Todays charts – November 30/21

(From CNN)… Stocks dropped on Tuesday as volatility resumed after a brief rebound earlier this week, with investors contemplating the impacts of a new coronavirus variant and new comments Federal Reserve Chair Jerome Powell.

The S&P 500, Dow and Nasdaq declined. The S&P 500 dropped about 88 points, or 1.90% on Tuesday. US crude oil prices dropped more than 4%. And shares of airlines, cruise lines and lodging companies considered to be some of the most exposed to virus-related disruptions each sank in early trading to reverse Monday’s gains.

Investors reacted to Fed Chair Powell’s latest remarks before the Senate Banking Committee, wherein Powell said the central bank could speed up its tapering process to end sooner than previously telegraphed in the face of rising inflationary pressures. The comments came even as some other market participants had expected the Fed to strike a more accommodative tone for longer in the face of the recently discovered Omicron variant.

“At this point the economy is very strong and inflation pressures are high, and it is therefore appropriate, in my view, to consider wrapping up the taper of our asset purchases, which we announced at the November meeting, perhaps a few months sooner,” Powell said. “I expect we will discuss that at our upcoming meeting.”

The S&P 500 dropped below its recent low from Friday and is now approaching near-term support at 4550. A drop to 4550 would represent a pullback of 3.27% from the recent high. If the 4550 level does not hold, we have key support at early October low of 4300. A drop to 4300 would amount to an 8.72% decline. Should 4300 not hold, then we could see a significant correction.

The Russell 2000 was down 2.04% and has made a rapid 10% decline from its all-time high achieved just over three weeks ago. Next support for the Russell 2000 ETF is 217, with key support at 211. A drop to 211 would result in a 12.88% sell-off.

Note at the bottom of the chart, IWM is now technically oversold, suggesting we see a bounce very soon. But the near-term trend is certainly down at this time, so any bounce may simply be a dead-cat bounce, and lower lows are certainly possible, if not likely.

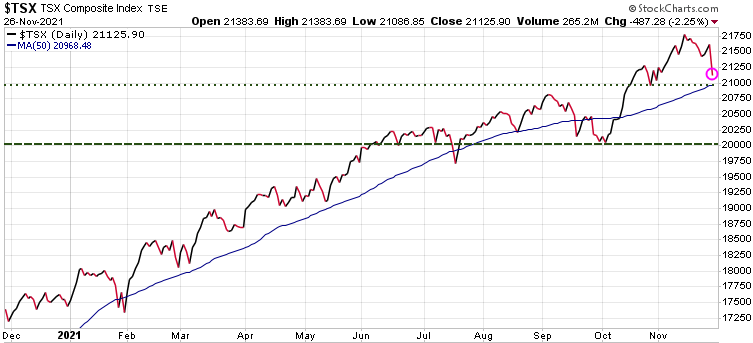

The Canadian TSX index dropped 2.31% today and is now 5.10% below recent highs. There is weak support at the 20,400 level, and stronger support at 20,030. A drop to 20.030 would represent a decline of ~8% from recent highs.

US 10-year bond yields dropped another 5.92% Tuesday, and are down over 14% in the last week.

Gold was down another 8.70 and will try to find support at 1765 level.

Stay tuned!

Our Black Friday specials are up until the end of this week. See below for some great Special Offers on all our services.

Trend Letter:

Since start-up in 2002 Trend Letter has provided investors with a great track record, giving exceptionally accurate information about where the markets are going, and it has explained in clear, concise language the reasons why. Using unique and comprehensive tools, Trend Letter gives investors a true edge in understanding current market conditions and shows investors how to generate and retain wealth in today’s climate of extreme market volatility.

A weekly publication covering global bonds, currencies, equities, commodities, & precious metals. Over the 20 years Trend Letter has been published, it has achieved an incredible average return of 65% on its closed trades.

Timer Digest says: “Trend Letter has been a Timer Digest top performer in our Bond and Gold categories, along with competitive performance for the intermediate-term Stock category.”

Technical Trader:

Trend Technical Trader (TTT) is a premier trading service, designed to profit in both up and down markets. Included is our proprietary Gold Technical Indicator (GTI).

TTT had another excellent year in 2020 averaging +27.3% per closed trade with an average holding time of 9.5 weeks, or +149% annualized overall.

Over the past 5 years TTT’s closed trades have averaged +40% annualized.

Trend Disruptors:

Disruptive technology trends will propel our future and the reality is that no industry will go untouched by this digital transformation. At the root of this transformation is the blurring of boundaries between the physical and virtual worlds. As digital business integrates these worlds through emerging and strategic technologies, entirely new business models are created.

Trend Disruptors is a service for investors seeking to invest in advanced, often unproven technology stocks on the cheap, with the objective to sell them when masses finally catch on. Covering Artificial Intelligence (AI), Virtual Reality (VR), Augmented Reality (AR), 5G, Quantum Computing & many more.

Trend Disruptors has realized average annualized gains of 178% over its 3 years of service.

Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | $349.95 | $250 | Trend Letter $349.95 |

| Technical Trader | $649.95 | $349.95 | $300 | Trend Technical Trader $349.95 |

| Trend Disruptors | $599.95 | $349.95 | $250 | Trend Disruptors $349.95 |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1,249.90 | $549.95 | $699.95 | Trend Letter & Technical Trader $549.95 |

| Trend Letter + Trend Disruptors | $1,199.90 | $549.95 | $649.95 | Trend Letter & Trend Disruptors $549.95 |

| Technical Trader + Trend Disruptors | $1,249.90 | $549.95 | $699.95 | Technical Trader & Trend Disruptors $549.95 |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1,849.85 | $649.95 | $1,199.90 | Trend Suite: TL + TTT + TD $649.95 |