Stock Market crashes – again!

The S&P 500 plunged nearly 3% again today.

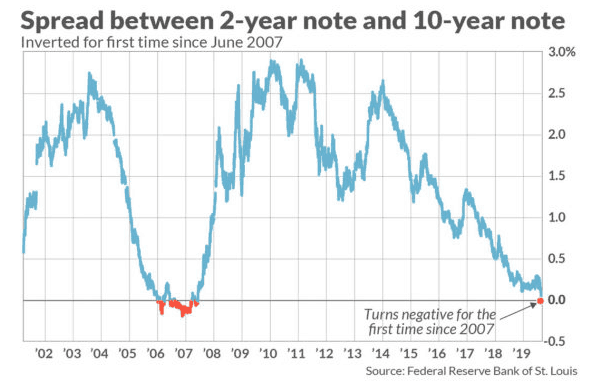

Today’s selling was driven primarily by the news that the ‘yield curve’ has inverted. As long-term subscribers are well aware, we have been watching the yield curve for over a year now, and had posted a number of blogs on it such as here and here.

For a quick summary, whenever the yield curve becomes ‘inverted’ (meaning whenever short-term interest rates are higher than long-term rates) bear markets and recessions inevitably follow. Today, the 2-year Treasury note did rise above the 10-year Treasury note.

If you read the previous blogs we wrote on the yield curve you will understand that a recession usually happens 12-24 months AFTER the yield curve inverts, suggesting that this is not necessarily the end of the bull market. But it is a very important warning that a recession is coming and every investor needs to have a plan for that inevitability.

A couple of weeks ago, Martin was on the Money Talks investment radio show and in the interview he warned that we are in the “final innings of this 10-year bull market” and said that “it is time to get prepared for the melt-down”. Here are some of the key points from the interview.

- Bull markets tend to climb gradually, which we have witnessed since 2009, & then they typically end in a melt-up & ‘blow off top”

- When that melt-up ends & the ‘blow off top’ hits, we will enter a new bear market

- Bear markets happen much quicker, typically lasting about ¼ of the duration of bull markets

- These declines can be melt-downs which are steep & vicious

- When the melt-down comes it will likely be the biggest market crash EVER, it will be global

- It will have an affect on every type of investment… bonds, stocks, currencies, commodities, & precious metals

- The message is “it is time to get prepared for the melt-down”

In the interview Martin offered listeners a special rate for each of the Trend services and he especially encouraged listeners to seriously consider subscribing to Trend Technical Trader, a premier hedging service designed to profit in a declining market. Includes our proprietary Gold Technical Indicator (GTI). We are re-opening that offer to all readers, meaning you can subscribe now and save $250 off the regular price and pay only $399.95