500 opened fairly strong, pushing up to 2731, near our immediate resistance level in the 2740-2760 range. But then trade war fears took over as Trump announced a 25% tariff on steel, and 10% on aluminum, which pushed the S&P down 72 pts, finally closing at 2677 , down 1.32% for the day.

Immediate Resistance = 2760

Near-term Resistance = 2780

Key Resistance = 2873

Immediate Support =2581

Near-term Support = 2535

Key Support = 2470

Tomorrow will be important, as a weekly close below 2760 suggests that we could test the the immediate support level of 2581, with potential to test 2535, and then 2470 before we see new highs. A close tomorrow above 2740, opens the door to re-test resistance at 2760, 2780, and the January high of 2873.

Be cautious here, as we expect the bearish scenario to play out.

Note that on Monday our Trend Technical Trader (TTT) service warned its subscribers to apply hedge positions to protect themselves. That timing looks bang on.

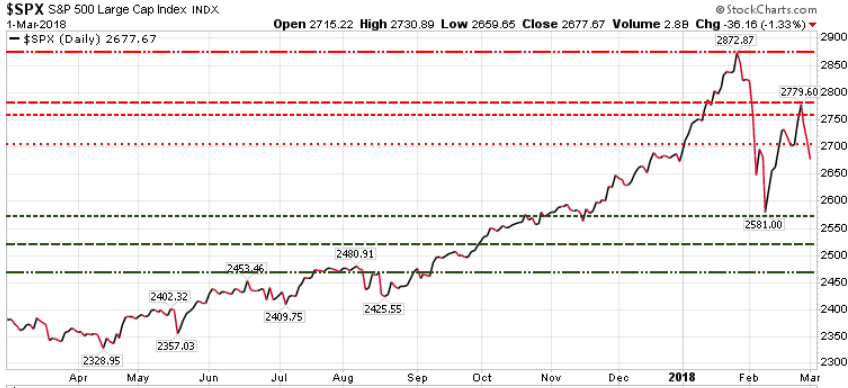

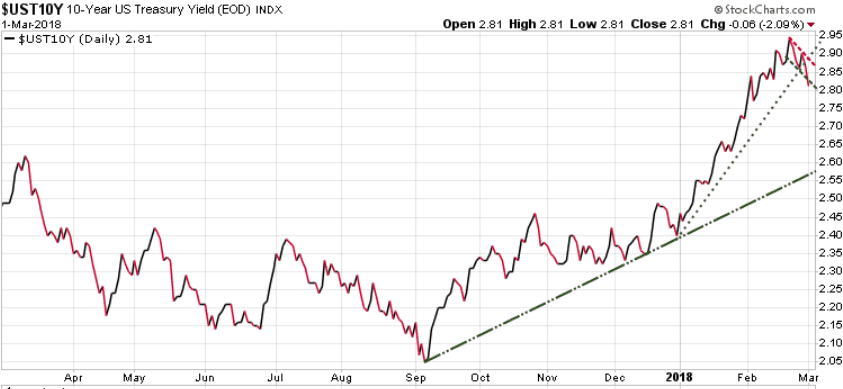

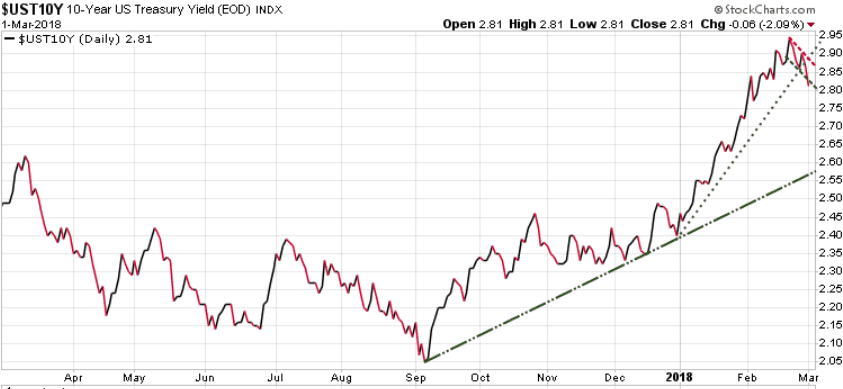

Bonds

For months in The Trend Letter subscribers have been warned that as bond yields approached 3% we would likely see a short-term capital flow into bonds, pushing yields lower. Long-term yields will move much higher, but short-term, holders of these bonds will have an opportunity to unload these bonds. Remember, that when rates do rise again, anyone holding existing bonds will see the value of existing bonds lose value. If you need that money and are forced to sell before maturity (10 years), you will get whatever the market offers, which will almost certainly be lower than what you paid.

As we keep highlighting in The Trend Letter, governments everywhere are issuing massive amounts of new debt, on top of all their maturing debt, at the same time as the US Fed has stopped buying debt, and other central banks are tightening their stimulative bond buying programs. The Fed is also starting to unwind their enormous balance sheet, meaning they will let bonds mature (meaning won’t be re-purchasing), and more importantly, they are looking to sell portions of their huge $4.4 trillion balance sheet.

It is simply supply and demand. Every government is racking up huge deficits and must issue new bonds to play for all those promises. They must also issue new bonds to cover maturing debt. The fact is the US Fed, Bank of Japan, Bank of England, ECB, and most other central banks are the largest buyers of government debt. Now that these central banks are all scaling back, and even selling off their own bonds, the market is going to see a lot of new debt coming on the market, at the same time as the biggest buyers are no longer buying. In order to entice new buyers, yields will have to rise.

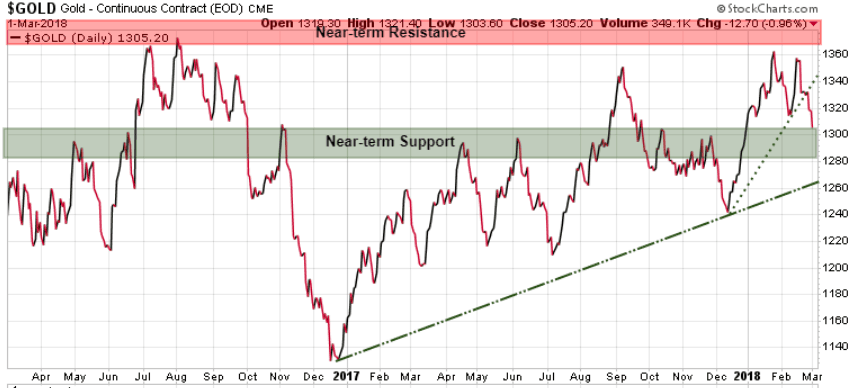

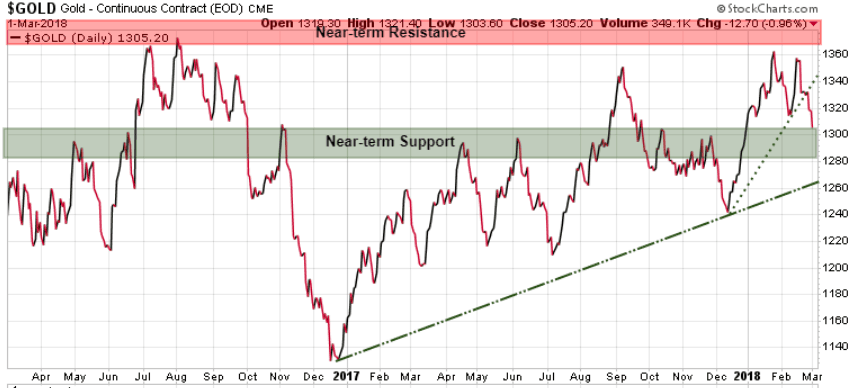

Gold

Gold was down 12.70 today to close at 1305, and is now touching its Near-term Support level of 1280-1307. Again, gold was not able to catch any bid from capital seeking a ‘safe-haven.’ Gold will have its day to shine, but that time is not now.

—————————————————————-

We want to make sure that as many investors as possible are prepared for the massive changes that are coming. The Trend Letter gives subscribers weekly updates on the equity, currency, bond, gold, & commodity markets. Trend Technical Trader gives investors strategies to not just protect your investments in declining markets, but to actually profit in declining markets.

For those of you who are not yet subscribers to these services, we are offering you fantastic special offers so that you will not be left behind. Seriously consider subscribing today…it’s your money – take control!

Good deal – We are offering you The Trend Letter at $230 off the regular price of $599.95, now just $369.95. Click here to take advantage of this offer.

Good deal – We are offering you Trend Technical Trader (TTT ) at $250 off the regular price of $649.95, now just $399.95. Click here to take advantage of this offer.

Great deal – We are offering you both The Trend Letter & Trend Technical Trader at $600 off the regular price, now just $649.95. Click here to take advantage of this offer.

Stay tuned!