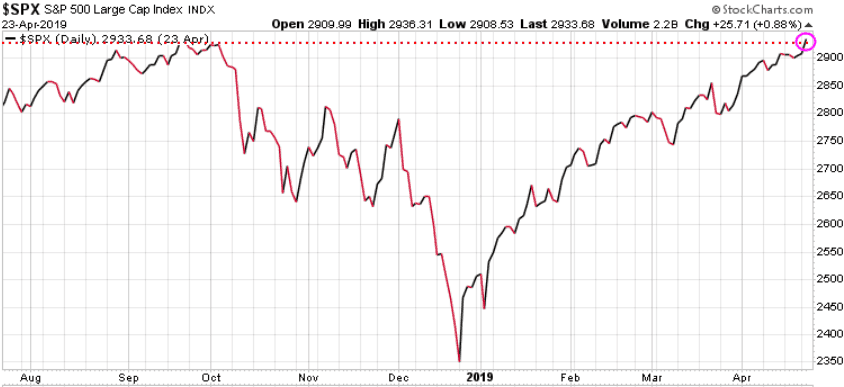

S&P 500 hits new all-time high – but why?

The S&P 500 hit a new all-time high yesterday.

While the mainstream media keeps pointing to Fed policy on interest rates and US-China trade optimism, the real driving force for the rise in the S&P 500 is much deeper and more powerful than the daily news. We have often stated that if you get the currencies right, the rest follows. The main reason that the S&P 500 is rising is that for many foreign investors, US equities are a ‘safer’ place to invest than most others.

Most investors focus far too much on their domestic markets. We live in Canada, and we are amazed how little Canadian and American investors understand of the global markets. We keep getting questions from American investors wondering why the US dollar keeps rising, given the huge debt problem the US has. It is true the US has a massive, unsustainable debt problem, but right now, that is not the big global problem.

To illustrate how currencies drive most markets, let’s see how wealthy investors look at things. Let’s assume we are a Swiss investor. Here is a chart of the Swiss Franc and we we can see it has lost over 6% in value since late September.

Not only is their currency declining, if they want to make a ‘safe’ investment in their country’s Government Bonds, the yield they receive is actually negative. For every SF 100,000 invested in Swiss bonds, the investors loses SF 750 each year or SF 7,500 over the 10 year time-frame.

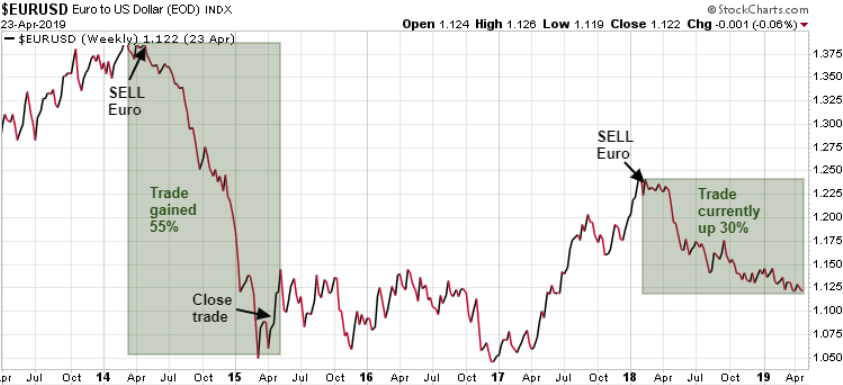

It is not just the Swiss Franc that is losing ground to the $US, virtually every currency has lost ground to the $US. The Euro is no exception. In 2014 we recommended subscribers buy an Exchange Traded Fund (ETF) that allows investors to ‘short’ the Euro very easily without having to invest in futures or options. That initial trade netted subscribers over 55% in less than a year. We re-entered that trade last February and still hold that trade which is currently up over 30% today.

Why are the Euro and Swiss Franc declining while the $US is rising? Think about it. Say you live in Switzerland, France, or Portugal, or even Germany. Your currency is declining, your economy is declining, and your domestic government bonds are paying very little or even negative yields. Then you look at the US. Yes, it has a terrible debt situation and eventually that will be a big problem, but it is not as big a problem as what is currently happening in Europe and Japan.

Wealthy investors in those countries (and many others such as China, Russia, South America etc) are looking for a safer, better place to put their capital, and the US bond and equity markets look very attractive to them. That Swiss investor could put $100,000 into US bonds and instead of paying -.75%, each year, he or she would receive 2.55% every year.

Those investors are also moving their capital into the US equity markets where they are seeing great returns on their capital. In addition to those gains, whenever they buy US stocks or bonds, they are converting their SF into $US. As the $US appreciates against the SF they are gaining on the currency exchange as well.

The following chart illustrates how foreigners having been moving their capital into the US markets.

It is this global flow of capital into US markets that is driving up the US stocks and $US. These foreign investors are quickly losing faith in their governments and central bankers to manage their economy. Europe and Japan are the biggest risks for the next couple of years. Once they collapse, the debt and economic issues in North America will move to centre stage and then we will see a global economic crash, far worse than 2007, or 2001.

Every investor needs to think like a global investor. We continue to guide our subscribers through this looming global crisis and while it will be volatile and frightening to most, we plan to make significant gains staying ahead of the herd by following the global flow of capital. In addition to the Trend Letter, we have a great hedging service called Trend Technical Trader which will help our subscribers not just protect themselves during severe market corrections, but to actually profit from those dramatic moves.

If you are not a subscriber but wish to follow our research and recommendations, we are offering some special rates. Note: we are sending subscribers two new recommendations tonight. It’s your money- take control!

1. Special Offer for Trend Letter. Regular price $599.95…this week only $399.95

2. Special Offer for Trend Technical Trader. Regular price $649.95…this week only $399.95

3. Special Offer for both Trend Letter & Trend Technical Trader. Regular price for only $1249.90…this week only $649.95