Stocks tumble, Bonds rise, & Gold breaking out

Stocks:

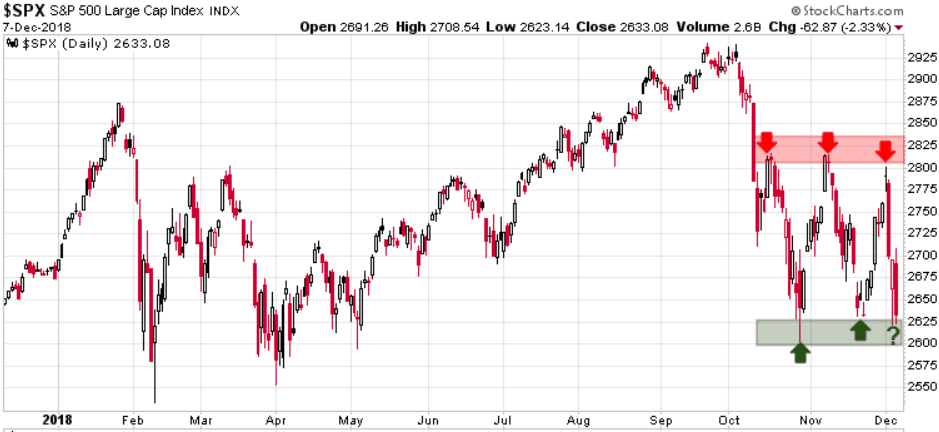

The S&P 500 was down 62.87 points or 2.33% today and was down 4.5% for the week, its worst week since March. As we can see on the following chart the S&P 500 has been trading in a range between 2600 and 2825 and is now testing the low end of that range. If the 2600 support level does not hold, we will likely see trading algorithms kick in and push the market lower, with a test of 2500 a valid scenario.

Watch the 2600 support level for next week, it is key. We have warned that instead of a Santa Claus rally we could well see a cycle inversion where instead of a rally we see a correction.

The main noise this week was the arrest in Canada (Vancouver) of Huawei CFO (Meng Wanzhou). Ms Meng was arrested at the request of the US government. On Friday in the Supreme Court of British Columbia a Canadian government lawyer said Ms Meng was accused of “conspiracy to defraud multiple financial institutions” using a Huawei subsidiary called Skycom to evade sanctions on Iran between 2009 and 2014. According to sources she faces up to 30 years in prison in the US. This incident has the market nervous that it will negatively impact trade negotiations between the US and China.

Next week’s vote on a deal covering Britain’s exit from the European Union as well as negotiations between Italy and the EU over its budget deficit also contributed to the risk-off sentiment with investors.

Bonds:

With a risk-off sentiment in equities, capital continued to flow into US bonds, driving yields lower. The yield on the US 10-year has broken below its uptrend line and closed today at 2.85%.

Gold:

Gold had a good day and has now broken above near-term resistance at 1237, closing the week at 1253.

In the bigger picture gold has been trading in a 7+ year downtrend channel, a classic bear market. Earlier this year gold managed to break through that long-term resistance level but by April gold resumed its decline and fell back into that downtrend channel. But now gold is making a run to push through this key resistance level (pink circle on chart).

Subscribers were sent another new recommendation for gold and will get a full update on Sunday.

Stay tuned!