November 7/18

S&P 500:

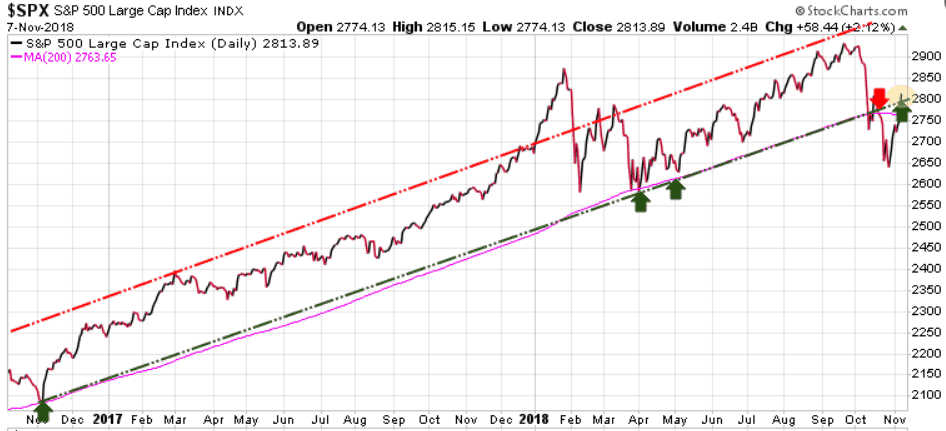

In Monday’s update we highlighted a potential scenario where depending on the election results we could see a quick drop to test the previous 2600 support level and if that level gave way, black box algorithmic SELL Stops would be triggered, causing a potential spike lower to 2500. We also noted that a quick run to 2800 would diminish the odds of a move to 2500. Fortunately for the bulls, we saw the latter scenario.

As we can see on the chart below, the S&P closed the day at 2813, an impressive 58.44 point or 2.12% move higher, putting it back into its 2-year uptrend channel, and above its 200-day MA…bullish action.

Long-term trend is bullish

Immediate trend is bullish

Our current position is neutral

Note that the S&P must close above 2830 this week to maintain its immediate bullish trend.

Stay tuned!