Market update – February 19/20

China has pledged to support small businesses and this was responsible for triggering today’s rally. This perceived positive news has overshadowed the global disruption to supply chains from the coronavirus which the mass media has pushed to the back burner, at least until we see the next level of concern.

Here is a look at some key markets.

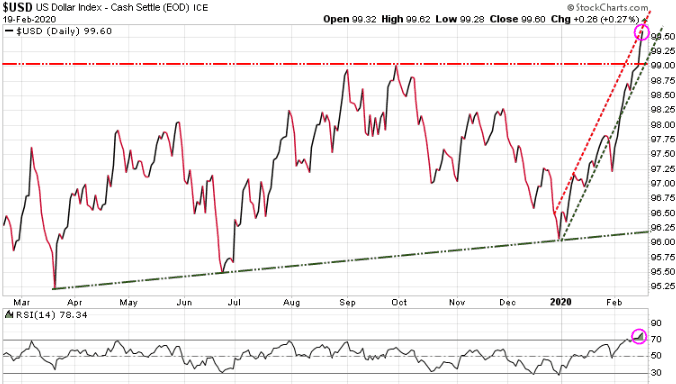

US dollar: The $US has gone vertical, blasting through near-term resistance levels. We have been bullish the $US since February ’14 and remain so for the next 1-2 years. Everyone asks why the $US is so strong and we keep pointing to the looming disaster coming to Europe and Japan, where those regions have destroyed their bond markets with negative rates. We are seeing European investors moving their capital out of Europe and therefore the Euro, into the US bonds and therefore the $US.

Note on the bottom of the chart the Relative Strength Index (RSI) shows the $US is now overbought, so a pullback is due soon.

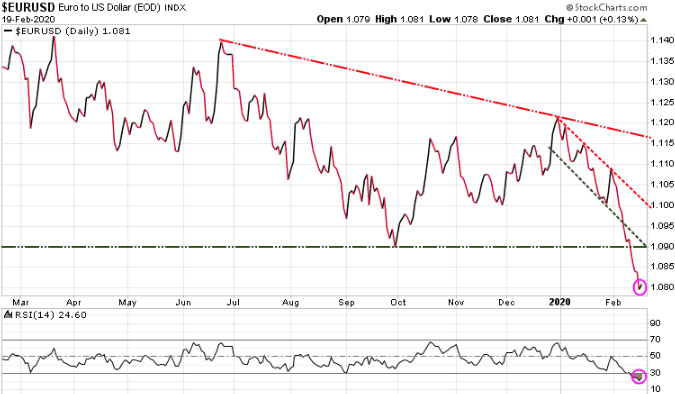

Euro: The Euro has been in a free-fall, plunging through a number of support levels recently. Capital has been flowing out of Europe and coming to North America. Two years ago we recommended a simple ETF trade to short the Euro, and that trade is up over 45% today. Most investors ignore currencies, which is a huge mistake. If you understand the flow of capital, everything else starts to make sense.

Note that RSI is indicating the Euro is oversold, meaning a bounce is due soon.

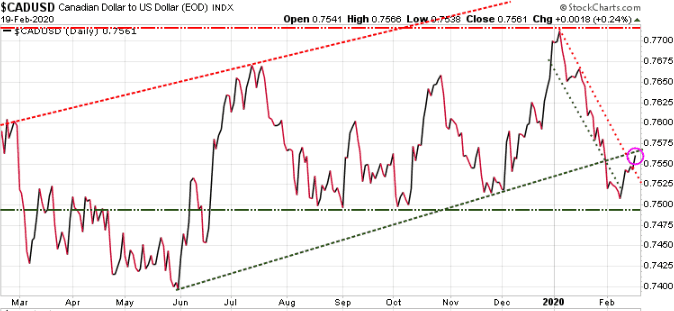

Canadian dollar: The loonie is trying to gain momentum after its big decline since the start of the year.

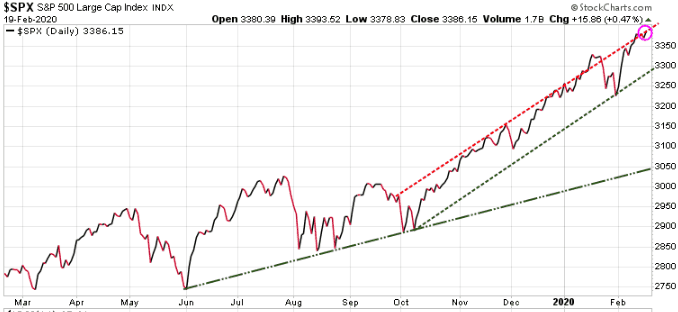

US S&P 500: Concerns over the apparent spread of the coronavirus was put on the back burner Wednesday and investors pushed the S&P 500 to a new all-time high. We do not believe that the market has fully priced in the potential global disruption to supply chains from the coronavirus.

Canada TSX: The Canadian market chart looks very much like the S&P 500, trading in its near-term uptrend channel, and making another all-time high. Note a bottom of chart, the RSI is now technically overbought, so a pull back soon would not be a surprise.

Shanghai Market: After major sell-off once coconavirus was confirmed, the SSEC had a solid rebound after being quite oversold.

Gold: Gold has been acting very strong here, in spite of the strength in the $US. This suggests that while the equity markets continue to rally to new highs, investors are also using gold as a hedge against potential coronavirus fears. We remain bullish on gold

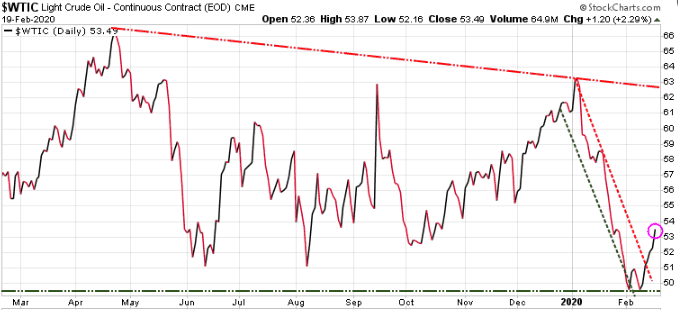

Oil: Oil has bounced nicely after being oversold and expectations that China will initiate a massive stimulus program has given oil a real boost.

Stay tuned!