Market Notes – June 16/22

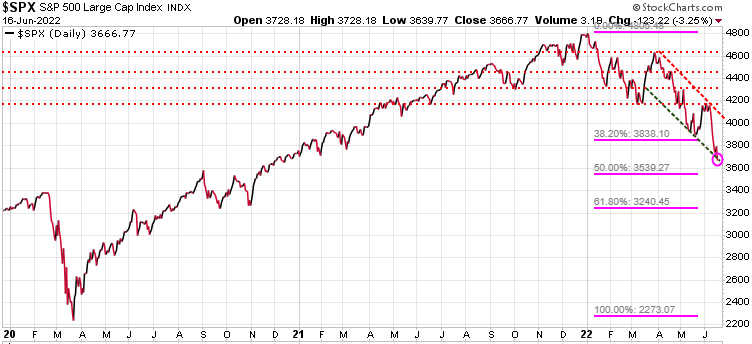

The S&P 500 dropped 123 points or 3.25% and is now close to testng the 50% Fibonacci retracement level from the rally from Mar’20 to Jan’22. Remember our warning all through this year… bear market rallies tend to be sucker rallies, usually failing to reach new highs, and instead make new lows. We are neutral right now, with our insurance trade offsetting our long play.

We do have a great list of stocks on our watch list, but we are NOT buying the dip here. We will let our subscribers know when our models trigger a BUY Signal. If you want receive those BUY Signals when they are triggered, subscribe now to the Trend Letter and receive 50% off the regular rate. Click here to take advantage of this special offer.

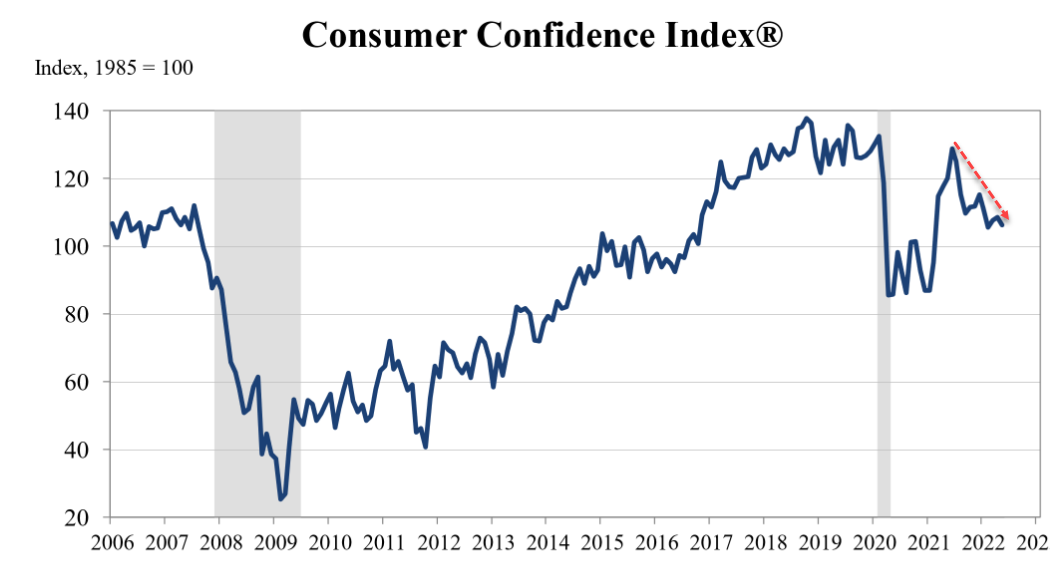

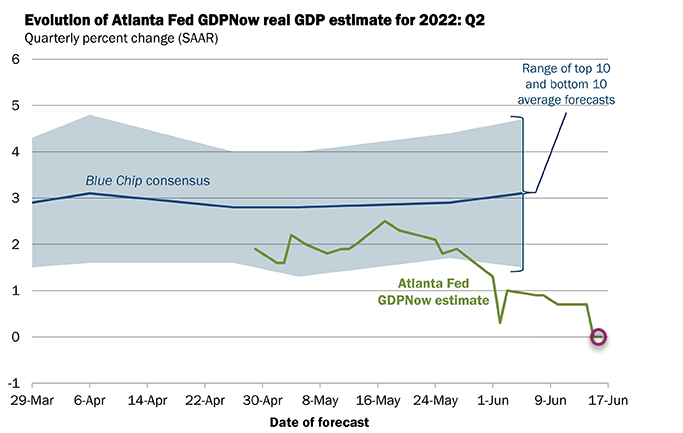

Yesterday Fed chair Jerome Powell stated ‘Overall, spending is very strong, the consumer’s in really good shape financially — they’re spending. There’s no sign of a broader slowdown that I can see in the economy.’ That is quite an astonishing statement and we have no idea what data he is looking at. Every consumer sentiment chart we see shows consumers are anything but confident.

Even the Atlanta Fed, Powell’s own institution, is now forecasting Q2 GDP to come in precisely at 0.0%. That’s down from a 2% forecast in May and then a 1% forecast earlier this month. Given that the consumer accounts for~70% of the economy, how can he possibly say the consumer is in ‘really good shape financially’

Inflation was caused by excess government spending, a very dovish Fed, and high energy prices caused by the Ukraine war and extremely nearsighted energy policies.. The way the Fed seems to be planning to stop inflation is to drive the economy into a recession. And then once the recession takes hold, those laid off workers will not be able to afford things like gasoline or healthy food, so the prices will finally start to fall.

Gold had been oversold and had a nice bounce today. Still trading in 1800-1975 range.

Mortgage rates for the US 30-year jumped by the most since 1987 and are now at the highest level since 2008, which coincided with the real estate crash and a recession. Sound familiar?

Stay tuned!