Where is the euphoria?

In December each year Timer Digest asks investment newsletter editors to make their predictions for the following year. In December when we were asked to make our predictions the stock market was coming off its biggest correction since 2008.

Our December forecast surprised many, as there was a lot of doom and gloom at the time. Here are our answers to their questions:

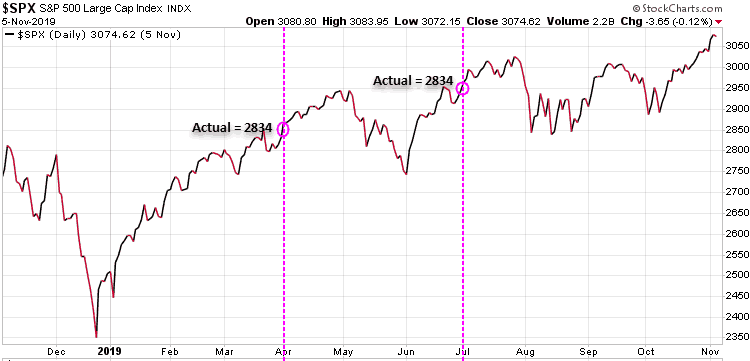

- In your view, will 2019 be a Bull or a Bear market? Bull

- What is your S&P 500 (target range) forecast for the 1st quarter, 2019? 2500-2830. Actual = 2834

- What is your S&P 500 forecast for mid-year, 2019? 2830-3020. Actual = 2964

- What is your S&P 500 forecast for year-end 2019? 2940-3300. Actual = TBD

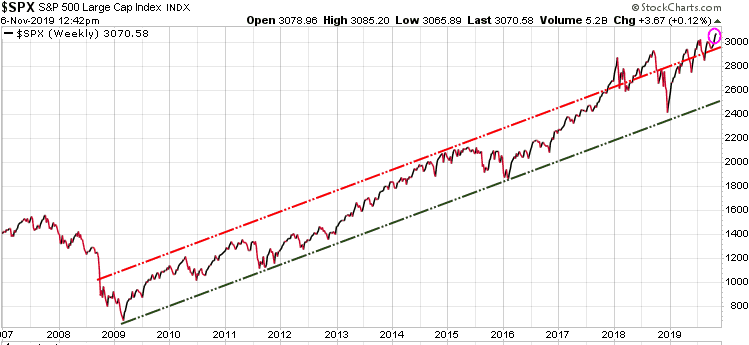

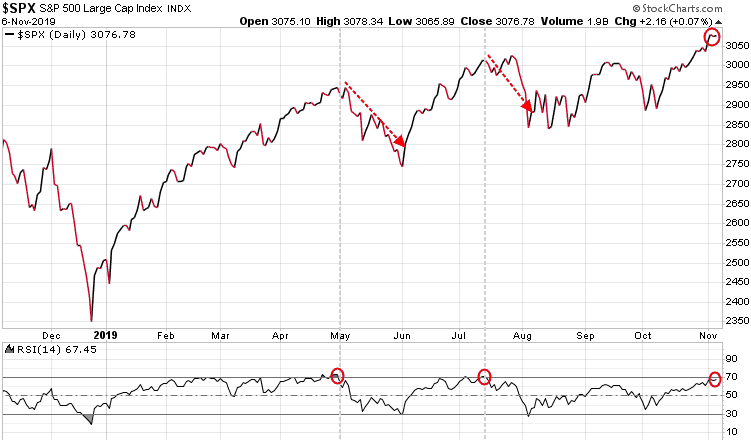

Last week the S&P 500, Dow Jones Industrial Average and the NASDAQ Composite Index all set new all-time highs. The S&P 500 is trading above its 10-year uptrend channel, which is very bullish!

Yet despite these record highs, according to Goldman Sachs, US equity funds have seen an outflow of over $100 billion so far in 2019. Meanwhile, more than $350 billion of inflows have poured into bonds, while more than $430 billion moved into cash.

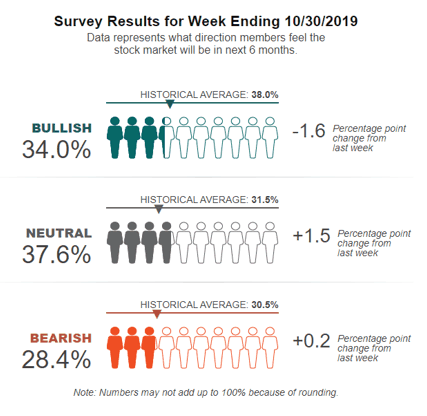

With equity markets setting new all-time highs, the American Association of Individual Investors (AAII) bullish sentiment is at 34%, 4% lower than the historical average of 38%.

Over the last 10 years this bull market has been the most hated bull market in history. There have been so many negative concerns: US-China trade war, Brexit unknowns, Iran conflict, impeachment, you name it, there have been plenty of reasons to be scared.

Fear is keeping the masses out of the equity markets and they have missed out on this bull market. Despite all the fears in the world, stocks have continued to march higher. These investors have missed out on the longest bull market in history.

But we need to understand that bull markets do not peak when investors are scared, they typically peak when everyone is bullish, even euphoric, because that’s when there is no one left to buy.

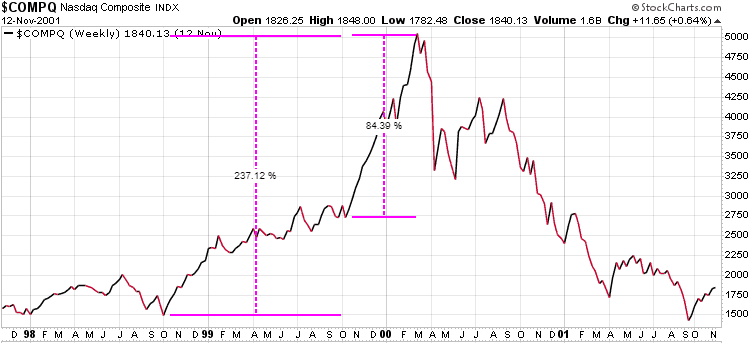

What typically happens is that the masses who have not been in the markets start to get the Fear Of Missing Out (FOMO). Just look at what happened during the run-ups to the 2000 and 2007 market peaks. Investors threw caution to the wind; they were buying with no fear of a major downturn.

In the 2000 tech market bubble, the NASDAQ climbed 237% from October 1998 to February 2000. But the final four months of the bull market saw the NASDAQ spike almost 85%.

While we are not expecting that level of euphoria here, we should see FOMO kick in, and the masses rushing in trying to be a part of the party. The masses are always wrong, and buy right at the top, and that has not happened yet. This tells us, despite all the reasons to be nervous, we are not yet at the peak of this market.

Looking at the markets today we can see that the S&P 500 just set a new all-time high, but if we look at the bottom of following chart, based on the Relative Strength Index (RSI), the S&P 500 is also close to being overbought in the short-term. This suggests we could see a pullback soon, and that could be a buying opportunity.

Once the masses get on board, we will be looking to get out because there will be no buyers left, and the top will be in.

Stay tuned!