Market Notes – Aug 31/21

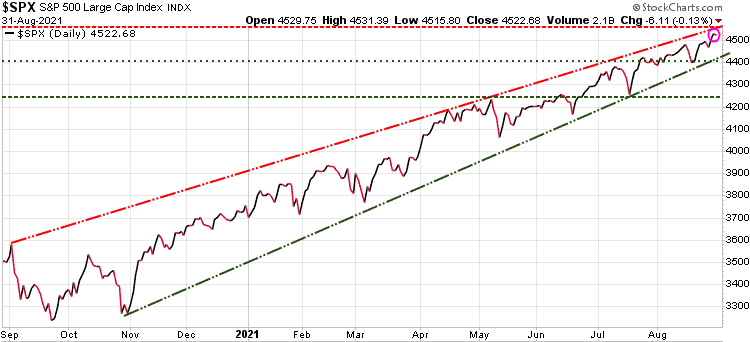

Wall Street’s main indexes hovered near record highs on Tuesday despite weakness in technology stocks, with the S&P 500 heading for a seventh straight month of gains as fears ebbed over near-term policy tightening by the Federal Reserve.

The S&P 500 was down slightly for the day, but had a solid month in August, which is typically a weak month for stocks. The S&P 500 was up 2.9% in August, the seventh straight month of gains at just below all-time highs.

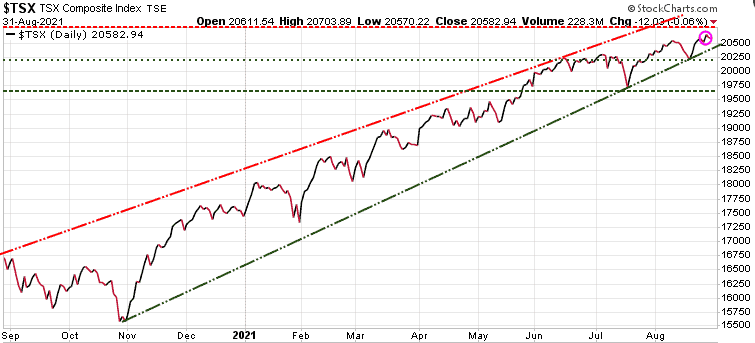

The Canadian TSX index closed down 12.03 points to 20,582.94 after setting a record of 20.703.89 in earlier trading. Just like the S&P 500, the TSX ended August by notching a seventh straight month of gains for the longest streak in more than four years.

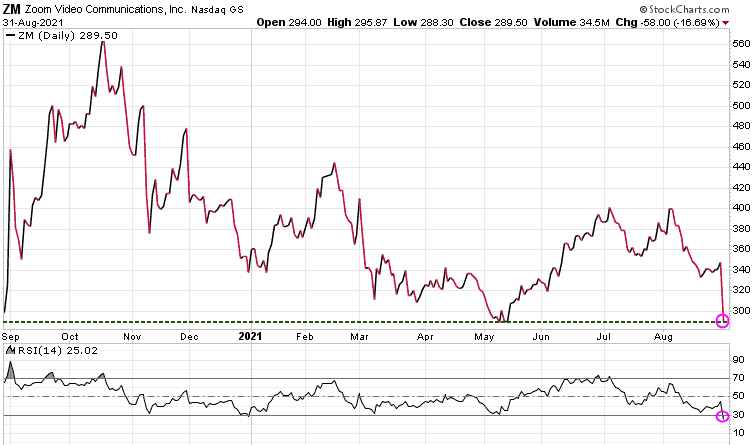

Zoom was a big loser today, down over 16% after it posted its first billion-dollar revenue quarter but signaled a faster-than-expected easing in demand for its video-conferencing service after a pandemic-driven boom. We can see at the bottom of the chart, based on Relative Strength (RSI), it now in oversold territory, so we should see at least a temporary bottom soon.

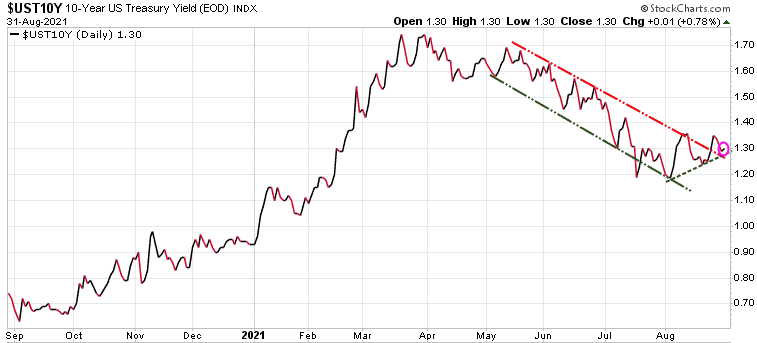

US 10-year bonds declined slightly, meaning yield up slightly.

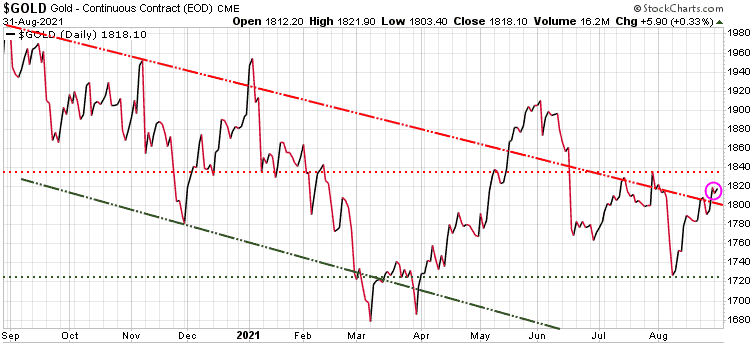

Gold was up 5.90, as it continues to move above its downtrend channel. Needs to break above 1835 to really have a chance at a new bull run.

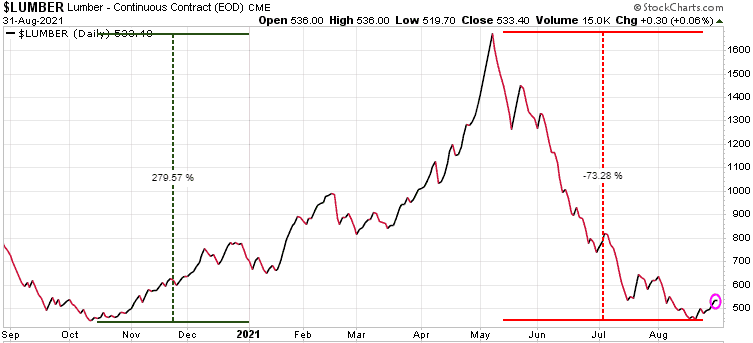

Lumber has had a wild ride, rising ~280% in 6.5 months, then giving back ~75% of those gains in a little over 3 months.

Stay tuned!