S&P 500 Projections

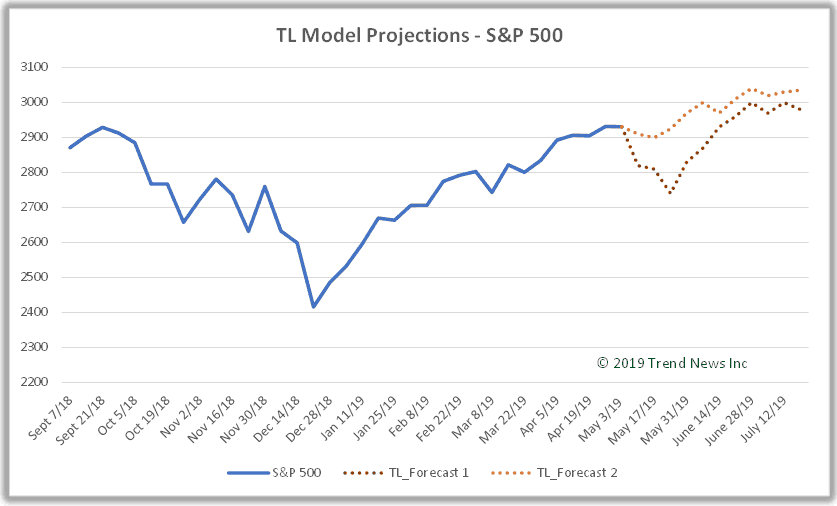

In our blog on April 22/18 we showed our TL_Forecaster Model’s projection for the S&P 500 ‘to a pullback to the mid 2700 range by mid/late May and if that level holds it could be a great buying opportunity.’

Since that forecast the market has moved moderately higher, peaking at 2955, just above our near-term target of 2942.

This past weekend we had US president Trump threaten to more than double tariffs on $200 bn of Chinese goods and introduce fresh tariffs. As a result of this threat we saw a bit of a sell-off in the markets today. Fundamental forces are now matching our model’s near-term negative bias, which increases the probability our model’s projection #1 which calls for a pull back into the low 2700 range over the next few weeks. If the 2720 support level does not hold, then we could see a re-test of the December low in the 2400 range.

Note: If the 2900 support level can hold here it would signal that our model’s projection #2 scenario would likely prevail and the S&P 500 would resume its bullish path and move toward the next resistance level at 3000.

In the big picture the S&P 500 is trading above its very solid 10-year uptrend channel and until the S&P falls below that channel, this bull market remains intact.

Stay tuned!