Market Charts – March 7/22

Stocks extended declines on Monday and oil prices soared as investors nervously considered the potential for even higher inflation and greater global economic damage from Russia’s war in Ukraine and sanctions that have ensued.

The S&P 500 closed down nearly 3% at 4,200.89, its worst day in more than a year, while the Dow fell 2.4% to 32,813.56. The Nasdaq Composite dropped 3.62% at 12,380.96 clocking in its worst day in more than a month, and formally entered a bear market after dropping more than 20% from its recent record high.

The S&P 500 has now dropped below the previous near-term support level and is testing our original call for support at 4200.

Gold has had a great run but is now getting technically overbought (see RSI at bottom of chart). Watch for a potential near-term pullback with support at 1885, then 1850.

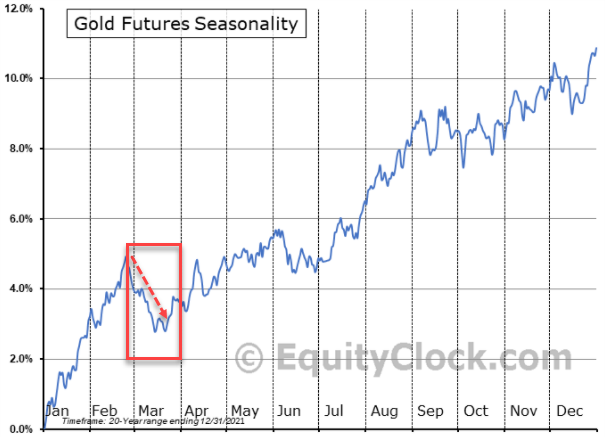

Based on seasonality, gold is now entering negative period that typically runs to mid-late March

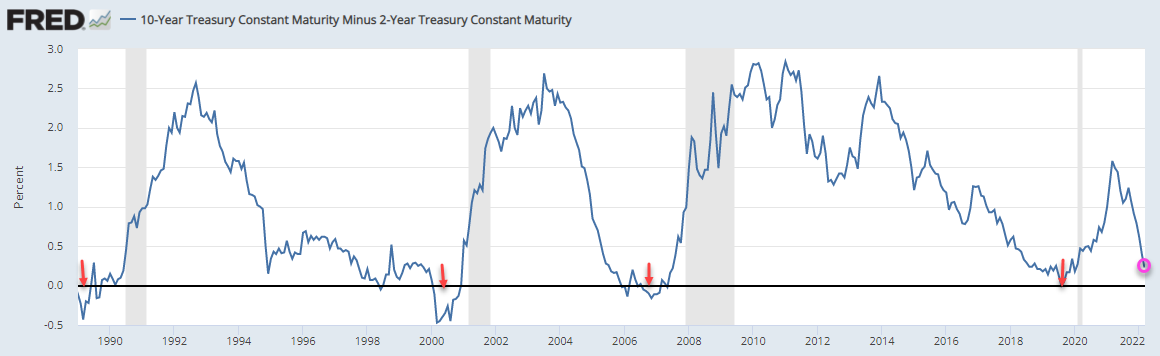

While investor’s focus has been understandably on the Russian invasion of Ukraine, there is another problem that is creeping up that most are not aware of…a recession. One of the best indicators that a recession is coming is the yield curve (the 10-year yield – 2-year yield).

On the chart below, inverted yield curves are identified by red arrows and we can see that when the yield curve inverts (10-year yield lower than 2-year yield) a recession always follows (grey shaded area). As we can see, the yield curve has been heading lower since May of 2021 and if the Fed raises rates at their meeting next week, the yield curve could be inverted in the next few months. And that means a recession should follow.

Hopefully, you have taken our advise and established exit or hedging strategies. If you do not have a hedging strategy, seriously consider subscribing to Trend Technical Trader (TTT) which offers numerous hedging options. Note also, TTT includes the Gold Technical Indicator (GTI).

To ensure all readers have access to this hedge service, we temporarily reduced the price by $300. Click button below to subscribe. It’s your money – take control!

Stay tuned!