Is this the bottom?

In a recent blog we discussed the importance of having a hedging strategy. It’s a way to protect your portfolio, and protection is often just as important as appreciation.

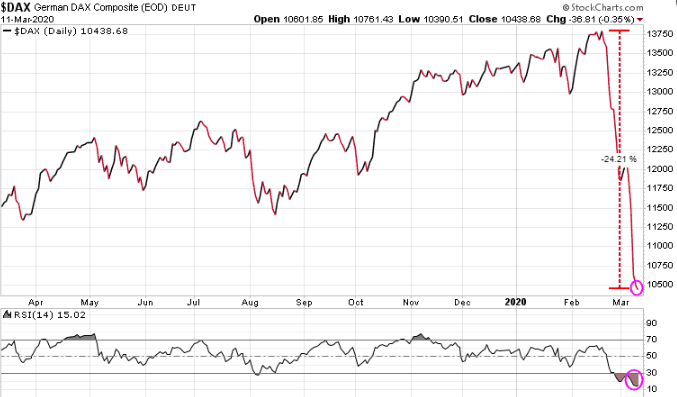

Since February 21st, we have seen a significant stock market crash, with the S&P 500 dropping 35% from the high, blindsiding most investors.

Fortunately for subscribers to our Trend Technical Trader (TTT) service, they were presented with several effective hedging strategies that were simple to follow and easy to implement. The results allowed subscribers to not only protect their capital in this bear market, but to actually make some significant gains.

Some examples:

An Exchange Traded Fund (ETF) that trades on volatility: +29.5% in 3 days

A 2nd position in that same ETF: +48.5% in 1 month

A leveraged Bear Small Cap ETF: +47.2% in 1 month

A leveraged Short DJIA ETF: + 61.5% in 2.5 weeks

A leveraged Bear Jr Miner Gold ETF: +86.5% in less than a week

The question now is, ‘what next?’ As we can see from this chart, after the significant decline, the S&P 500 is in a near-term uptrend channel. Is this the start of a new bull market, or a dead-cat bounce?

The headlines are full of talking heads predicting everything from ‘back up the truck’, to ‘it’s a bear trap.’ If we look at other major bear markets one thing is clear, they all end eventually. But typically they only end after it is no longer the lead story in the mainstream media.

Typically markets only bottom out once people have moved on, not when investors are buying every dip. If you followed a hedging strategy during the big crash, and are now in a strong cash position, you need to have a strategy for when to get back in, just like you needed to have a strategy for the decline.

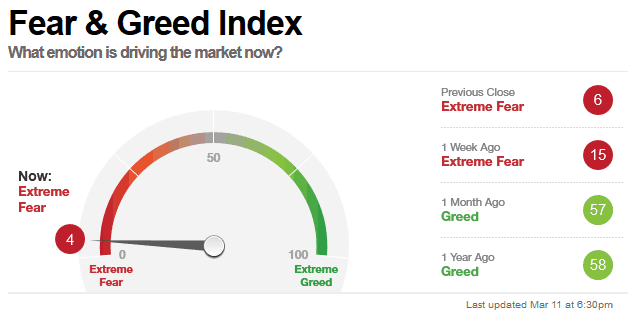

After the big crash we saw a lot of ‘bottom picking,’ buying, which suggests that there is still too much optimism in the markets. There is a real FOMO (Fear of Missing Out) sentiment in the markets, which suggests that a re-test of the low, or even lower lows, could be in the cards.

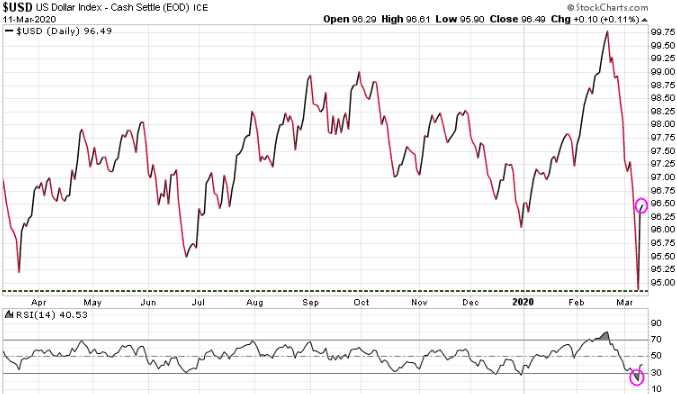

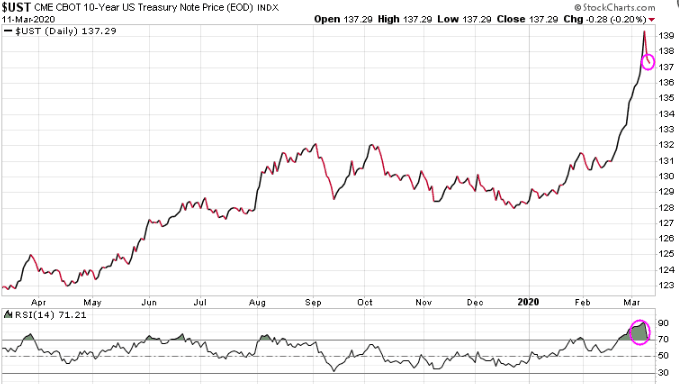

These are crazy times. We have a global pandemic, with fear and panic running rampant. We have central banks and governments turning on the fire hoses, pumping out $trillions into monetary and fiscal stimulus programs.

While we can’t know exactly how things will play out, we will follow our models to get a better idea of when to get back in. Our TTT service has been actively making very short-term, and even a few long-term trades already, positioning for when we get the full green light to buy back in.

Here is Monday’s commentary from TTT:

DJIA started the week with a gain of 690 points.

While earlier this year that would’ve made for a truly remarkable day, instead it was the calmest trading day in many weeks.

It’s likely this current rally is very near its end, and we expect many more stellar entry levels during the next major leg downward.

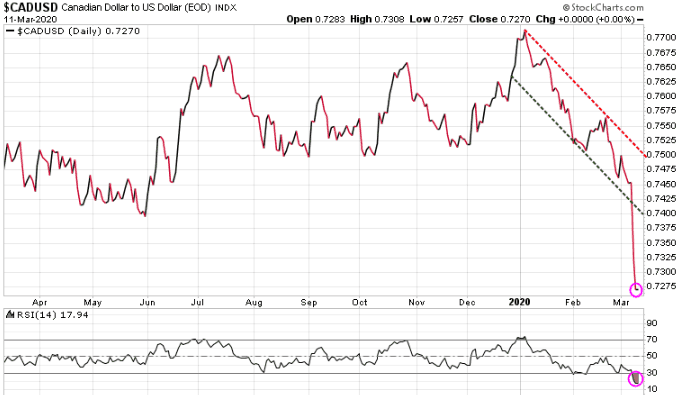

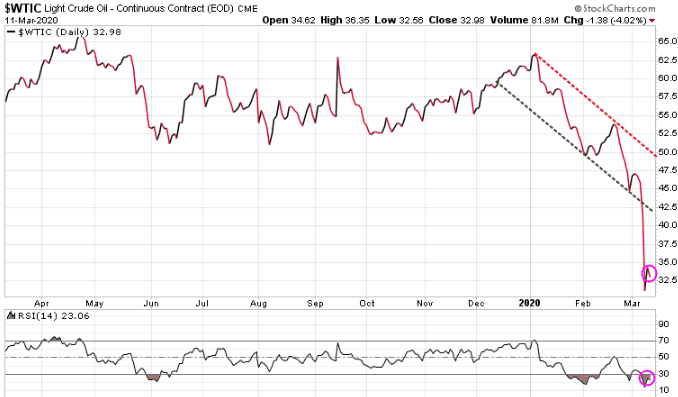

When stocks drop significantly again, we’ll suggest lowball bids for additional positions, focusing on the resource sector and specifically oil.

The overwhelming bearish sentiment and predictions on oil at present has us ready and eager to buy. We made absolute killings in oil-related stocks the last time prices crashed and the world turned ultra-bearish. We expect this time won’t be different, and once again we’ll be focusing on a variety of companies and related funds, some paying considerable yields.

In contrast beware of the extreme hype currently with respect to gold and silver. Such extreme sentiment along with stories of shortage and conspiracies about price suppression tend to attend a top. We’ll load up on quality mining stocks and speculations related to precious metals if there’s another major liquidation soon.

If interested in subscribing to TTT at a special rate of $399.95, click here.

Stay tuned!