Market update – March 11/20

This market environment was primed for the kind of volatility that we are experiencing, and the coronavirus just gave it an excuse. Wave after wave of negative news flooded the markets today. First we hear that the CV-19 virus continues to explode outside of China, especially in Italy, where the country is now in a lock-down. The World Health Organization (WHO ) has declared CV-19 a pandemic, as the virus has spread to 114 countries and claimed 4,000 lives. And then we had German Chancellor Merkel warn that 70%, or 58 million Germans could contract the virus. It was all too much for the markets.

Update: NBA suspends season due to players testing positive.

Volatility

The VIX Volatility Index closed today at its highest level since the 2008 Financial crisis.

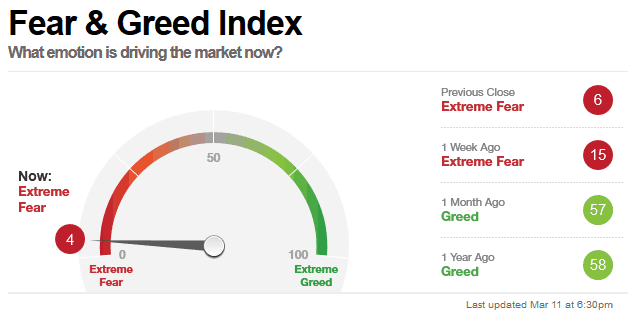

The CNN Fear & Greed index is now at an ‘extreme fear’ reading of just 4.

US – S&P 500

The S&P 500 lost another 140 points, or almost 5% today, closing at 2741, just under the Monday low. This support level is very key as a break below here opens the door for a much deeper correction. Watch for a potential low on Thursday, but understand that if we do get a low, the bounce will likely only be for a few days.

Canada – TSX

The Canadian market closed to day lower than Monday’s close. Weak oil, and gold prices were big factors. On the bottom of the chart we can see that the Relative Strength Index (RSI) is at 22.47, which is technically oversold.

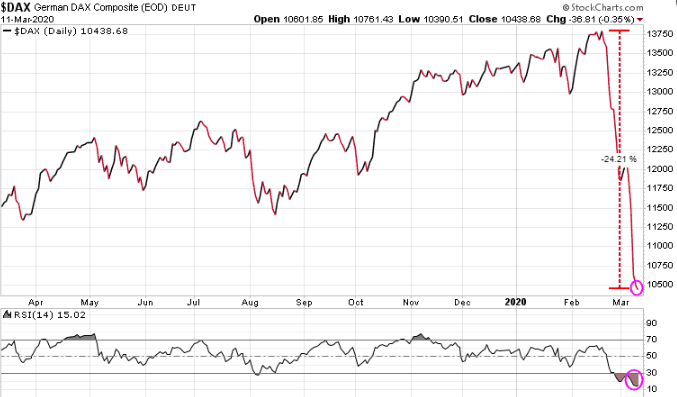

Germany – Dax

The German Dax index is now down over 24% from its February highs. It’s RSI reading is down to just 15.52, extremely oversold.

Japan – Nikkei

The Japanese Nikkei Index is now down 19.30% from its January high. RSI at 20.48 indicates this market is also oversold.

China – Shanghai Index

On a more positive front, according to UBS, China appears to have “passed its worst,” citing a decline in the number of reported infections in the country. The Chinese economy could be the first in the world to get back on track as production activity has started coming back to the Chinese economy. The Shanghai index is outperforming all other markets.

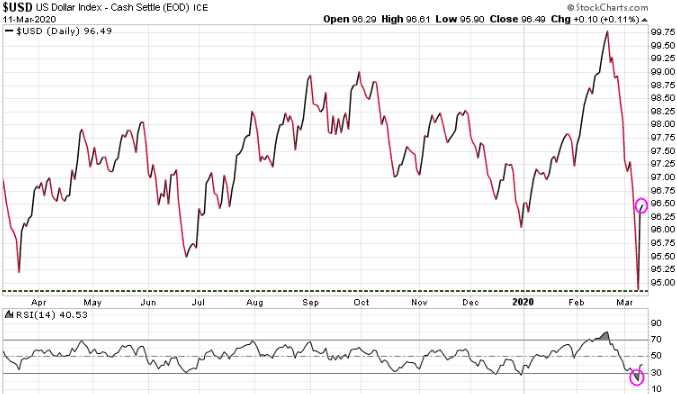

US dollar

Capital started to flow back into the $US after we saw foreign investors sell US stocks and take currency home. We expect the $US to gain with ‘least ugly’ status.

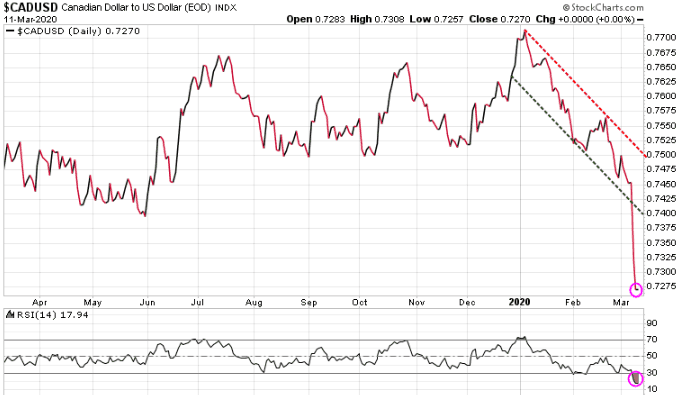

Canadian dollar

The Canadian dollar is in a free-fall with weak oil, and gold prices, plus the recent rate cut. RSI at 17.94, very oversold.

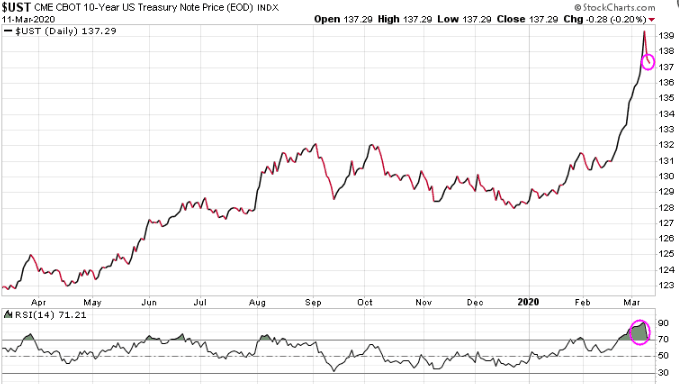

US bonds

US bonds have been the primary go to safe-haven target. Some selling over the last 2-days after being massively overbought.

Gold

Gold struggles to gain safe-haven status with profit taking and a strong $US. Also, in market sell-off investors are selling everything to cover losses.

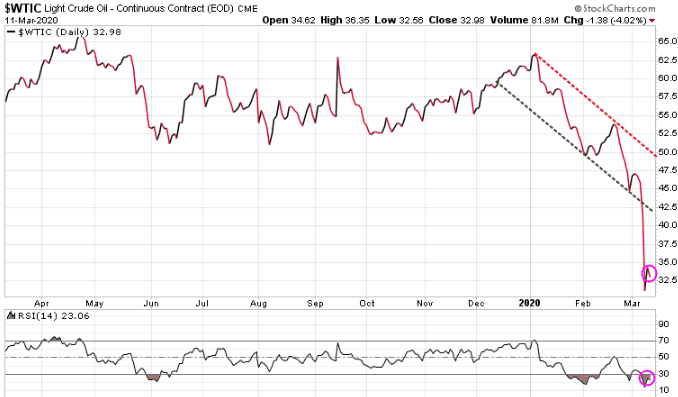

Oil

The Saudi-Russia standoff is more likely an attempt to hit the US shale producers. Whatever the root cause, oil prices continues to struggle. Watch for some serious debt problems in the US energy sector as a result.

Over the last few weeks our hedging service Trend Technical Trader has had some phenomenal returns, not just protecting subscribers against losses, but making terrific gains. If you want to profit from a potential serious stock market decline, then seriously consider subscribing to our Trend Technical Trader (TTT) service. TTT is primarily a hedging service designed to profit during market declines.

If interested, you can subscribe for only $399.95, a $250 discount off the regular price

Click here to subscribe at this special rate

Stay tuned!