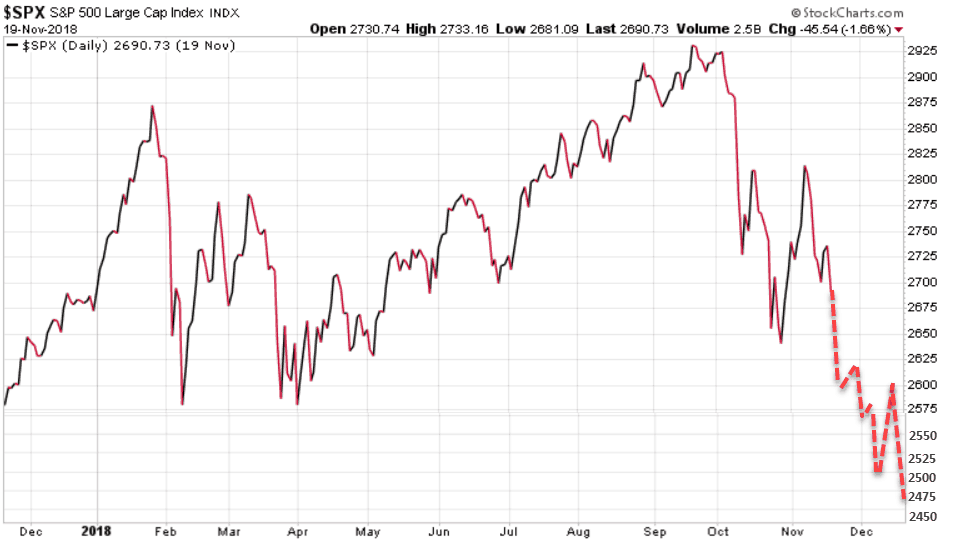

S&P 500 – November 20/18

In our November 11/18 issue of the Trend Letter we showed a chart with our model’s bearish projection for the S&P 500 to have a cycle inversion targeting a drop to 2600 and even 2500 by year-end. With last night’s close of 2690 being sub 2700, we now have the scenario where this 2600 target could be achieved much sooner than year-end, potentially in the next week.

Below is our model’s updated bearish chart. If we do test 2600 in the next week watch for a further decline to test 2500 in early December. A gap down to 2500 should then trigger a rally back up to 2600, but then look for a double bottom to re-test 2500, and even our initial target low of 2470 by year-end.

We are now short-term bearish and we would need a rally and close this week above 2700 to open the door for a run to test the key resistance at 2830.

Long-term trend is bullish

Immediate trend is bearish

Our current position is neutral

Stay tuned!