This Week’s Key Market Highlights:

October 25, 2024:

The S&P 500 dip: The first weekly decline after six gains suggests a potential bounce next week, though election volatility could bring market jitters, especially if results are delayed.

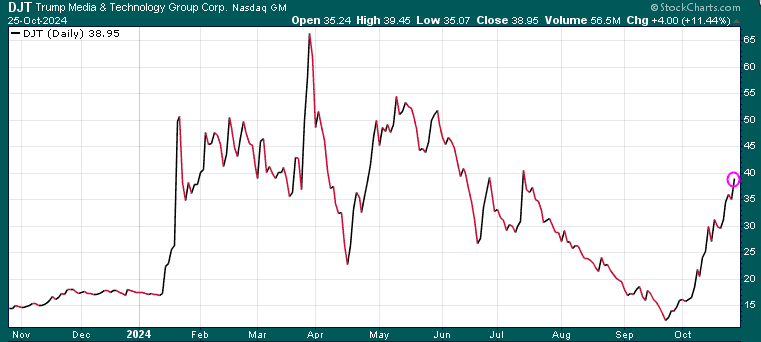

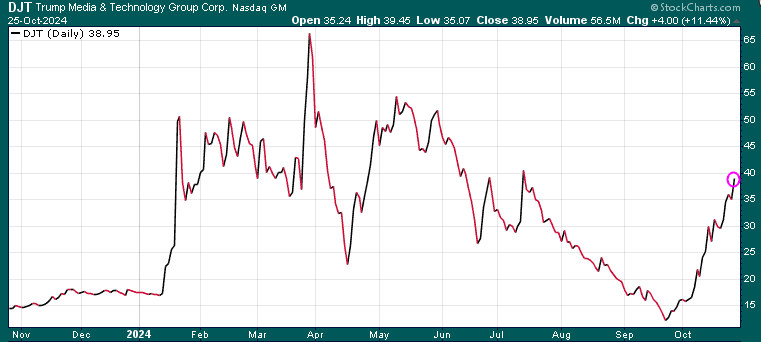

US Election Countdown: With just 10 days until the election, markets leaning toward a Trump victory due to his pro-deregulation stance, seen as favorable for business.

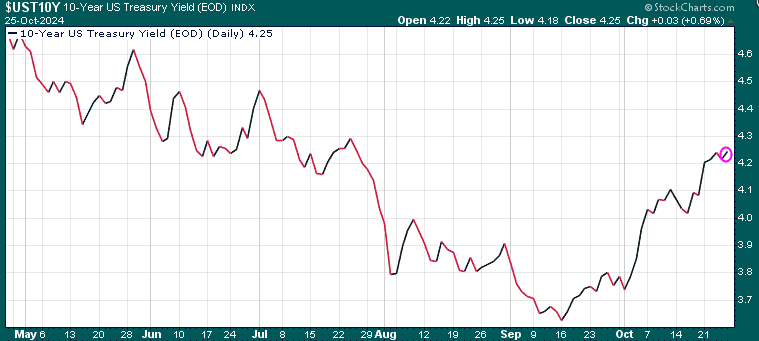

Rising Bond Yields: Concerns about persistent inflation are pushing bond yields higher, limiting room for Fed rate cuts. The Bank of Canada cut rates by 50 bps to 3.75%, and the ECB by 25 bps to 3.4%, contrasting with the Fed’s 5%.

Rising Mortgage Rates: Contrary to expectations, mortgage rates are rising, tracking higher bond yields despite the Fed’s September rate cut.

US Dollar Surge: Up 4% since late September, the dollar’s strength reflects robust US economic data, solidifying it as the “least ugly” currency in uncertain times.

Canadian Dollar Weakness: As the Bank of Canada cuts more aggressively, the loonie falters amid Canada’s weaker economic outlook.

Homebuilder Setbacks: Rising mortgage rates weigh on homebuilder stocks.

Gold Near Highs: Gold is nearing new highs with its RSI around 70 (bottom of chart), signaling potential overbought conditions and a possible pullback.

Market Insights: Bullish trends continue, but election uncertainty looms. A clear election outcome may trigger a ‘sell the fact’ reaction.

Special Offer: Upgrade to a full Trend Letter subscription this weekend at 33% off—offer ends Sunday, October 27 at midnight.