Are you ready for a potential great buying opportunity?

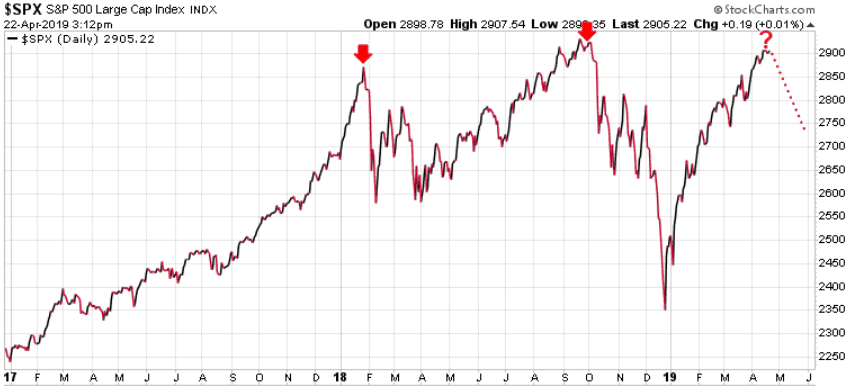

In late 2017 we warned of much more volatile times ahead, from 2018 to 2020. Up until the start of 2018 the stock markets were in a solid 9+ year bull market. Investors were confident, to the point of being ‘complacent’ , with a ‘risk-on’ sentiment. But then things changed, inflation worries crept into the markets and investor sentiment did a quick about-turn, going from ‘complacent’ to ‘fearful’. As a result, the VIX Volatility index spiked and we saw the S&P 500 drop over 10% for the first time since January 2016.

After that initial ‘correction’, volatility worked its way back down as investors became more confident that the ‘correction’ was just that, and not the start of an all-out bear market. The S&P 500 slowly worked its way back to break-even territory and actually made a new high in August ’18, before topping out in October’18 at a new all-time high.

From that October high we had the Fed talk about more rate cuts and quantitative tightening via reduction of its balance sheet. The investor reaction was quick, volatility spiked, and the S&P dropped over 20% from the October high to the December 24th low.

The Fed started to panic and backpedal on its previously hawkish tone regarding future rate hikes and quantitative tightening. The market’s reaction was again quick, with the S&P 500 now up over 24% and the VIX Volatility Index back down to levels where we saw previous market tops.

No market goes straight up or straight down and we are now getting signals that this market is due for a pullback, and that could be great news for investors. Pullbacks are healthy for equity markets and a pullback at this juncture would help the market digest its recent gains and work off stocks’ overbought condition, which will actually give it a better chance of rallying further in the future.

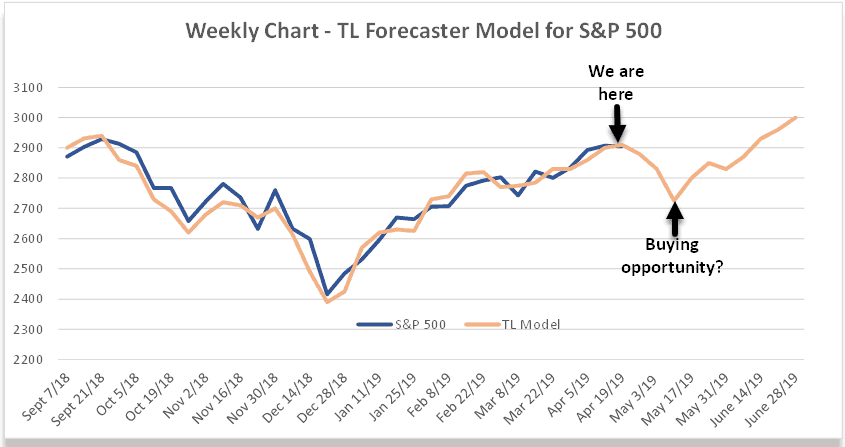

Make no mistake, we are in the late innings of this 10-year bull market for stocks, but that does not mean this bull market is over. In fact our models are calling for a pullback here and then another rally higher to new all-time highs in mid summer. Below is the most recent projection from our TL Forecaster Model. As we can see it is projecting a pullback to the mid 2700 range by mid/late May, and if that level holds it could be a great buying opportunity.

Stay tuned!