Market Notes – June 10/22

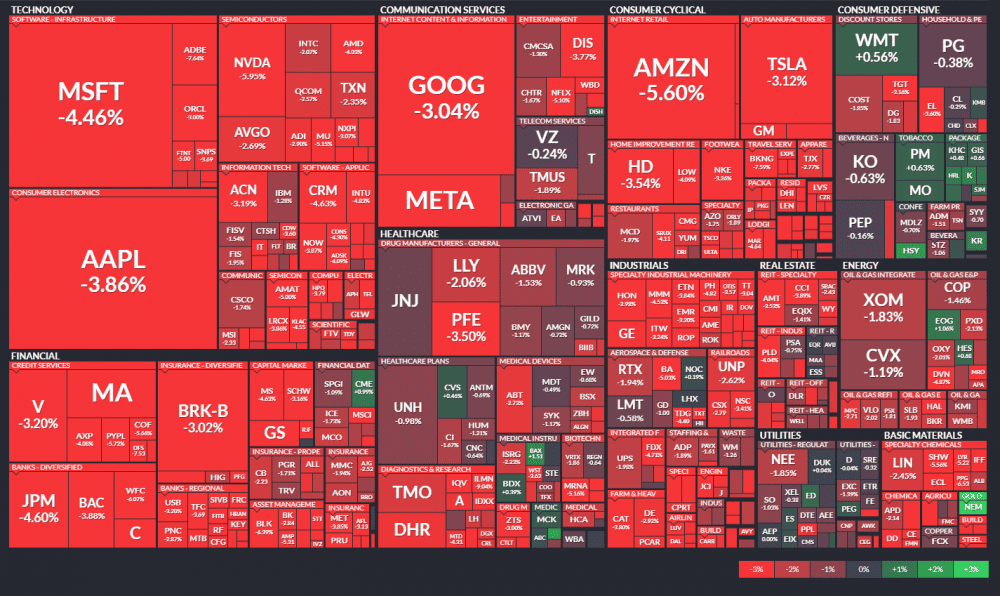

US stocks sank Friday as investors digested two downbeat prints on the US economy.

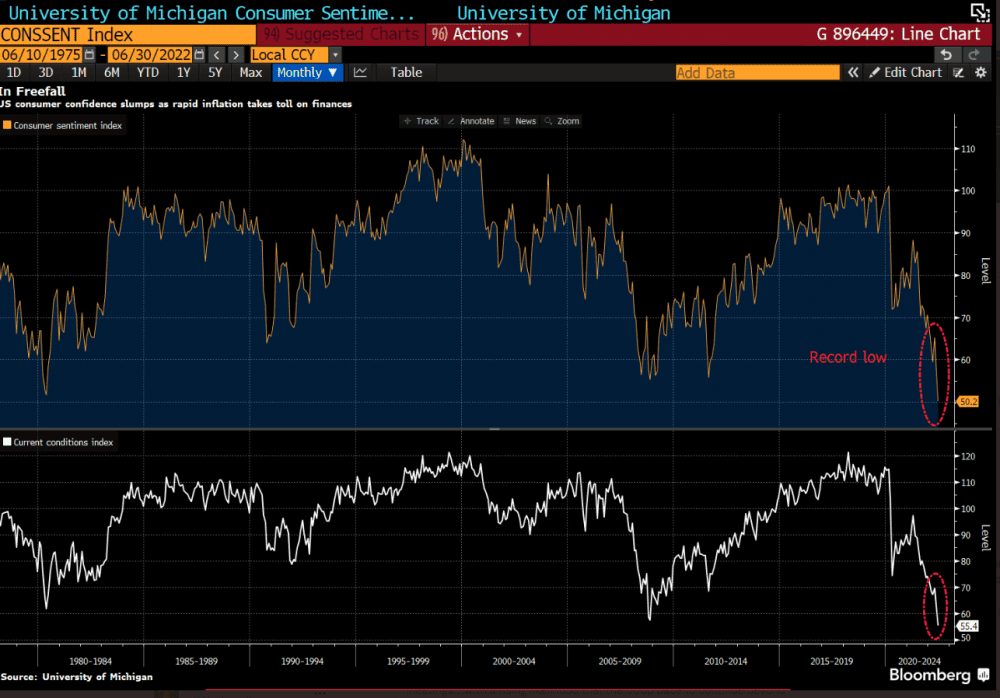

May data on inflation showed price increases unexpectedly accelerated last month, with consumer prices rising 8.6% year-over-year in May, the most since 1981. Consumer sentiment data released Friday morning came in at a record low, as inflation weighs on American households.

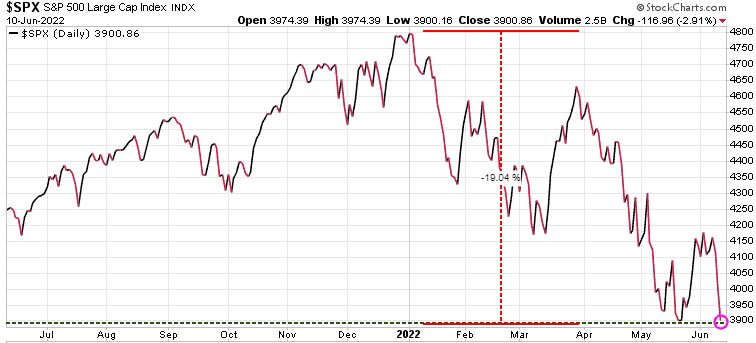

The S&P 500, Dow and Nasdaq dropped sharply following the print. The S&P 500 sank by 2.9% during the session, and by more than 5% since last Friday to post its worst weekly performance since January. The index ended just a hair above 3,900, or its lowest level in about three weeks. The Dow sank by 880 points, or 2.7%, and the Nasdaq Composite dropped 3.5% by the end of Friday’s session.

The S&P 500 is back to testng its previous low and if that level does not hold, we could see a significant decline.

Note that Trend Letter subscribers were given a new BUY recommendation on an insurance play this week. These insurance plays, or hedges are critical to protecting your wealth in a bear market. Our hedging service Trend Technical Trader (TTT) has a number of hedging options and subscribers can decide which one suits their specific trading strategy. If you do not have a hedging strategy, seriously consider subscribing to TTT at a 50% discount. Click here to subscribe to TTT

Consumer sentiment has dropped to a record low.

A sea of red.

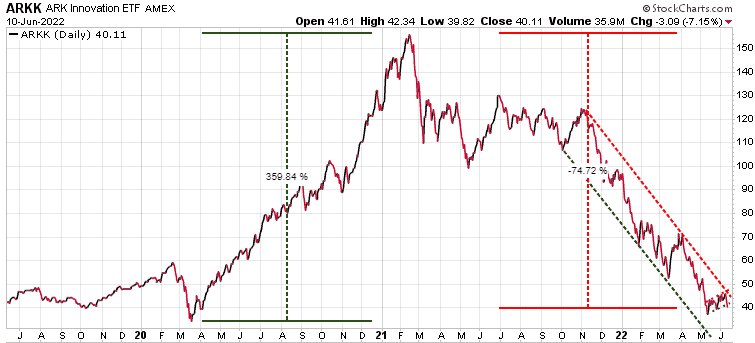

Cathy Wood’s ARKK ETF was the darling of the Tech sector after the Covid crash, having soared ~360%. In this bear market since the high in Feb’21, it has given up ~75%.

Stay tuned!