Money Talks charts – August 20/22

The Trend Letter’s Martin Straith was the featured guest on Mike Campbell’s Money Talks podcast on Saturday. In the interview Martin gives his views on what is driving the markets currently and where he sees things moving from here. Topics include the stock market trend, how the US dollar drives markets, and how he sees a potential bull market in gold coming soon. Click here to hear the interview.

Below are Martin’s notes and charts from interview on Money Talks:

Market drivers:

Inflation

US 9.1% -> 8.5%

Canada 8.1% ->7.6%

Argentina 64% -> 71%

Turkey 78.7% -> 79.8%

It’s a global market….inflation is a big issue globally

GDP Growth

US -1.6% -> -0.9%

Canada 1.60% -> 0.8%

Employment

Still strong

Central Bank monetary policy

US raised .75%

Canada raised 1.00%

Current status:

High, (yet lower) inflation

Declining economy

Equals stagflation…not a good combination

Expectations = Fed to slow or even ‘pivot’ policy

Bear rally or Bull market??

This rally has been fueled by expectations that inflation has peaked & the Fed will stop raising rates – even that they will ‘pivot’ & start to lower rates to fend off a recession

Also, there was a lot of pessimism in the markets…a lot of short positions

Which was contrarian…suggesting a rally was overdue

Short covering drove the markets higher

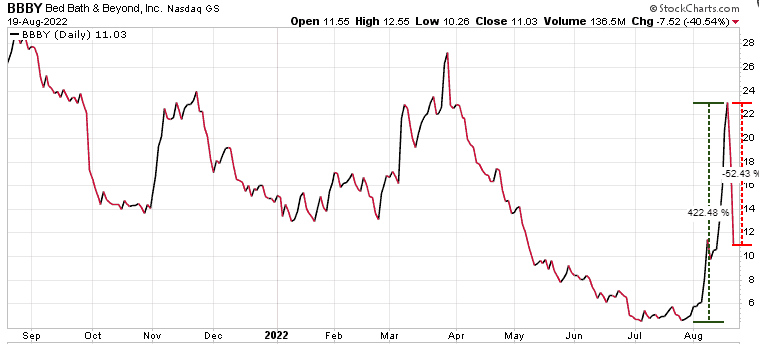

Very speculative MEME stocks got hot again

Reddit crowd squeezed those short positions

Best example was Bed, Bath & Beyond …up over 420% in last 3 weeks

Then sold off 52% this week

That short covering pushed markets higher…but has now stopped

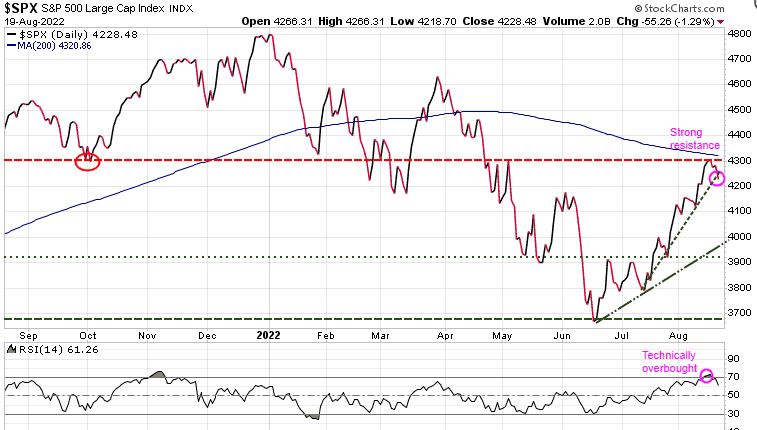

The S&P 500 is testing the 200-DMA (blue wavy line) which is presenting as strong resistance here

SPX is at same level as Sept’21 when Fed was keeping rates low & buying $120 billion of bonds & MBS each month

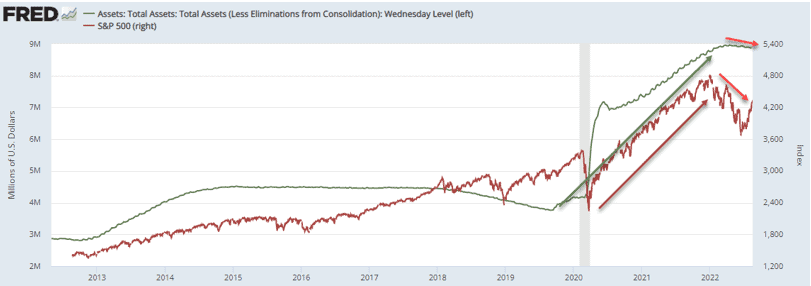

Fed loose policies have juiced the markets

Back in Sept the Fed was being very accommodative & the market responded very favourably

Now Fed is raising rates & reducing balance sheet by $95 billion/month

Inflation is still a big deal

Retail sales were up, but only because prices are higher

High inflation in a slowing economy = stagflation

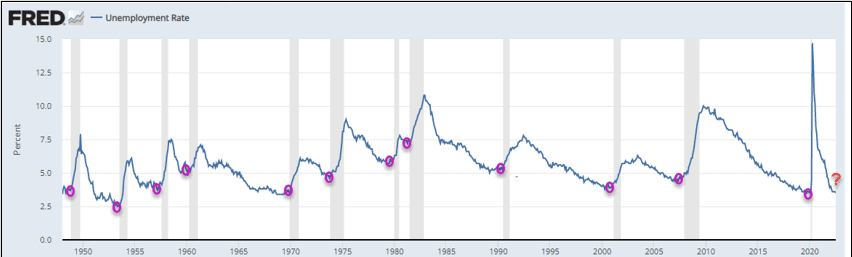

Unemployment the one outlier:

Higher unemployment would seal the deal but so far employment is still very strong

BUT, low unemployment rates are typically a good indication of an overheated economy & unemployment tends to rise quickly once a recession has kicked in

So, we need to keep an eye on the unemployment levels

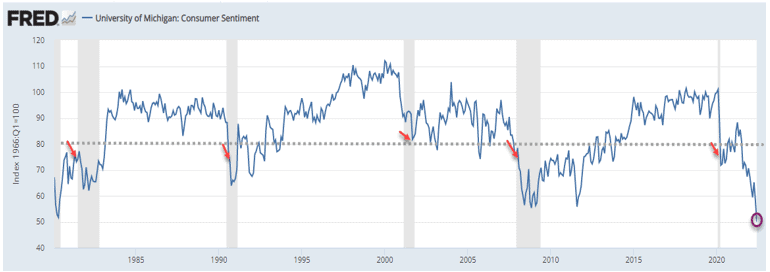

U of Mich publishes the Consumer Sentiment Index

Historically, when consumer confidence & expectations declined below 80, it signaled a recessionary environment was present

Today the reading is <55

FOMC notes released said Fed will continue with a ‘restrictive stance’

Meaning they will continue to raise rates to reduce demand & ‘slow economic growth’

So, while the markets expect the Fed to reverse policy, the Fed is saying they will continue to tighten. Near-term, we believe the Fed.

Our investing

We have been long via ETF plays since 2016 but since Jan have used ‘insurance’ plays early this year to protect our gains

For September we are looking for the markets to decline September is typically a volatile month, but tends to end lower

A slowing global economy does not bode well for the markets

We have given our subscribers a new insurance play to buy if our BUY Stop triggers

For September we are looking for another pullback, likely ~8%

Currencies:

Investors need to understand how currencies affect other markets

When $US strong, other currencies, commodities lower etc

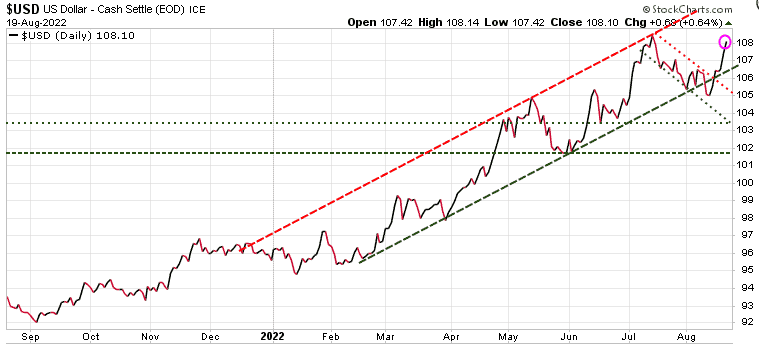

$US has been on a tear during this year, acting as ‘safe-haven’

Was technically overbought early July at 1.09, but we expect it to regain momentum in the Fall

Currently ~1.07

Targeting a high 1.15 -> 1.20

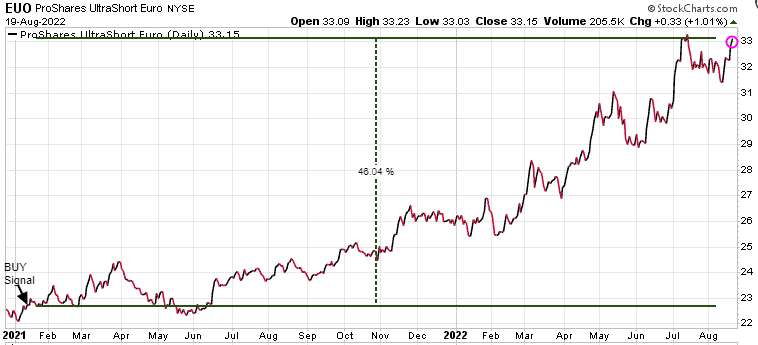

One of our favourite trades over the last decade has been to short the Euro

Been in & out of that trade many times with great gains

Use 2X leveraged short Euro ETF (EUO)

Current open position is up ~45% since Jan’21

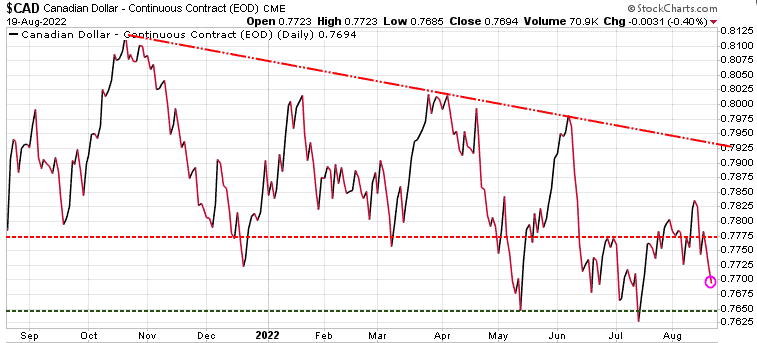

$CAD follows commodities & will potentially rise through to September but then expect it to fall

Could see low of .72 & if that doesn’t hold, then .68 is possible

Is it gold’s time to shine??

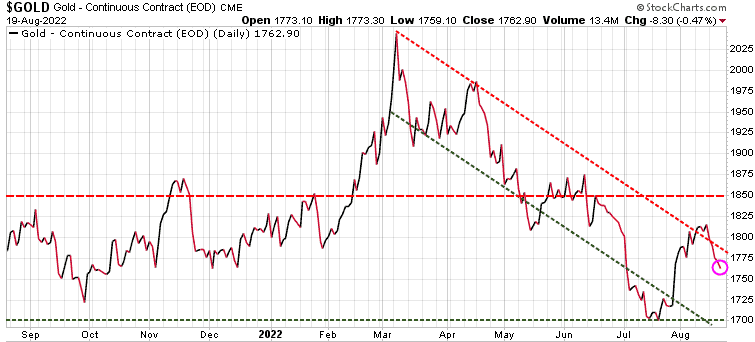

Gold has been disappointing…. since its high in March Gold has been in a downtrend channel

From that March high of 2043, gold dropped 17% to 1700 in July & rallied to 1825

Hasn’t been able to push through 1825

We could see 1700 re-tested & even 1675

But our models are highlighting a potential for gold to be bottoming here & a nice bull market could be on the horizon

We are expecting to issue BUY signals soon, likely in the Fall

Could be a multi-year run!!

Money Talk Specials – For each new subscription we will donate $50 to the Kids Help Phone and $50 to the Special Olympics.

Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | $349.95 | $250 | Trend Letter $349.95 |

| Technical Trader | $649.95 | $349.95 | $300 | Trend Technical Trader $349.95 |

| Trend Disruptors | $599.95 | $349.95 | $250 | Trend Disruptors $349.95 |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1,249.90 | $549.95 | $699.95 | Trend Letter & Technical Trader $549.95 |

| Trend Letter + Trend Disruptors | $1,199.90 | $549.95 | $649.95 | Trend Letter & Trend Disruptors $549.95 |

| Technical Trader + Trend Disruptors | $1,249.90 | $549.95 | $699.95 | Technical Trader & Trend Disruptors $549.95 |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1,849.85 | $649.95 | $1,199.90 | Trend Suite: TL + TTT + TD $649.95 |