The Looming Repo Crisis

We have been warning our subscribers for a few months of a looming crisis that could be the first domino to fall in what we expect to be a liquidity crisis that would affect the global financial system.

Back on September 16/19 the overnight Reno rate jumped from 2% to 10%. The Repo market is used by banks and big institutions. A repurchase agreement, or ‘Repo ‘, is a short-term agreement to sell securities in order to buy them back, typically the next day, at a slightly higher price. The implicit interest rate on these agreements is known as the Repo rate, a proxy for the overnight risk-free rate.

The Repo market is pivotal to the efficient workings of almost all financial markets. It is an efficient source of short-term funding and provides a secure and flexible home for short-term investments.

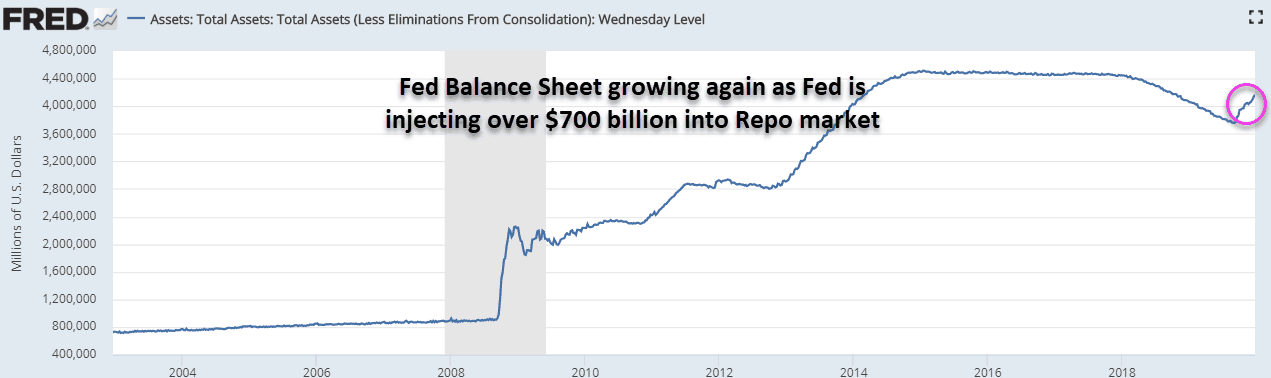

On September 16th when that rate jumped from 2% to 10%, the US Federal Reserve had to jump in and inject over $200 billion in 3 days to quell the funding crisis and bring the effective fed fund rate back down to 2%. Two weeks ago the Fed noted it will pump another $500 billion into the overnight Repo market over the next few weeks.

What happened was the Repo market ran out of cash, there simply weren’t enough lenders to meet demand. So now the Fed is buying very short-term Treasury Bills just to put enough cash in the system to keep the Repo market afloat.

The key point here is that banks are not willing to lend to other financial institutions because they don’t know what exposure the borrowers have.

Although this is similar to 2008 when the Lehman Bro and Bear Stern collapsed, and the Fed had to bail out the banking system, there is a big difference. Today the problem is global, and the source of the problem is most likely in Europe and the ECB has made it clear that it will not bail out any banks…this will be a liquidity crisis.

In addition, according to the Institute of International Finance (IIF) global debt is on course to end 2019 at a record high of more than $255 trillion – nearly $32,500 for each of the 7.7 billion people on earth.

There is almost $17 trillion invested in negative yielding bonds. Almost 30% of ALL government and corporate bonds globally are now yielding negative returns.

When investors see trouble, they move their money to a perceived safer place with a better return. People keep asking us why the $US has been so strong, it’s because investors in other countries are moving their money out of Europe, Russia, China, Turkey, Argentina, and Venezuela.

A catastrophic event is probably going to happen, likely starting in Europe. The Repo crisis could very well be the start. Such an event will cause:

- a banking crisis

- pension plan crisis

- sovereign debt crisis

As an investor you need to understand that such a series of events would cause panic in all markets. Fear moves capital out of the sector or region where the problem starts, and into perceived ‘safer’ places to park capital.

Currently, with the US Fed pumping hundreds of billions of $US into the Repo market, it is causing the $US to weaken. Speculators have been selling off long $US positions and have been covering their short Euro positions before year-end. We see this as a temporary scenario, with the $US hitting a low, and the Euro a high in mid-to-late January.

With negative rates in Europe, large institutional investors have had to move capital out of Europe and the Euro, and into $US denominated investments. We see this pattern re-emerging in early 2020.

Watch for a crisis to start in Europe, likely in the banking and/or bond markets. If that happens, we will see capital leave the Euro and move to the $US, and likely the Yen and Swiss Franc. US bonds will also benefit. Gold should also get a boost.

But the first move will likely be into $US and US bonds

Ultimately, if we see the Sovereign bond market get hit, then there will be contagion, investors will be asking ‘who’s next?’ and ‘is any bond safe?’

That is when North American stocks and Gold are likely to take off

This is not all going to happen overnight, it will likely evolve over the next 2 years.

As an investor you need to be ahead of the herd, ahead of the flow of capital

You want to be where the global flow of capital is heading. And that is what we do.

Stay tuned!