Some reasons for caution

Our model gave a recent warning of a potential market top coming soon and we sent subscribers a strategy to protect their portfolio. Below we show a few charts that allow investors to see some reasons for concern here.

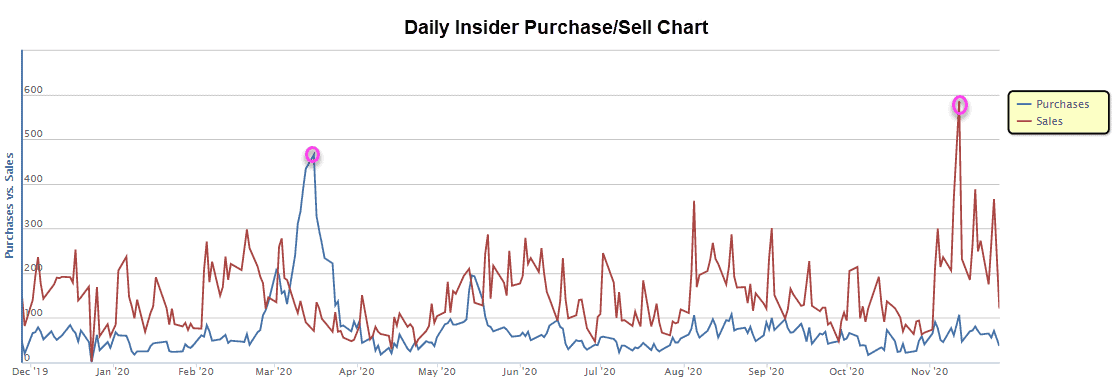

The first chart shows the daily purchase and sell transactions by corporate insiders – officers, directors, and holders of more than 10% of company shares. The SEC requires these shareholders to report purchases and sells within two days of a transaction. As we can see on the chart, during the massive sell-off in February and March, insiders were big buyers of their company’s shares (pink circle on blue line). But now in this record setting rally in November, corporate insiders have been massive sellers of their company’s stock (pink circle on red line) .

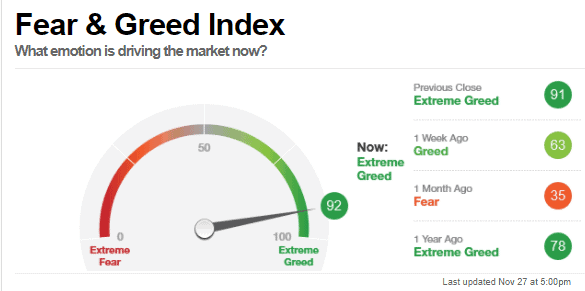

On the second chart we see CNN Fear & Greed Indicator. This indicator combines seven real-time market indicators to assess current investor mood. Of those seven indicators, six have reached “Extreme Greed,” levels, which is typically indicative of at least a short-term market top.

As investors we need to be aware that this transfer of shares from strong insider hands to weaker retail investors is a warning that we could be in for a correction very soon.

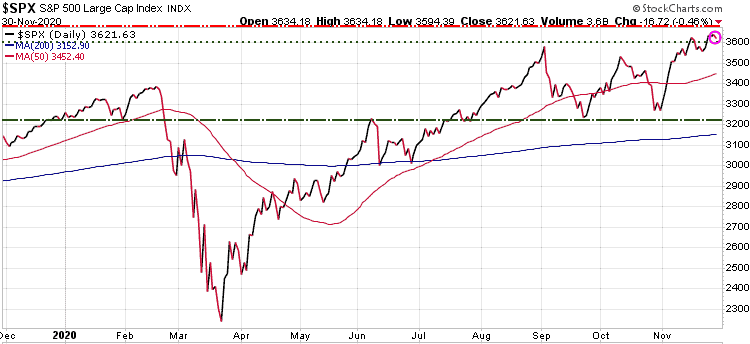

Our models monitor these and many other indicators, and are they have given us a warning signal that we could see a top here in the next 10 days. At the beginning of the year our model forecast the S&P 500 would reach 3600 by the end of 2020; well we have now achieved that target. Over the next 10 days we have a target high of 3740 for the S&P 500, and our first support level is 3600. A drop below 3600 warns of a steeper decline, with further support targets at 3462, (the 50-Day Moving Average ((red wavy line)), then 3220 ((green horizontal line)), and then the 200-DMA at 3152 ((blue wavy line)).

If, like many investors today, you are heavily invested right now, you might want to consider some hedging strategies. Every investor should have a plan, an exit strategy to turn to during a a major correction. If you have no strategy on how to lighten up and protect your investments, plus you want to potentially achieve significant gains in a severe correction, seriously consider subscribing to our Trend Technical Trader service. Cyber Monday price only $649.95 $399.95