Unpacking the Inflation Dilemma: Government Solutions and Their Consequences

Inflation has become a significant concern for voters in both Canada and the United States, prompting politicians from all sides to promise solutions. But before we place our trust in their ability to address this problem, let’s review how this inflation problem evolved.

After the financial crisis in 2008, the US Federal Reserve, which manages ‘monetary policy’, initiated the first round of Quantitative Easing (QE), to inject liquidity into the financial system and lower long-term interest rates.

They continued to add subsequent rounds of QE type policies keeping interest rates low, being concerned about an economic depression or severe recession. As we can see below, from the financial crisis recession in 2008, the Fed kept rates near zero percent until late 2015, before gradually allowing them to rise. Essentially, the Fed was trying to inflate the economy.

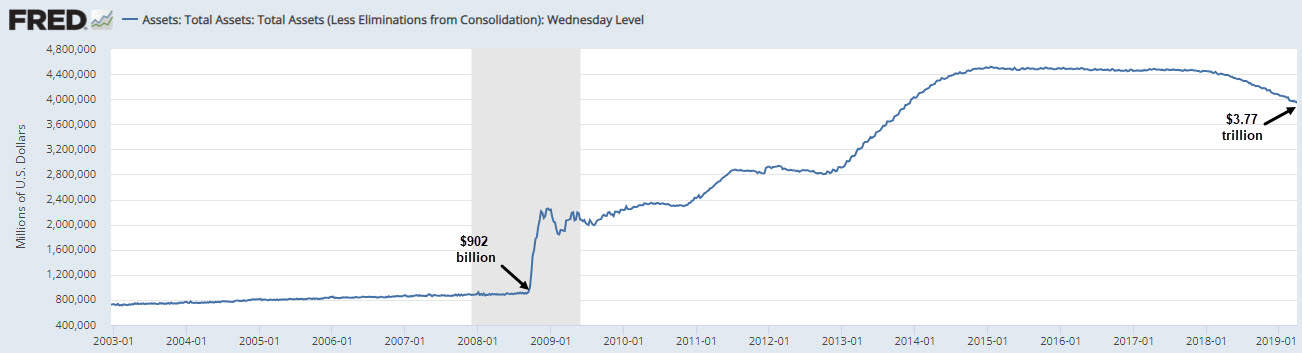

The method they used to keep rates low was to purchase government bonds and mortgage-backed securities (MBS), injecting liquidity into the economy. The result was they increased their balance sheet by $2.86 trillion, from $902 billion to $3.77 trillion between June 2008 and March 2019.

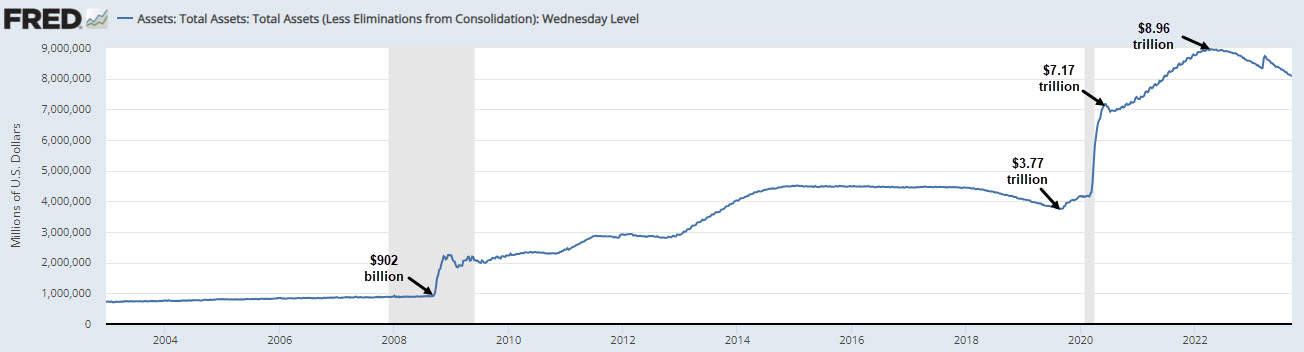

Then, the COVID-19 pandemic struck, leading governments worldwide to impose lockdowns that severely disrupted the global supply chain. To avert an economic crisis, the Fed pledged to engage in ‘unlimited asset purchases.’ In the first half of 2020, the Fed added another $3.4 trillion to its balance sheet, and by April 2022, they had injected an additional $5.18 trillion in slightly over two years.

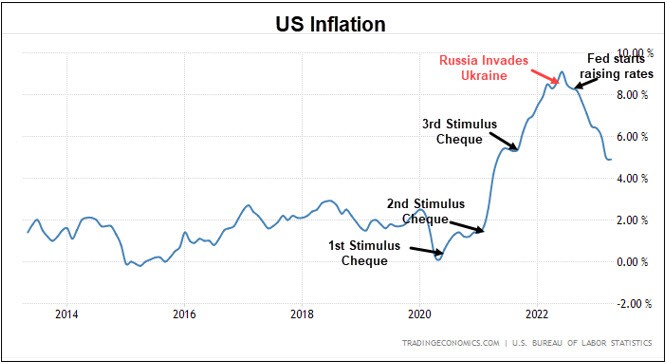

Simultaneously, the federal government implemented unprecedented fiscal stimulus measures, totaling over $5 trillion, equivalent to nearly 25% of the 2020 GDP. These measures involved sending out checks to both businesses and individuals to mitigate the economic impacts of the lockdowns.

While these actions may have been well-intentioned, they had unintended consequences. The issuance of relief checks led to a significant increase in personal savings. The US had typically seen a personal savings rate below 10% for decades, but with the arrival of stimulus checks, this rate skyrocketed from 8.3% to 33.8%. As people began spending this newfound cash, the savings rate gradually decreased to 13.3%. This pattern persisted until most of the extra funds were spent, and the savings rate returned to more conventional levels.

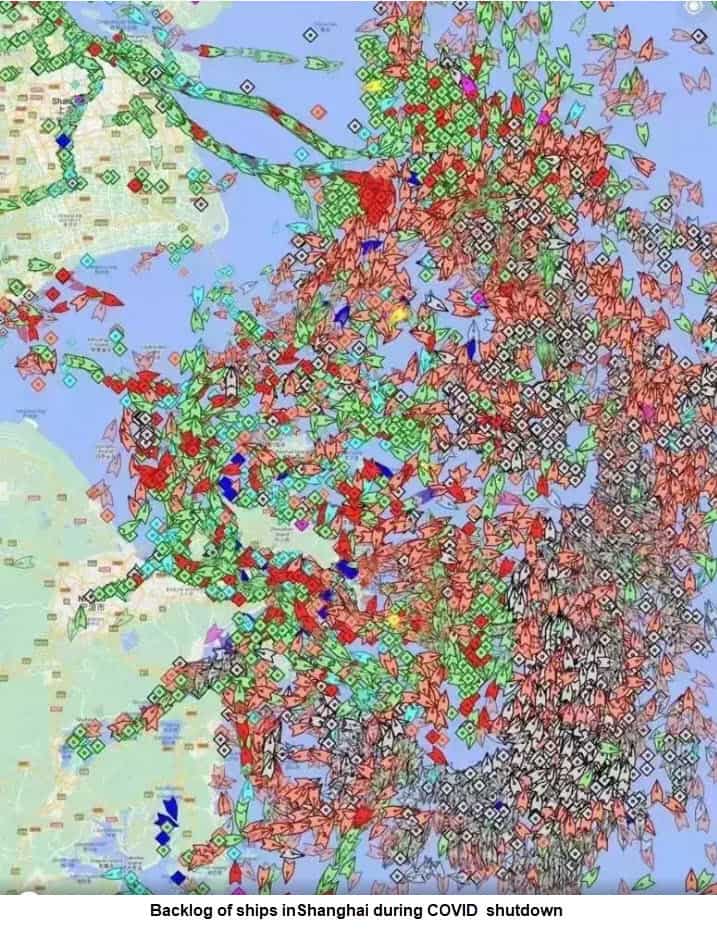

During this period, with the Fed injecting $5.19 trillion into the economy and the government distributing over $5 trillion in stimulus, a total of $10 trillion was pumped into the economy. This surge in demand for various goods coincided with a heavily constrained supply chain due to the lockdowns. The result was a perfect storm of soaring demand and a clogged supply chain, leading to a sharp rise in inflation.

Here is an image map depicting the congestion of ships in Shanghai’s port during the COVID lockdown, as they await their turn for loading/unloading.

It’s evident in the chart below that the rise in inflation in the US was closely correlated with the distribution of stimulus checks. Inflation had already exceeded 8% before Russia’s invasion of Ukraine, which pushed it past 9%. Only then did the Fed begin to raise interest rates.

The current challenge is that while central banks in Canada and the US are striving to combat inflation, the federal governments in both countries continue to spend at a record pace. It’s important to recognize that government spending has an inflationary impact.

In Canada, the federal debt has reached $1.2 trillion and is increasing by nearly $110 million per day, or $4.5 million per hour. This translates to roughly $30,000 per person.

In the US, the numbers are even more staggering, with a total debt exceeding $33 trillion, equivalent to over $98,000 per person and $255,000 per taxpayer.

With a US election next year and a Canadian one in about two years, it seems clear that these politicians are going to continue this trend of spending and that will keep inflation higher for longer. Although it’s important to note that inflation has multiple contributing factors, politicians and bureaucrats play a significant role in exacerbating this issue as prominent contributors.

Stay tuned!