Market Charts – February 15/22

The S&P 500 closed higher by 1.6% in its first rise in four sessions. The jump came amid an announcement from Russia that it had pulled back troops near Ukraine and was seeking to continue diplomatic efforts with the West. However, President Joe Biden said during a news conference Tuesday afternoon that a Russian invasion of Ukraine remained “distinctly possible,” while noting that diplomacy should be given “every chance to succeed.”

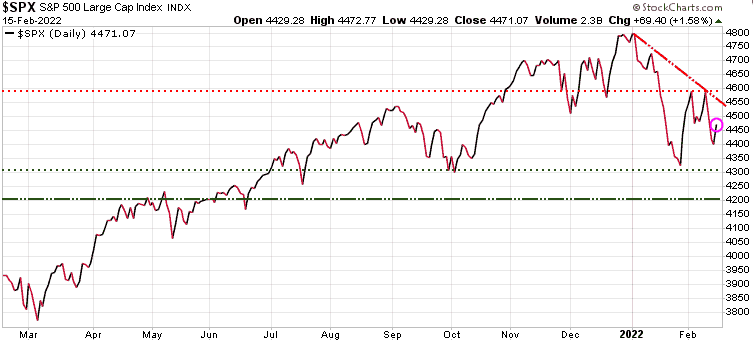

For the S&P 500 the levels to watch are the 4600 near-term resistance level and the 4300 near-term support.

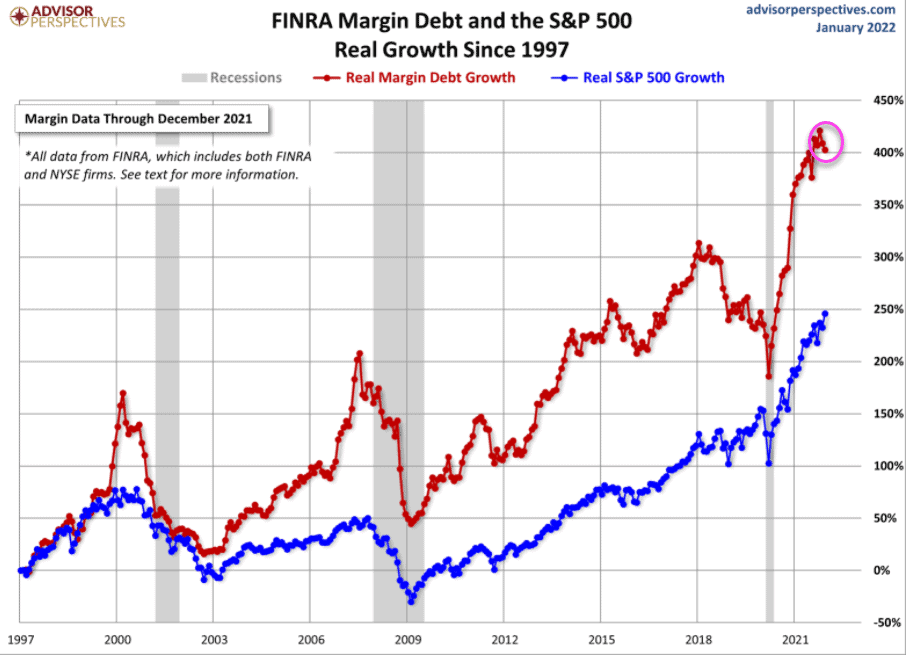

New margin debt totals were just released. This chart shows real growth of both the S&P500 and margin debt. The real risk here is that with margin debt so high, if we get a significant pull back or correction in the equity markets, margin calls will kick in, forcing these speculators to sell to cover, exacerbating the decline.

The threat of a Russian invasion of Ukraine has been pushing oil prices to a seven year high this year. But with Russia claiming to be pulling troops back from the Ukraine border, oil and energy stocks reversed some of those recent gains today.

Stay tuned!