October 29/18

Stocks:

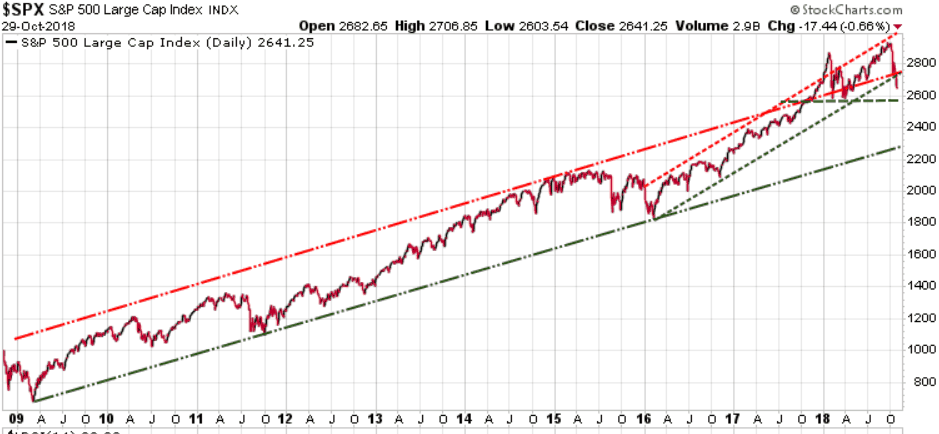

Another wild day as the markets opened strong, dropped dramatically, recovered some of those losses, but finally closed lower. The Dow had a swing of over 900 points during the day with the S&P and Nasdaq also having tough days. At the end of the day the tech heavy Nasdaq was down 2.02%, the Dow down .99% and the S&P down .66%.

The big talking points today were more China/US trade tensions, trading algorithms, and the US elections, where polls are showing that the Republicans will lose the House.

We now must watch to see if the 2600 level holds and particularly the 2580 level (green horizontal line).

Key support levels to watch this week are 2600, 2580, 2535

Understand that the long-term trend is still bullish and will be as long as the S&P 500 holds above 2300.

Long-term trend is bullish

Immediate trend is bearish

Our current position is neutral

Gold:

Gold continues to struggle to maintain any ‘safe haven’ status as it was down 8.20 today, even with all the market angst.

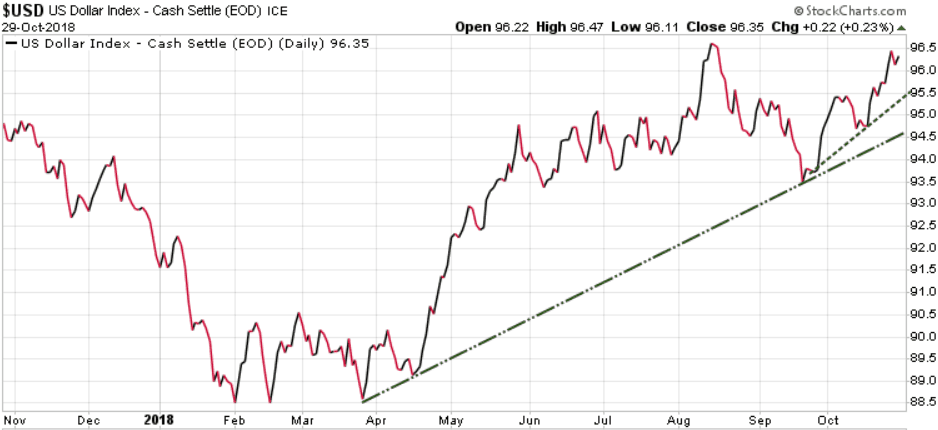

Currency:

Global capital seeking a ‘safe haven’ continues to flow into the US dollar.

Stay tuned!