Market Notes – June 13/22

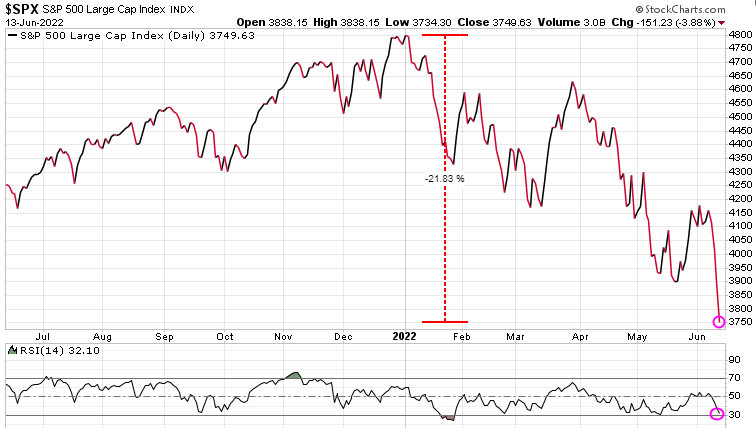

The S&P 500 dropped back into a bear market within the first 30 minutes of trading today. The index is now down over 20% from its January high, marking the lowest level since March 2021. The Dow plummeted 2.79% while the Nasdaq fell 4.8%. Recession fears are growing amid crippling inflation and people are pulling out of their positions before the situation worsens.

For the last six months we have warned that in bear markets, relief rallies typical fail to make new highs and in fact tend to make new lows. Our Trend Letter and especially our Trend Technical Trader (TTT) services have been using hedging strategies to protect our portfolios from these violent bear markets and even to profit from them.

Bear markets typically have three phases. The first stage is a sharp decline, followed by a rebound, and then a drawn-out fundamental downtrend. This is likely where we are now and we are likely to see some strong relief rallies, followed by deep corrections.

If you have yet to put any hedging strategies in place, we should be due for a rally very soon, which would be an opportunity to put in such a strategy. If you need assistance on how to hedge, seriously think about subscribing to TTT at a 50% discount. Click here to subscribe.

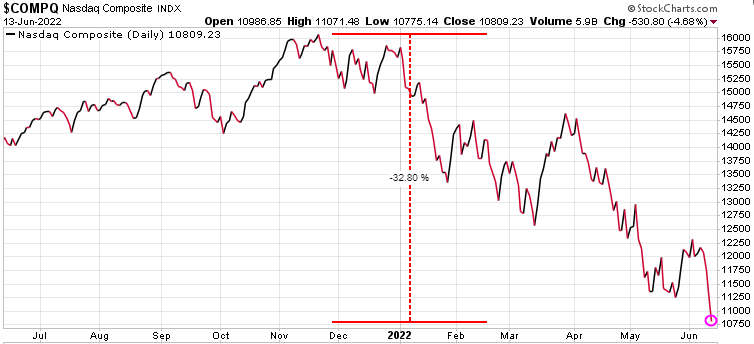

The Nasdaq representing the tech stocks is now down over 32% since its high in November.

The S&P 500 is now officially in a bear market, having dropped over 21% since its high at the start of January.

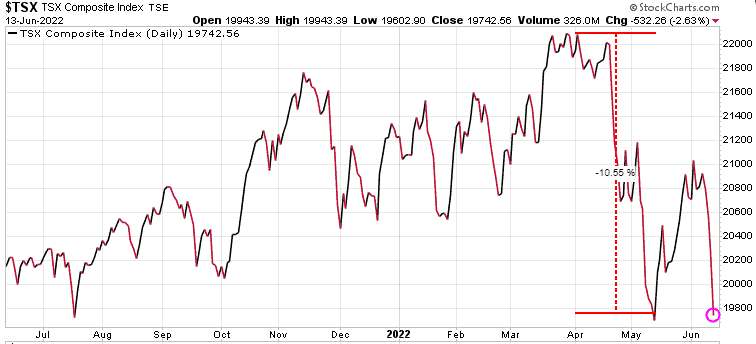

The Canadian TSX has fared much better thanks to energy sector. The TSX is down ~10% and has not yet hit new lows.

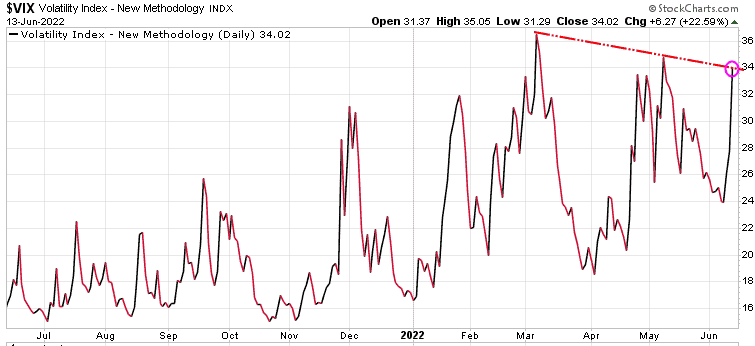

Volatility spiked over 22% today.

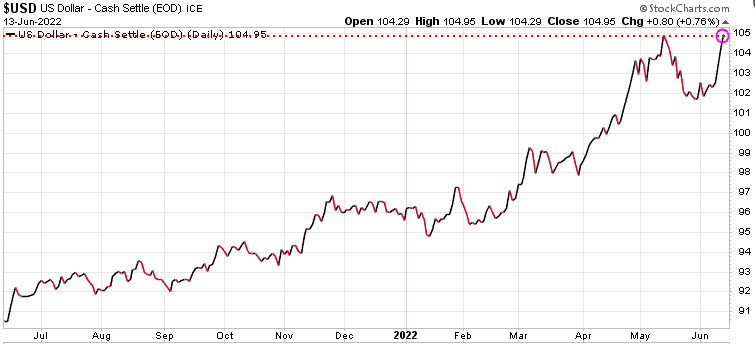

The $US continues to be a safe-haven play in this bear market, testing recent high.

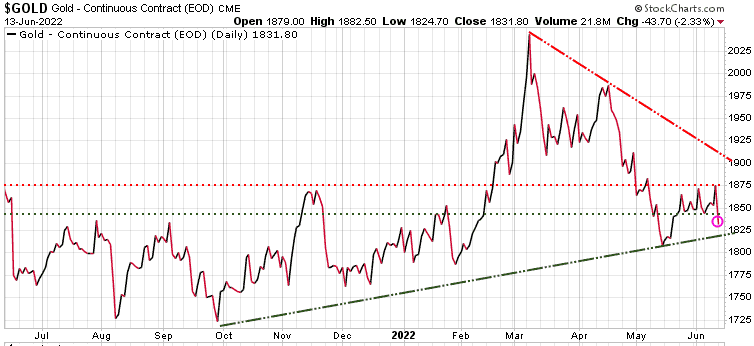

On Friday Gold jumped along with the $US as a safe-haven play. Today it fell off – very inconsistent and frustrating!

Stay tuned!